Pandemic Lessons for Rebuilding Canada’s Welfare State

In what now seems like a distant memory, the early stages of the pandemic gave rise to a host of hopeful prognostications about the urgency of rebuilding of our social safety net. Arundathi Roy envisioned portals to potentially more humane futures. Even the Economist called for more robust social safety nets to shield us from future shocks. Much of this enthusiasm stemmed from the sudden and significant increases in spending on income support programs. Almost overnight, governments found money to pour into critical social protection programs that prevented massive layoffs and supported households through periods of unemployment. While temporary, these measures were some of the most significant investments in social protection we have seen in generations.

Two years on, many of these hopes look rather foolish. Initials proposals for ‘building back better’ have been dashed against the rocks of austerity and inflationary pressures – pot-clanging support for frontline workers soon became wage freezes. Despite much discussion about ‘lessons learned,’ there have been few efforts at actually adapting our social protection systems in the pandemic’s wake. There has been alarmingly limited recognition that our income support systems remain ill-equipped to deal with both the changing world of work and future crises. Witness recent moves by the federal government to end the relaxation of employment insurance (EI) measures that had made it easier for laid-off workers to access income support.

Since the 2008/09 financial crisis, government responses to sudden economic shocks have taken the form of emergency welfarism, or temporary adjustments to existing income supports aimed at maintaining consumer demand and blunting the trauma of sudden income losses. The problem is that these have become band-aid measures for a system that has long been in crisis. Before the pandemic, barely 40 percent of unemployed workers in Canada qualified for EI coverage. For many workers, these crises are rarely temporary, and income losses without adequate supports can be devastating.

As the threat of a recession looms large, it is critical that we push for urgent reforms to our social protection systems. This involves a range of strategies, from improved labour regulations to higher wages, but fixing our system of income supports should be seen as central to any left project. Rather than simply technocratic policy fixes, improvements can be used to advance a redistributive left agenda which provides both material benefits in worker’s lives and raises the critical question of who should fund these programs.

Pandemic Supports Decreased Poverty

Canada’s welfare state is characterized by a mix of liberal and social democratic programs. While health care provides universal coverage, the majority of our income support systems are designed to provide temporary, limited, and conditional coverage. Income supports are based on an insurance model in which the labour market is seen as the primary form of income security. Low rates and eligibility testing are, in effect, aimed at pushing the unemployed into work, however poorly paid. When the pandemic hit, this model simply could not cope with the tsunami of sudden and wide-ranging unemployment. Like almost every other country on Earth, Canada introduced a range of new income support measures while relaxing conditions and eligibility on others.

Developed in a remarkably short timeframe, the Canada Emergency Response Benefit (CERB) provided millions who had lost work or faced caregiving requirements with money in the bank. While it was limited by certain exclusions – notably among temporary foreign workers and those who had earned less than $5,000 per year – CERB performed a critical function. Part of the reason the system worked so well for so many is that it reintroduced elements of trust into the application process. Many of the eligibility requirements and document checks were waived and people got access to their money fast through the Canada Revenue Agency’s deposit system. Alongside increases to child benefit payments and provincial income supports, CERB had a remarkable impact.

Pandemic income supports contributed to the largest year-on-year reduction in poverty in Canada in 50 years. Canada saw a 18.9 percent drop in poverty between 2019-2020, the largest in decades, with some of the sharpest declines among youth and children. Families with children received increases to child benefit payments, which had a significant impact on reducing youth poverty. Similarly, students who were faced with a loss of seasonal employment received significant support through the Canada Emergency Student Benefit. These declines occurred in provinces with some of the highest levels of poverty in Canada – Manitoba and Nova Scotia. While still higher than the national average, the number of Indigenous people living in low income households also dropped significantly, from 28.1 percent in 2016 to 18.8 percent in 2021.

In a few months, government was able to do what anti-poverty advocates had been advocating for years: increase rates, expand eligibility, trust that people need money and get it to them fast. It also demonstrated the inadequacy of our existing social protection systems to support a rapidly expanding category of temporary, seasonal, and self-employed workers who have historically been denied coverage.

The impact on poverty rates was an unintended outcome of these programs. Their primary aim was not to reduce poverty, but to maintain consumer demand. A massive shortage of cash circulating through the system would have been devastating for business, and so income support programs, alongside generous forms of support directly to business, provided a cushion against a massive reduction in consumer spending. But they also revealed what many social policy researchers have known for some time, that wide-ranging forms of income support can actually be effective tools at addressing poverty provided that they are institutionalized over the long term and accessible to people not on the basis of employment but as a social right.

Moving Beyond Emergency Welfarism

Part of the problem has been that state responses to past economic crises have taken the form of temporary welfare interventions aimed at stabilizing demand rather than addressing gaps in our social protection systems. Rather than institutionalizing systems of social support, the state operates in emergency management mode. Rapid injections of cash are seen as necessary to maintain cycles of accumulation through consumption, and then these supports are rapidly withdrawn in a return to fiscal austerity. Resistant to change, policymakers slap together programs with the hope that they will tide us through crises and back to a period of economic stability.

The logic of emergency welfarism delays necessary reforms to our social protection systems. All government can do is roll out temporary measures that blunt the effects of capitalism’s turbulence. By design, these programs are aimed facilitating a return to labour discipline through the market, even as markets do not provide an escape from poverty. As a result, the decreases we saw to overall poverty levels in 2020/21 will almost certainly be temporary. Mid- to long-term social and economic planning has to move beyond emergency response mode and contend with the reality that the ‘new normal’ will be characterized by recurrent instabilities, highly precarious and low wage work, and shocks to livelihoods.

We need solutions that take us beyond the technocratic management of these crises, and ones which rebuild infrastructures and institutions of care and support. Failing to do so ignores the risk of future crises, and potentially bolsters support for the right, which points to the failures of government to support workers and their families. A good place to start is recognizing that EI remains a partial and exclusionary system of income supports, largely benefitting workers in more stable employment. Those in expanding employment categories, such as gig workers, are largely excluded from this system.

Our EI system is premised on access to a range of income supports – including maternity benefits, parental benefits, caregiving leave, job loss benefits, and sickness benefits – through access to a good job. Those who work below a certain number of hours a year or are self-employed and in temporary and contract jobs rarely qualify when work dries up. These eligibility requirements have a negative impact on precarious and low wage workers, and women in particular. For example, only one in three new mothers accesses maternity benefits – some are not eligible and for others the rates are simply too low to make it worthwhile.

Reforms to the EI system in the 1990s undercut any potential that this system could be used to address poverty. More stringent eligibility requirements, combined with the move to fund the system directly from employer/employee contributions, reinforced an insurance-style model. These changes meant that in provinces like Ontario and Alberta, under 30 percent of contributors to EI actually qualified for benefits.

There may be room for some optimism in the current moves to reform the EI system. Based on consultations with labour, academic and business groups, the federal government is planning on making a number of changes to the EI system in the coming months. However, reports from these consultations largely reveal what we already know: seasonal, temporary, and self-employed workers are not able to access EI supports. While labour groups have advocated for a reduction in the hours needed to access benefits – and a common standard of hours across the country – business groups have primarily been concerned about increased premiums.

On the social assistance front, the situation appears grimmer. In Ontario at least, there has been a paltry five percent increase to the Ontario Disability Support Program (ODSP) and no increase to Ontario Works. In effect, the value of social assistance rates has been declining in the province since former Conservative Premier Mike Harris slashed rates by 21 percent in the late 1990s. Amidst rising food bank rates and deepening poverty among recipients, the Ford government has spent millions on a project of ‘welfare modernization,’ which involves outsourcing employment services to multinational corporations.

Moving beyond emergency welfarism requires long-term thinking about the types of income support programs that could help us weather future crises and meaningfully address poverty and inequality. Policies which are provided as a social right, rather than only accessible to those in particular employment categories, can have a dramatic impact on poverty reduction. We do not have to look for evidence of this. The establishment of the Canada Pension Plan (CPP) alongside Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) led to dramatic reductions in senior poverty – a 25 percent decline between 1976 and 2010. While this number has been on the rise recently – largely due to demographic factors and a decrease in access to registered pension plans – we should not ignore the evidence before us: where there is political will, meaningful steps can be taken to use income transfers to address poverty.

The Politics of Welfare

Historically, improvements to the welfare state came about as a result of strong trade unions, socialist parties, and social movements pushing for reforms. The expansion of social spending we witnessed during the pandemic did not come about as a result of these forces, but rather the disruptive nature of the virus itself. As these programs have been rolled back, we find ourselves without the social forces required to make any substantive and long-term improvements to our programs of social support.

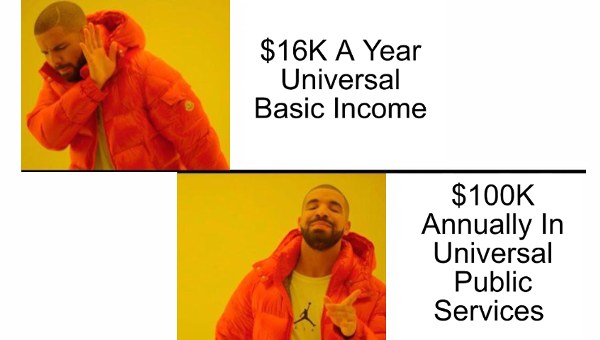

This requires inventive thinking about possible ways in which left movements, weak as they may be, can actually advance these reforms and the potential coalitions behind them. One possibility is through a renewed push for a basic income (BI).

The pandemic witnessed a rising tide of support for basic income-style programs. According to one poll, 60 percent of Canadians supported a universal basic income of $20,000 a year. New Democrat MP Leah Gazan’s Motion 46, tabled during the pandemic, builds on the success of CERB to argue for a permanent liveable income guarantee for Canadians as a way of directly tackling poverty, particularly in Indigenous communities. It’s not hard to imagine why many have come to see basic income as a logical outcome of pandemic support programs. A significant number of Canadians accessed support through CERB, and people generally received support in a timely manner with minimal fuss over documentation and eligibility testing. For many precarious workers, it may have been the only time they qualified for this type of income support.

As Gazan has noted, one of the major obstacles in advancing these debates is how polarized they have become on the left. There are those who see basic income as a silver bullet solution to problems of poverty and inequality, and those who see it as a neoliberal Trojan horse – essentially a market-based model of welfare provision. Neither of these positions are particularly helpful, and both begin from the position that basic income exists as some sort of pre-designed model rather than a set of debates about the current conditions of wage work, the role of the state, and the question of social rights. Rather than seeing basic income as a neoliberal bogeyman or a quick fix to inequality, we should start from certain shared perspectives: that wage work no longer guarantees income security for many, that our existing income support systems are wholly inadequate, and that Indigenous communities, seniors and racialized families continue to experience disproportionately high rates of poverty.

The idea of basic income should certainly be open to scrutiny and debate, but arguments that reduce it to a cog in the neoliberal machine cannot reckon with the enormously positive impact of pilot programs on health and wellbeing nor the need to drastically improve our social protection systems. The insistence that it would only increase market-dependency ignores the reality that for the vast majority access to shelter, food and other services occurs through markets. Those who suggest it may decrease worker’s bargaining power ignore the fact that improved social protections frequently do the opposite, increasing bargaining power and worker’s ability to leave exploitative work.

The sticking point in basic income debates is often the question of how to finance an admittedly large social program. But this is not a debate to be avoided. Rather, framing this in class terms provides opportunities for much needed tax reforms, including broadening the tax base through wealth taxes, increasing capital gains tax, re-instituting an inheritance tax, and clamping down on tax havens. Of course, much depends on the design and funding of these systems, and socialists should enter these debates with bold redistributive solutions rather than simply rejecting them outright. The questions that surround basic income are not substantially different from those that accompany the introduction of other forms of income support, from pensions to child support. Who should qualify and who doesn’t? How will it be financed? How should payments be delivered?

As a broad-based policy proposal, basic income also holds the potential to mobilize a wide base, from seniors to precarious workers to those on social assistance – not an insignificant constituency number wise. A significant number of Canadian households already effectively receive some form of basic income in the form of a negative income tax through the Canada Child Benefit and Senior’s the Guaranteed Income Supplement. For many, it makes good sense to use these existing programs to extend coverage to set minimum income floors and to use existing tax instruments to recoup funds from those who don’t need it. In short, basic income provides a basis for political mobilization that could combine left-populist demands for increased corporate taxation with material improvements to our social safety net.

Conclusion

The form that welfare spending takes has significant implications for political mobilization. In establishing CERB and other income support measures as temporary solutions to a temporary crisis, the Liberals foreclosed possibilities for long-term mobilization. When income support measures are provided on a temporary basis to those who are unemployed or destitute, they remain ‘poor benefits,’ subject to predictable forms of stigmatization. When these policies are institutionalized and when more people have a greater stake in them, they are more likely to defend them.

What I am suggesting is an openness to policy ideas and experiments that can enable redistribution, facilitate solidarity across the working class, and materially improve people’s lives. If liberal forms of welfarism are built around modest income transfers and means testing, then it follows that a socialist response should be to argue forcefully for increases in these transfers and to scrap conditionalities attached to them. In short, a core socialist principle is to assert the notion of universality regardless of income. The welfare state cannot be seen merely as a tool through which to assure some type of labour peace. Rather, the aim is to make the welfare state a tool of class struggle once again.

Basic income is but one form these proposals could take. And here there is significant overlap with a range of other redistributive proposals. First is the growth of abolitionist movements over the last two years and the demand to defund the police. Beyond the obvious aim of reducing police violence, these movements call for redirecting police and carceral funding toward a range of social programs from mental health supports to affordable housing to improved income supports. Second is the compatibility with ‘Just Transition’ proposals from labour groups, which recognize the disruptive impact of sectoral shifts on employment stability. Here there is a strong case to be made that minimum income floors would provide workers with needed support during periods of reskilling and employment shifts.

As Ursula Huws has noted, one of the lessons from the pandemic is that we need welfare systems that are adaptable to changing circumstances and labour markets. We are not returning to previous male breadwinner models, and as such our systems of income support should respond to changing labour market conditions. Socialists have long taken advantage of the spaces opened by liberal and centrist governments to advocate for improvements to existing welfare institutions. The British post-war welfare state was built on a report drafted by a liberal and enacted by a Labour government. Today, we lack the political forces required to rebuild our welfare state, and as such we need new models for how to advance these demands. This is hardly an easy task, but as the great historian of socialism Donald Sassoon once noted: “In the dunghills of politics, as opposed to the groves of academia, what is decisive in the final instance is not the writing of policies or even their commissioning. The quintessence of the game is to seize the appropriate policies and struggle for their implementation.” •

This article first published on the Canadian Dimension website.