Fueling the Tax Revolt: What’s Wrong with the NDP’s Anti-HST Campaign

The Canadian New Democratic Party (NDP) has devoted much of its energy in recent months to opposing the implementation of the Harmonized Sales Tax (HST) in Ontario and British Columbia. The new taxes came into effect on July 1, 2010. The HST merges the Goods and Services Tax (GST) with the Provincial Sales Tax (PST) in both provinces. Items covered by the GST that were previously exempt from the PST are included under the new HST.

Much of the Canadian Left has been supportive of the anti-HST campaign on the grounds that consumption taxes are regressive (i.e. people pay the same rate of tax regardless of income). In contrast, it will be argued here that while Left critics of the HST raise a valid point about neoliberal tax policies shifting the tax burden away from business, the campaign against the HST is misguided, for two main reasons. First, the anti-HST campaign dangerously dovetails the rhetoric of the Right and serves to foment anti-tax sentiment among the general population. Second, the implementation of a series of social democratic reforms necessitates the use of consumption taxes. As the example of the Nordic social democracies shows, consumption taxes play a key role in terms of financing welfare states and redistributive measures. Defending and expanding progressive taxation must remain a top priority, but progressive taxation alone is insufficient.

A Tax Shift

A central concern of the NDP’s anti-HST campaign is that its implementation coincides with the implementation of tax cuts for business. They correctly note that this results in a higher proportion of taxpayer revenues will come from individuals, and less from business. Since any revenue gains are scuttled away by the tax relief for corporate and personal income tax cuts, the HST package can be said to represent a tax shift rather than a tax increase.

Indeed, there is no shortage of anti-corporate rhetoric in the NDP’s anti-HST campaign. Federal leader Jack Layton stated recently that “I’m really pleased that people…are recognizing this is not money being collected from hard-working families to go into health-care and education…it’s a tax cut to business. It’s a wealth transfer.” Similarly, Ontario NDP (ONDP) leader Andrea Horwath stated: “We actually think this tax is the wrong thing to do. It shifts the burden of responsibility for taxation off of corporations again, which is something we’ve been doing for decades.”[1]

According to a study conducted by the Ontario NDP, the HST will raise between $4.7 and $5.9-billion in 2011, but the government would collect less in overall revenue. The average family would pay $792 more in taxes, or $470 when factoring in tax cuts. Low income families however would come out slightly ahead due to transfers.

Echoing the Right Wing Anti-Taxers

In addition to the NDP, there has also been a right wing campaign against the HST. In Ontario, the provincial Conservative Party under Tim Hudak has campaigned aggressively against the tax. In BC, former right wing Premier Bill Vander Zalm is the most prominent figure in the anti-HST movement. The right wing National Citizens Coalition (NCC) has come out against the HST as well.

Globe and Mail columnist Adam Radwanski, writing about the situation in Ontario, praised the NDP’s anti-HST campaign:

“The message of Andrea Horwath’s party against the new harmonized sales tax, which took effect on Canada Day, has not been quite as simplistic as that of Tim Hudak’s Conservatives. But it’s often been more convincing.

“For one thing, the NDP isn’t conflicted by federal cousins who partnered with Dalton McGuinty’s Liberals to implement the new tax. Instead, it’s tied to the only party in Ottawa that firmly opposed the policy.

“For another, the NDP’s position actually makes sense. The Tories have claimed the HST is a ‘tax grab,’ which it’s really not. The NDP more accurately argues, at least sometimes, that it’s a shifting of the tax burden from businesses to individuals. And that’s something that, alone among the parties, it can very strongly and credibly oppose.”[2]

The key phrase here is “at least sometimes.” In fact, the NDP’s campaign against the HST has largely been indistinguishable from that of right wing opponents of the tax. The slogan for the ONDP anti-HST campaign is “Stop the Unfair Tax Grab.” Visitors to the ONDP’s “Unfair Tax Grab” website are reminded that such things as using the Internet, putting gas in the car, buying a newspaper or a coffee, etc., will now cost 8% more. The federal NDP runs a similar website – “Block the HST” – where we are told that while Stephen Harper’s Conservatives are “Making Life More Expensive”, Layton’s New Democrats will “Make Life More Affordable” by scrapping the HST. You can even go to the “Harper HST Calculator” to find out how much more the HST is going to cost you.

The anti-HST website of the Ontario Tories – Stop Dalton’s Sales Tax – is remarkably similar. We are told that “Ontario families will pay more for countless items from gas for your car to home heating bills thanks to Dalton McGuinty’s HST tax grab” and that “It will hurt Ontario families when they can least afford it.” The site also features an “HST calculator.” The central message of the NDP’s campaign against the HST – that ‘ordinary Canadians’ already pay enough in taxes – is a theme that has long been used by the Right in its ideological crusade against taxation and ‘big government.’

Popular opposition to the HST is much more widespread in BC than in Ontario, perhaps due to the fact that Premier Gordon Campbell announced the implementation of the HST just a few days after the BC Liberals were re-elected in May 2009. As Roger Annis notes in a previous Bullet piece, “The government is facing a tax revolt that challenges its moral authority to govern and could eventually unseat it.” More so than is the case in Ontario, Left and Right forces have joined together to fight the tax. BC NDP leader Carole James – who fomented anti-tax sentiment in the previous election with her “Axe the Tax campaign” against the province’s carbon tax – has appeared at anti-HST rallies across the province with Vander Zalm. The campaign to bring the HST to a referendum – which met the requirement of obtaining the signatures of 10 per cent of registered voters in all 85 provincial ridings – is led by Vander Zalm and Chris Delaney, the former leader of the far-right BC Conservative Party, though the steering committee also includes political columnist and NDP supporter Bill Tieleman.[3] Yet it is clear that the right wing anti-taxers are in the drivers’ seat. Annis notes that Tieleman serves “strictly as second fiddle.” The Victoria Times Colonist columnist Les Lyne observes:

“The Carole James-Bill Vander Zalm marriage of convenience has thrived for the past several months. James essentially ceded the opposition function to Vander Zalm – despite any qualms she might have about him – because he’s making more progress fighting the Liberals in the streets with anti-HST campaign than the New Democrats were in the usual political arenas.

“And Vander Zalm welcomed her and her team aboard his bandwagon – even though he despises everything they stand for – because they represent a well-organized political machine that might come in handy.

“So far the mutual suspension of suspicions has worked beautifully. Most NDP caucus members adopted Vander Zalm as their new leader, as far as the petition drive was concerned, and dutifully went out and started collecting signatures. Vander Zalm used them and thousands of other volunteers and made the unworkable initiative process work.”[4]

The NDP-Vander Zalm alliance, however, seems to have run its course. Vander Zalm is now focused on making use of the province’s recall legislation to threaten to bring down the government. It allows for the recall of MLAs and to force a by-election if 50% of eligible voters sign a petition – which takes effect 18 months after the most recent election. On June 22, it was announced that a list of 24 targeted Liberal MLAs had been drawn up. The BC NDP does not support the recall campaign. Lyne argues that Vander Zalm has likely out-maneuvered the NDP:

“The New Democrats don’t seem to get how much momentum they’ve already handed over to Vander Zalm. And how quickly it could swing against them.

“On the premise that ‘the enemy of my enemy is my friend,’ they hooked up with Vander Zalm, assuming a Liberal downfall meant an NDP upswing.

“But Vander Zalm is attempting a slingshot move, working with the NDP to curb the Liberals, then breaking out the third-party option and sandbagging his former volunteer helpers.

“James must know this, but seems to have calculated that it will fail and that Vander Zalm will wind up making her premier.

“If the end result of all the drama is that the HST remains in place and the NDP takes power, then she’s right.

“But if he somehow overtakes them with a third party, then she’s lost a big gamble. And her job.”

The NDP campaign against the HST has troubling implications. The party’s legitimate criticisms of the tax reform package are overshadowed by its “tax grab” rhetoric. In this narrative, taxes are a burden to be avoided rather than a necessary and positive investment in public services. BC-based journalist Murray Dobbin, who signed the anti-HST petition in his own community of Powell River, expressed concern that the campaign plays into the hands of those who oppose taxation in general:

“I think that most anti-tax campaigns are put forward by people who want to see a diminished role of government. That’s what worries me. I have been writing for twenty years that we need to increase taxes on high-income earners and corporations. We have been losing unbelievable amounts of revenue. When you cut taxes, you lose revenue.”[5]

And while the unions in BC support the anti-HST campaign, Canadian Autoworkers (CAW) president Ken Lewenza warned about the dangers of involvement in an anti-tax campaign. In a speech to the CAW council, Lewenza stated:

“I said to the Ontario NDP leader Andrea Horwath, ‘Andrea, the harmonized sales tax, as unpopular as it may be, cannot be an issue from the progressive side. It can’t be an issue that makes Ontarians more cynical about taxes. We want to pay taxes. We want a civil society. We want health care. We want education. We want infrastructure. We do not want every Ontarian to think that taxes are bad.’

“…The NDP is never going to get elected on a revolt on taxes. Never. The only ones who are going to benefit as a result of this fightback will be the Tories.”[6]

Annis stresses that “[t]he campaign against the HST should not be the exclusive reserve of populist demagogues.” Unions and other Left forces must shift the focus of the campaign toward “eas[ing] the tax burden on working people” and pushing for tax increases on corporations and the wealthy in order to pay for social programs.

In spite of devoting months to fighting the ‘regressive’ HST, however, the NDP has failed to put progressive taxation on the agenda. Former federal leader Ed Broadbent’s call for increasing income taxes on those earning more than $250,000 per year to eliminate child poverty in Canada, for instance, fell on deaf ears.[7] However, the NDP’s focus on the increased taxes to be paid for by ‘average middle-income families’ highly problematic, as is much of the Canadian Left’s general aversion to consumption taxes.

Taxation and Left Agendas

In an editorial written in the Toronto Star, progressive economist Hugh Mackenzie criticized the Canadian Left’s tendency to “[campaign] for better public services as if they can be provided free.” It is assumed that the improvement of public services can entirely be paid for by taxing corporations and the wealthy, while middle-income taxpayers, ‘working families’ and small business can continue to pay the same levels of taxation or even receive tax relief. Mackenzie points out that: “Nations that have the most highly developed systems of public services pay for them with all kinds of taxes, including sales taxes and payroll taxes that everyone contributes to because everyone knows there is no such thing as a free lunch.”[8] This is indeed a key lesson of European social democracy.

There is little (if any) correlation, then, between the degree of tax progressivity on the one hand and the extensiveness of social welfare measures or levels of inequality on the other. There is, however, a positive correlation between levels of direct spending and equality. It is for this reason, that it is important to recognize not only the redistributive function of taxation, but also its role in financing welfare states and providing benefits that fall to low-income and dependent workers. To a substantial degree, this has been done via so-called ‘regressive taxation.’ The size of the public sector, too, is strongly correlated with levels of equality – that is, while the existence of a large public sector does not guarantee higher levels of equality, it is a necessary component in the pursuit of egalitarian welfare state measures.

The limitation of relying primarily on income taxes was recognized by public finance scholars and policy-makers (from across the spectrum of the Left including Marxists) in the post-World War II period. Indirect consumption taxes could serve as an administratively simple and efficient means of raising revenue, which was necessary for greatly increased spending in such areas as health, education, welfare and others with distributional objectives. Tax progressivity alone could not address such distributional concerns; high income taxes on the wealthy alone were insufficient in terms of raising revenue. Substantial revenue thus had to come from taxation of wage and salary earners. Given the administrative difficulties in reforming the income tax, it made much more sense to turn to broad-based, indirect consumption taxes to finance government redistributive programs. Revenue raised from consumption taxes does not fluctuate during economic downturns nearly as much as income taxes, and thus serve as an important revenue-raising tool.

While a broad-based indirect tax was an effective means of raising revenue to finance redistributive programs, it was also recognized that sales or consumption taxes alone do not contribute to equality, as lower-income households would be harmed by such taxes. Thus redistribution had to be met by other means: partly through personal direct taxation, but in the case of the most needy, mainly by enhanced transfers.[9]

The case of Sweden is illustrative. Sweden, along with Norway and Denmark, has the world’s highest VAT (value added tax) at 25%. This approach of broad-based taxation with few exemptions has contributed to a very high tax intake. The Swedish Left and the main trade union organization, the Landsorganisationen (LO), have long supported consumption taxes as a means of financing social expenditures.

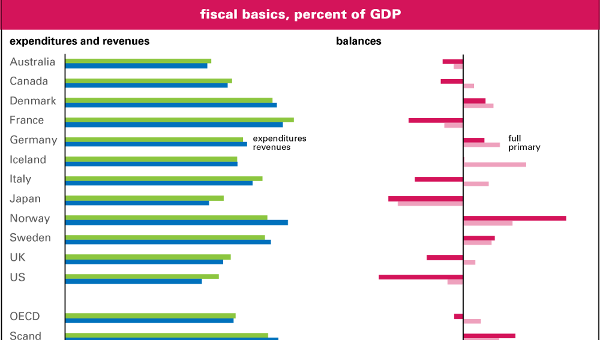

Canadian Labour Congress (CLC) chief economist Andrew Jackson provides a useful comparison of taxation levels in Canada, the U.S., Denmark and Sweden.[10] In 2004, tax revenues represented 33.6% of GDP in Canada, higher than the U.S. (25.6%), but significantly lower than Denmark (48.1%) and Sweden (50.1%). Social expenditures represented a much higher percentage of GDP in Sweden (31.3%) and Denmark (27.6%) than is the case in Canada (17.3%) and the U.S. (16.2%). In terms of tax mix, both Denmark and Sweden rely much more heavily on goods and services taxes, at 14.0% and 13.0% of GDP, respectively, than did Canada (8.7%) and especially the U.S. (4.7%). Sweden depends much more on social security and payroll taxes (16.7%), while they are barely a factor in Denmark (1.4%). Personal income taxes represented a much higher percentage of GDP in Sweden (15.8%) than in Canada (11.7%) and the U.S. (8.9%), but a lower percentage of overall taxation (31.3%, 35.1% and 34.7%, respectively). Denmark stands out for its reliance on personal income taxation – representing 24.7% of GDP and 50.7% of total taxation.

Ironically, the U.S. and Canada in fact have more progressive tax systems than Denmark and Sweden. Taxation rates are higher in the Scandinavian countries at all income levels. Thus the highest earners pay a higher level of income tax, but so does the working class – the ratio between the top bracket and what an average worker pays is smaller in Scandinavia. In 2004, the combined level of personal income taxation and social security contributions for an average production worker was 24.1% in the U.S. and 25.1% in Canada – compared to 33.7% in Sweden. And the average production worker in Denmark (44.1%), along with Germany (44.5%), paid the highest among OECD countries.

All countries use taxes and transfers to counter inequality, but the Nordic social democracies mainly rely on transfers. Transfers as well as taxation, have a role to play in terms of reducing inequality. In a paper for the Ontario Fair Tax Commission – which was established by the Ontario NDP government as a means of exploring tax reform – Lars Osberg stressed that transfers must also be taken into account when one speaks of progressivity:

“In practice, the tax and transfer systems are inevitably closely linked – indeed, it can be argued that transfer payments are ‘negative taxes.’ The net impact of taxes and transfers on individuals is the difference between payments made to and payments received from government. This net impact is relevant for equity purposes. Although some tax choices (such as a value-added tax) may be regressive, taking a higher percentage of the income of the relatively poor, the tax/transfer system as a whole may be progressive, if expenditures benefit primarily the less affluent (as in Sweden).”[11]

It should be stressed that progressive taxation must remain on the agenda for the Left, and that the shift away from progressive taxation (including in Scandinavia) over the past two decades remains a concern. In Canada, the case for far more progressive taxation remains especially compelling. Jackson points out that the income gains of the 1990s went disproportionately to the wealthiest 10 per cent of Canadian families – and these income gains were more pronounced the further up the income ladder. And while the effective income tax rate for most Canadian taxpayers declined only slightly, it declined much more sharply for the very wealthy. The phenomenon of rising incomes at the top, Jackson observes, can only be effectively countered by progressive taxation:

“Canada needs to pay much more attention to income tax progressivity given the steep increase in top incomes, which is now the key driving force of rising income inequality in Canada and other ‘neoliberal’ advanced capitalist countries. Transfers counter inequality by raising the lower end of the income distribution, compared to the middle and the top, while progressive income taxes counter inequality mainly between the top and the middle and the bottom of the distribution. If inequality is now being largely driven by the growth of the income share of the very top, progressive income taxes must play a larger role in our redistributive policy arsenal.”[12]

In spite of the NDP’s denunciation of the ‘regressive’ HST for taxing ‘ordinary

Canadians’ rather than corporations and the wealthy, it has failed to put progressive

taxation back on the agenda. Besides symbolic gestures opposing the latest round of

tax cuts by Liberal and Conservative governments, the NDP has been unwilling to call for increased income taxes for those with the highest incomes. By failing to do so, claims that the party is not “anti-tax” just “anti-regressive tax” ring hollow. The declining progressivity of the Canadian tax system remains a core concern, and an issue that certainly should be taken up by the NDP. However, the key lesson of Nordic social democracy – that a well-financed welfare state necessitates the use of consumption taxes and other so-called “regressive” taxes – remains essential.

There in fact is a compelling case for consumption taxes on socialist and ecological grounds. Social democrats, include those in Scandinavia, have been rightly criticized for pursuing ‘shared austerity’ policies that redistribute income within the working class/middle class while having abandoned policies that target capital. That being said, socialists ought to defend policies that redistribute income from higher-income workers to low-income and unwaged workers on solidaristic grounds. As the Nordic social democracies have shown, this is done through sales and turnover taxes. There is also a ‘public goods’ argument. The taxation of private consumption can fund the provision of public goods (such as parks, public transit, public housing, etc.) that are more ecological than private goods. Furthermore, public goods provision has the effect of decommodification which is as important as progressive taxation in terms of moving toward socialist relations in capitalist societies.

The global economic crisis has resulted in a hard-neoliberal turn toward fiscal austerity and public sector wage restraint and cutbacks. Such an anti-austerity campaign necessitates at the minimum reversal of the Harper government’s cutting of the GST from 7 per cent to 5 per cent, a move that was opposed by the NDP but goes against the spirit of the anti-HST campaign. As Mel Hurtig observes, Canada already ranked number 27 out of 30 OECD countries in terms of taxation of goods and services in 2003. While “someone buying expensive jewellery or new Bentley will save a bundle…a 1 or 2 per cent saving on even inexpensive household items represents only pennies. Yes, pennies to a poor person are important, but 2 per cent of the cost of a million-dollar house could pay for a big pile of groceries for many poor families.”[13]

The GST cut costs the national treasury billions of dollars per year. The restoration of the GST to 7 per cent alone would significantly offset the cuts to the public sector. Further increases to the tax are essential components to the improvement and expansion of public services. Transfers to low-income households could be significantly increased as well.[14]

The building of an anti-austerity campaign that makes the case in support of expanded public services is not likely to come from the NDP leadership, given its opportunistic stoking of anti-tax politics on behalf of so-called “working families,” as well as its muted opposition to current attacks on public sector unions. It is a matter of some urgency to re-imagine what a new anti-neoliberal alliance will look like in Canada. The union movement in Canada is, for the most part, providing almost as little leadership in social struggles. Public sector unions in alliance with users of public services ought to take up the leadership here, but they will only be pushed to do so to the

extent a new left begins to emerge inside the wider union movement. But it

could be argued that private sector unions and social movements – anti-poverty, feminist, environmental, and other organizations – are in an even worse state of disorganization. This speaks – like the debate over the HST as a whole – to the wider crisis of the left in Canada. An anti-austerity campaign needs to be equal parts a fight against neoliberalism and building a new left. •

Footnotes

1.

Cindy Harnett, “NDP Leader Jack Layton Lauds Islanders for anti-HST Efforts,” Times Colonist, April 23, 2010; Scott Taylor, “Ontario NDP would alter ‘wrong’ HST,” Toronto Sun, July 13, 2010.

2.

Adam Radwanski, “NDP tackles punitive taxation stigma by engaging in HST”, Globe and Mail, June 8, 2010.

3.

Vander Zalm’s petition was challenged by business groups in court. Robert Bauman, Chief Justice of the BC Supreme Court, ruled in support of Vander Zalm.

4.

Les Lyne, “Vander Zalm might outsmart NDP,” Times Colonist, June 29, 2010.

5.

Prince Rupert News, June 30, 2010.

6.

CAW President Ken Lewenza Speech to CAW Council, December 4-6, 2009.

7.

Ed Broadbent, “How to end child poverty: Tax the rich,” Globe and Mail, November 23, 2009.

8.

Hugh Mackenzie, “Can we have an adult conversation about taxes?,” Toronto Star, October 26, 2009.

9.

A good overview of these issues can be found in the following: John G. Head, “Tax-Fairness Principles: A Conceptual, Historical, and Practical Overview,” in Allan M. Maslove, ed., Fairness in Taxation: Exploring the Principles (Toronto: University of Toronto, 1993); and Junko Kato, Regressive Taxation and the Welfare State: Path Dependence and Policy Diffusion (Cambridge, Eng.: Cambridge University Press, 2003).

10.

Andrew Jackson, “Why Charity Isn’t Enough: The Case for Raising Taxes on Canada’s Rich,” Canadian Centre for Policy Alternatives paper, December 2007.

11.

Lars Osberg, “What’s Fair? The Problem of Equity in Taxation,” in Maslove, ed.

12.

Jackson, 2007.

13.

Mel Hurtig, The Truth About Canada: Some Important, Some Astonishing, and Some Truly Appalling Things All Canadians Should Know About Our Country (Toronto: McClelland and Stewart, 2008): 133.

14.

Remarkably, one-third of Canadian families with incomes over $100,000 received a GST credit in 2003, while low-income families represented one quarter of those receiving the GST credit. Hurtig correctly asks: “How’s that for great public policy?” See Hurtig, p. 131. It is clear that the GST credit ought to be more targeted toward those with the lowest incomes.