Don’t Blame the Virus for Capitalism’s Latest Crisis!

Is corona-virus driving Canada into recession? Some people want us to think so. As early as March 27, CBC News referred to “the recession caused by COVID-19.” The Toronto Star picked up the refrain April 9, referring matter-of-factly to “the recession brought on by COVID-19.” The Globe and Mail repeated it on April 13. And as of May 1, says the C.D. Howe Institute, Canada is in a recession “due to the COVID-19 pandemic.”

Short months ago, however, business economists were far more sanguine. They saw no signs of an oncoming recession at all. Quite the opposite: they predicted substantial growth for this year. In January, the Conference Board was just one of the mainstream outlets predicting solid GDP growth in Canada: 1.8 per cent for 2020 and 1.9 per cent for 2021.

Mainstream economists will therefore have good reason to claim ‘the virus did it!’ Yes, they will say, everything was fine until COVID-19 came along and knocked an otherwise buoyant Canadian economy off the tracks. But look again. There’s no question Canadian capital is headed back into the tank – but not just because of the virus. I will demonstrate how it was, in fact, already in crisis well before the virus, Wuhan alarms or pandemic. Let’s consider some key economic indicators based on Statistics Canada data. They support the view that the economy was in recession by last fall.

Overall, Canada’s GDP grew by 1.7 per cent in 2019, but it was already faltering by summer’s end. Over the whole in fact, the volume of corporate profit stagnated, rising precisely 0.1 per cent over the entire year and falling steadily after the first quarter. Employment measured as “persons employed” stagnated through 2019; measured as “hours worked” it rose slightly, 0.8 per cent. But by either measure it too fell from September onward. Industrial capacity utilization, already suffering the prolonged slump caused by low petroleum prices, declined farther in the fourth quarter. Conversely, one key indicator did not reverse direction, however: the value of capital formation continued to rise, it was up 0.9 per cent year-on-year and still rising slightly as late as January.

What Does All This Tell Us?

In a capitalist economy, profitability drives the system. But what drives profitability (also known as the rate of profit)? The profit rate is a function of production costs (the combined values of fixed-capital and labour employed in production), productivity and the quantity (and prices) at which output is sold. Technological change generally increases (and potentially cheapens) output. Everything else being equal in other words, if a firm enjoys more output without higher production costs, its profits will rise – and vice-versa.

But at the same time, technological change also tends to reduce the value of the labour-power employed in production. Since most new production technologies are ‘labour-saving’, when the value rises of the capital employed in production, the ratio of capital to labour employed in production will rise as well. In time, this rise in the ‘organic composition of capital’ – that is, more capital, less labour in production – necessarily drives down the profit rate. That’s because profitability is inversely related to productivity: if production costs go up, whether labour or capital costs, profitability must necessarily fall, a serious problem for corporations and the system.

There’s also another problem. Only ‘living labour’, workers actively engaged in production, can impart value to products. (You can test this proposition by asking yourself how much gets produced during a strike where neither management nor strike-breakers replace the workers!) At some point, if less living labour, then a lower profit rate and ultimately, less total profit. When profitability begins to slow, corporations typically try to implement one or another ‘countervailing measure’ (cheaper inputs or reduced real wages, for example). In time, however, the combination of rising productivity and a falling value of labour employed in production will drive down profitability. And falling profitability steadily eats into firms’ ability to purchase or build new capital, hire more workers, improve production systems, pay down debt, borrow, save, etc. In short, it drives the economy toward crisis.

Our quick snapshot of the Canadian economy supports this theoretical scenario. For most of 2019 the value of capital employed continued to rise, so that well before year’s end it was rising faster than the volume of profit, as well as employment and output. Profitability was, in other words, softening: by late summer the profit rate was falling absolutely in most sectors and by September, it was falling across the entire economy.

Introducing New Technologies

To know why the value of the capital employed in production rises despite falling profitability, we need to know why firms add new technologies and what happens when they do. In a capitalist economy, the quest for profits combines with the struggle for competitive advantage to force each firm to constantly strive to cut production costs and increase output. The most common means corporations have found to do this is to deploy ever-more powerful and efficient machinery and production methods. Firms introduce new production methods to steal sales and market share from their rivals. And all things being equal, the first few firms to introduce a new technology actually do, in fact, stand to reap attractive temporary ‘super-profits’. Having succeeded in reducing production costs and increasing output at less cost than the resulting increase in revenue, these companies can sell at lower prices than their rivals, yet still outsell them.

There is a downside, however. Once every firm in the sector adopts the new processes, the ‘organic composition of capital’, the ratio of capital to labour employed in production, has risen across the industry. In other words, the organic composition of capital has now been more or less equalized at a higher rate across the industry. And since everyone is once more deploying the same or similar technologies, no one any longer enjoys any competitive advantage at all… but they do all experience decreased profitability. For the firms that were effectively forced to follow the industry innovator’s lead, the industry-wide decline in profitability will likely be enough to negate any benefits they derived from introducing the new technology in the first place. They will have made little or no gain in market share; still, to compete at all they will have introduced the new technology anyway – and as a result, they each must deal with the industry-wide effects of reduced profitability.

Eventually, all the firms in an industry must introduce the same or similar labour-saving technologies – although by now some will be unable to keep on operating and will be forced out of the industry. Others have simply resigned themselves to operating at a lower-than-average rate of profit. At the same time however, because the new production process is labour-saving, the ratio of capital to labour employed in production is higher right across the sector.

Lower-Than-Average Rate of Profit

As for the workers, by now many will have either lost their jobs and incomes or are working reduced hours – either way, they are collectively adding less value to their employers’ products, even though, ironically, at the same time most of those firms’ profitability has been reduced. In time, this process precipitates an economic crisis. In addition to a falling profit rate, signs of impending crisis include rising corporate borrowing, a surge in bankruptcies and business failures and rising joblessness.

The financial effects of a crisis are often its first signs. Karl Marx (1818 – 1883) observed that although economic crises inevitably arise from falling profitability, they very often first appear to be financial crises. As profits, the profit rate and corporate cash flows diminish, capitalism’s complex networks of lending and borrowing, debts and payments becomes ‘broken in a hundred places’. Since as profitability dries up, firms likely have less cash on hand, many corporations will have trouble meeting their financial obligations. If credit is available, we can expect a rise in corporate borrowing, even though excessive borrowing makes firms more unwieldy, precarious and prone to failure.

This is exactly what is happening now to the Canadian economy. Business insolvencies actually declined through most of the first three quarters of 2019 – as late as August, they were 2.6 per cent fewer than in July. But after that, they rose very sharply and there was an 18.4 per cent year-on-year rise in September, another 10.9 per cent jump in October. By year’s end, the volume of insolvencies was 9.8 per cent higher than in 2018, a level of failure that has been maintained into 2020.

Canada’s economic managers were already concerned about excessive corporate borrowing before 2019. By the end of 2018, non-financial corporate debt was 315 per cent of income, said the Bank of Canada, which also regarded with alarm the share of outstanding debt owed by firms with poor debt-service capacity and low liquid asset holdings. By May the central bank said the debt-to-income ratio among Canadian non-financial corporations was ‘well above’ historical levels, making corporate debt one of the country’s top financial vulnerabilities, according to Bank of Canada Governor, Stephen Poloz, although at the same time, Poloz suggested the risk would recede due to improved economic growth.

Similarly, although the greatest job losses would not hit until the new year, the number of employment insurance claims began to rise sharply from September onward: in the second half of 2019, there were fully 28 per cent more claims than in the first half, although the big flood in joblessness would not begin until February. Again, it is important to note that the large increases in corporate indebtedness, business insolvency, joblessness and other indicators of crisis clearly started before COVID-19 was a thing, although, of course, they have surged since then.

No one foresaw the virus. But some people did notice the economy sliding into crisis. At the beginning of 2019, Marxist economist Alan Woods noted “the imminent threat of a new world recession… The question is not if it will happen, only when.” Marxist economist Michael Roberts, who had tracked the unfolding crisis, pointed out at year’s end that 2019 had recorded “the slowest rate of growth in any year since the end of the Great Recession,” while over the entire the decade of the 2010s, capitalism saw “the weakest recovery from any recession” since the Second World War. Accordingly – again well before COVID-19 was a factor – Roberts suggested that “2020 may be the year that it collapses.” Indeed.

But what of mainstream economists? Sadly, as in 2007-08, they were taken quite unawares. You might recall that then, even as late as August 2008, the US Federal Reserve was so obsessed with a perceived inflationary threat that they failed to notice the system was rapidly sliding into recession. By October however, the economy was absolutely melting down. In a Congressional hearing, Federal Reserve chair Alan Greenspan was asked whether he now “found that (his) view of the world… was not working?” Remember, this is the US’s highest-ranking and most lauded economist! In a staggering admission of failure, Greenspan agreed: “That’s precisely the reason I was shocked because I’d been going for 40 years or so with considerable evidence that it was working exceptionally well.” Similarly, when journalist John Cassidy asked University of Chicago Nobel-prize winning economist Eugene Fama of the University of Chicago what happened in 2007-08, Fama shrugged: “We don’t know what causes recessions (Laughs). Now, I’m not a macroeconomist so I don’t feel bad about that… (Laughs again.) We’ve never known. Economics is not very good at explaining swings in economic activity.” And it is good for…?

Sadly, it’s no different this time. In January, US Fed vice-chair Richard H. Clarida asserted, “The US economy begins the year 2020 in a good place.” Although “foreign developments weighed on investment, exports, and manufacturing” in 2019, Clarida predicted steady, 1.9 per cent growth for 2020. In Canada, the Bank of Canada was equally hopeful, suggesting 1.9 per cent growth in 2020, 1.8 per cent for 2021, the same scenario foreseen by the Conference Board’s economists. Crisis; what crisis?…

So now, we can expect many of these mystified business economists to blame it all on the virus. We know differently, however. By the last quarter of last year, all the signs were there: the Canadian economy was already in crisis. By spring 2019, profitability was weakening and by summer, falling absolutely. By September, firms were canceling investments and starting to shed workers or cut their hours. StatsCan notes that business non-residential investment rose 3.4 per cent in the first quarter but fell 3.4 per cent in the second – including a 28 per cent reduction in spending on industrial machinery, itself a good indicator of an impending slump. Many projects already in progress were being completed, nonetheless – which helps explain why the stock of fixed capital kept going up although the profit rate was falling. The value of capital deployed in production relative to labour was still rising but already facing reduced profitability, many companies began jettisoning investment plans.

Nature of Capitalism

In short, none of this is the work of nature but rather, it’s the nature of capitalism. The system’s own inner workings and laws of motion don’t need sudden ‘shocks’ like COVID to cause recession (although the economics mainstream recognizes no other source of crisis). In actual fact, the system repeatedly falls back into crisis on its own, an inevitable effect of its normal operations. Unexpected developments like COVID-19 or oil-price manipulations don’t help, certainly. But neither do they explain the current crisis any better than they can explain any economic crisis.

COVID-19 has surely changed Canadian society and will keep on changing it in unpredictable ways. It is already threatening the lives of countless working people, making their jobs and livelihoods more precarious, unpredictable and dangerous, while disrupting the lives of millions of other Canadians.

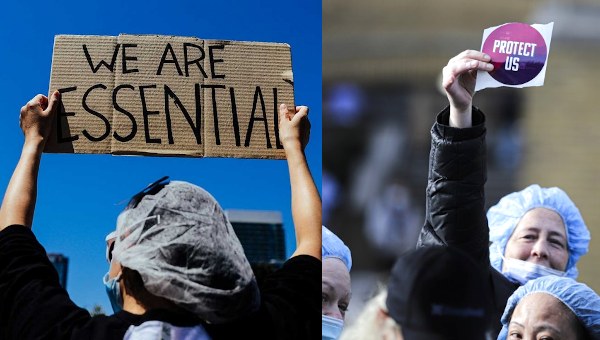

We experience much of this pandemic as bewildering, frightening and painful. But one silver lining is that by highlighting the working class’s immense social contributions, risks and sacrifices in the pandemic, the crisis potentially empowers all working people. Not just healthcare workers but all workers are suddenly being hailed as ‘heroes’. Were labour and the left to grasp the moment, we might easily find ourselves poised to make significant economic and social demands and make important gains for most Canadians: higher wages, better benefits, working conditions, living standards and more social recognition. Because, suddenly, everyone can see who is really ‘essential’, who struggles daily to not just protect us and keep us healthy but also feed, clean, house, illuminate, fuel, transport and provision us. And we also see just as clearly who is inessential or whose contributions are actually unhelpful.

Yet, what, so far, does our society offer all these ‘heroes’? First, a dangerous, frightening and stressful journey through the fight against COVID. Then a return to ‘normal’: an economy that is once more devolving into a crisis, again killing our jobs, savings, homes, careers and futures. Will all our working-class heroes decide their sacrifices warrant somewhat more and better? We can only hope!

So no, COVID has not driven our economy into recession. Capitalism’s own ‘inner workings’ and ‘laws of motion’ have already accomplished that… again. But this time, perhaps Canadians won’t stand for it. •