The Ontario Budget: Hard Times Ahead

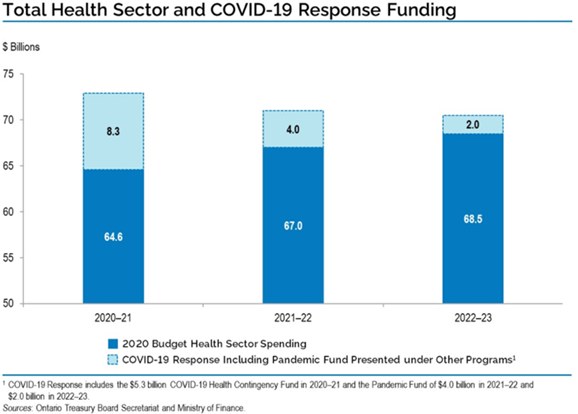

To ease future cuts, the government established a budgeting system this year which would see much of the COVID-related funding budgeted under special funds distinct from the normal ministries. So much of the increased funding for the Ministry of Health or Ministry of Long-Term Care (LTC) is not reflected in their line items but instead through special funds that are then later allocated to a ministry.

So first the good news: The health and LTC special COVID funds are “budgeted” to continue for a couple of years. An additional $4-billion in 2021–22 and $2-billion in 2022–23 is currently planned to help the health sector address COVID-19.

The bad news, however, is that even with that continuation of special COVID funds, overall healthcare and LTC funding is budgeted to go down – by $1.9-billion in 2021/22 and another $500-million in 2022/23. That’s a lot of cutting.

Of course that is “down” after a major increase this year. Including the special funds, $72.8-billion is budgeted for health and LTC this year. That is up from $63.7-billion in 2019/20, a $9.1-billion increase (or 14.3%). We are truly living in a healthcare bubble right now. Unfortunately, the plan is to end that extra funding fast.

Notably, outside of the special COVID funds healthcare and LTC got a pathetic increase of 1.4% this year – up from $63.7-billion last fiscal year to $64.6-billion. Next year, the non-COVID related increase is planned at 3.7%, still significantly less than cost pressures and so likely to further deepen the healthcare service squeeze. The non-COVID increase planned for 2022/23 is even less (2.2%).

Since the release of the 2020–21 First Quarter Finances, the Budget reports that they have made a number of COVID-related funding improvements, many related to hospitals:

- $1.4-billion to expand laboratory capacity, reduce testing backlogs, support existing assessment centres and more testing locations. Funding will also support additional contact tracers and case managers to trace and isolate new COVID-19 cases;

- $351-million to build additional hospital capacity to handle a surge in COVID-19 and influenza patients;

- $284-million to address surgical and diagnostic backlogs by supporting extended hours for additional priority surgeries and diagnostic imaging;

- $572-million to support hospitals facing additional costs related to responding to COVID-19;

- $367-million for wage enhancements for personal support workers (PSWs) and direct support workers in home and community care, long-term care, public hospitals and the social services sector. Investments will help attract and retain professionals to care for patients, clients and residents in response to COVID-19; and

- $200-million for the procurement of personal protective equipment (PPE) and critical supplies to protect healthcare workers, patients, and frontline staff in other sectors.

The government reports that hospital funding will be up $2.5-billion this year (well over 10%). That is likely the biggest dollar increase ever (although not the biggest percentage increase – Harris increased it 12% in one year when he overcame his anti-hospital bias). Of course, most of the increase is for COVID, so it won’t stay around.

Following the Budget, the Ontario Hospital Association identified the need for more funding this year due to COVID-related revenue shortfalls and extra expenses: “The hospital sector is facing a potential forecast deficit of at least $2-billion in 20/21, primarily a result of their role in fighting the pandemic. Yesterday’s Budget directly acknowledges the significant financial pressure facing hospitals and reaffirms the government’s commitment to supporting them and stabilizing their financial position through the remainder of this fiscal year.”

More funding is needed this year to offset COVID-related issues – $2-billion would be a big deficit for hospitals, requiring major cuts in the future.

Privatization of Hospital Services

The Budget further confirms government plans to place hospital beds in “alternate health facilities”:

“The Ontario government is proceeding with its $2.8-billion COVID-19 Fall Preparedness Plan by investing $116.5-million to add up to 766 additional beds in hospitals and alternate health facilities across the province. Making more beds available will help reduce surgical backlogs and improve access to care during COVID-19. This is in addition to the 139 critical care beds and 1,349 hospital beds already announced as part of the Fall Preparedness Plan, bringing the total new beds to more than 2,250 in hospitals and alternate health facilities across the province. Beds are being added across the province to help address the surgical backlog and ensure hospitals have enough beds to treat severe COVID-19 patients, particularly in COVID-19 hot spots. Beds are also being added to transition alternate level of care patients from the hospital to transitional health care settings, which will help alleviate the capacity pressure in hospitals. That is why the government is investing $351-million to add more than 2,250 beds across the province in response to the COVID-19 outbreak.”

This deepens longstanding attempts by government to narrow hospital work to acute care and remove other work to lower paying and less unionized settings. The recently passed Bill 175 allows home and community care employers to take over hospital work in various ways, including by establishing residential congregate care settings.

No doubt the intention is for many of these alternate health facilities to be for-profit. The Ottawa Citizen has just reported a story of a new “alternate health facility” at a retirement home managed by a for-profit home care corporation that is taking over hospital work through a $14 million deal. The government intends to “solve” the hospital capacity crisis by removing services from hospitals and putting them in settings with less care and lower wages. This ain’t good.

Long-Term Care

Despite the government’s recent promises to increase nursing and personal care to four worked hours per resident per day in long-term care, it appears there is no new money for LTC staffing this year, other than changes related to COVID. Here’s what they say about how they have spent new LTC COVID money:

“The government is working to ensure that loved ones in long-term care are protected as COVID-19 continues to unfold. In addition to the $243 million in support immediately provided to long-term care homes in March for emergency capacity and virus containment measures, the government is providing close to an additional $540-million in new funding to protect residents, caregivers and staff in long-term care homes from future surges of COVID-19, for a total of $783-million. This includes:

- $405-million to help homes continue prevention and containment of COVID-19 including enhanced screening, staffing supports and purchasing additional supplies and PPE

- $61.4-million for minor capital repairs and renovations in homes to improve infection prevention and control; $40-million to help stabilize the homes as they transition to lower occupancy rooms, to stop admissions of third and fourth residents to larger rooms;

- $30-million to allow long-term care homes to hire more infection prevention and control staff and train new and existing staff; and

- $2.8-million to extend the High Wage Transition Fund to ensure that gaps in long-term care staffing can continue to be addressed during COVID-19.”

Presumably, this is in addition to the standard increase to the MLTC line item. That increase was a very modest $113.8 million or 2.6%.

Notably, they do not break down a forecast for MLTC funding in the years ahead, so we do not know what sort of funding they plan for the staffing increases in 2021/22 and 2022/23, if any. The cost should be in the range of $350 million per year if done over four equal steps (not counting the new beds they keep promising).

Instead of a staffing increase, the government is now pushing to hire “Resident Support Aides” in LTC. These would be workers with less training than PSWs who would assist with activities of daily living. The government says this is for the COVID period. No doubt their intention is to pay them less than PSWs. The government has promised the 4 hours of worked care will not include such new categories of workers, but instead will be restricted to nurses and PSWs. We will see.

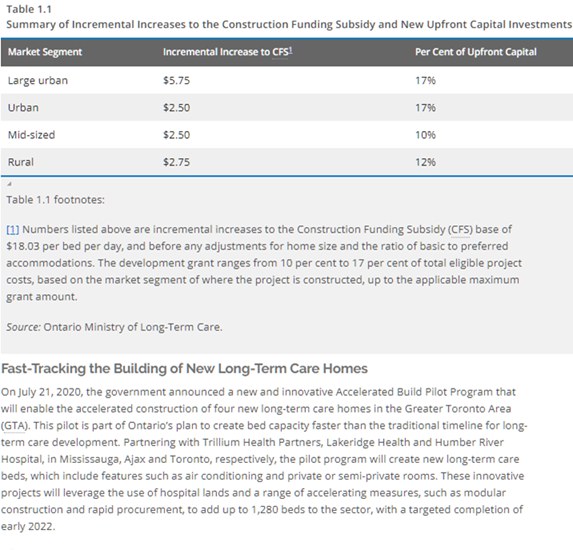

They are increasing the funding for construction of LTC beds, especially in large urban areas (where the cost of land has sky-rocketed).

This is a fat increase for the corporations involved in LTC. The government is determined, it seems, to pay a lot of money to for-profit corporations so they can own land and facilities, rather than the public.

Debt, Deficit, and the Reeling Economy

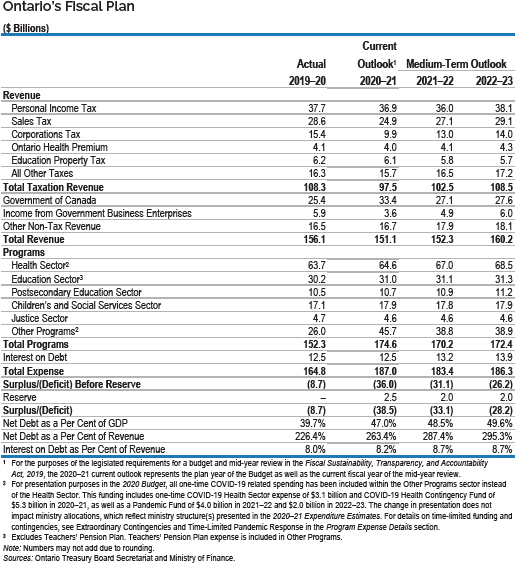

Total funding is up from $164.8-billion last year (actual) to $187-billion budgeted this year. That would be an increase of a whopping $22.2-billion, or 13.5%. Approximately 41% of that is for health care and LTC. None of the increase is due to increased debt charges (which are budgeted to remain at $12.5-billion).

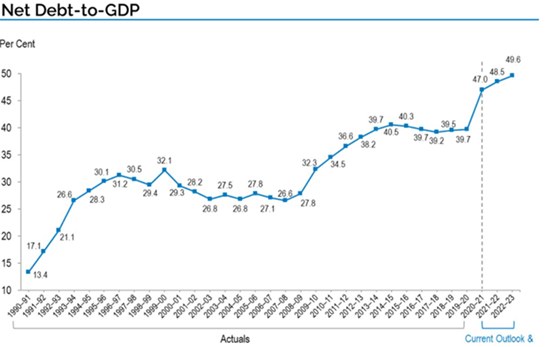

I had thought this Budget would report a significantly lower deficit than their earlier plans reported, as it appeared they were not going to spend their special funds. But no, the deficit is still reported at a whopping $38.5-billion. I still expect this to go down somewhat as they continue to report on this fiscal year (in the spring Budget and the fall Public Accounts). Even so, we are in for some eye-watering increases in deficit and debt levels.

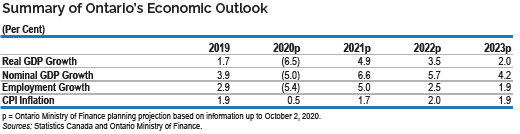

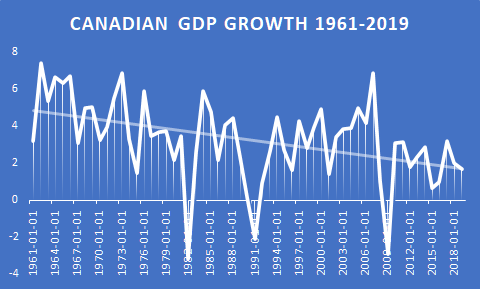

The government continues to forecast that we will not get back to 2019 GDP levels until 2022, and will then return in 2023 to the low level of growth that capitalism seems to deliver these days.

Medium and long-term forecasts for Canada (and the USA) suggest that growth will decline, creating an ongoing problem for working people (and capitalism). This continues a very long trend in declining growth in Canada and other developed capitalist economies:

After COVID, hospital and other public sector workers are facing a frosty future. Likely, corporations and the rich will turn on public sector services and public sector workers to pay down the deficit, rather than face increased taxes on themselves. Given the extent of the economic decline, it could take many years to get off the defensive, if that coming attack is not blunted.

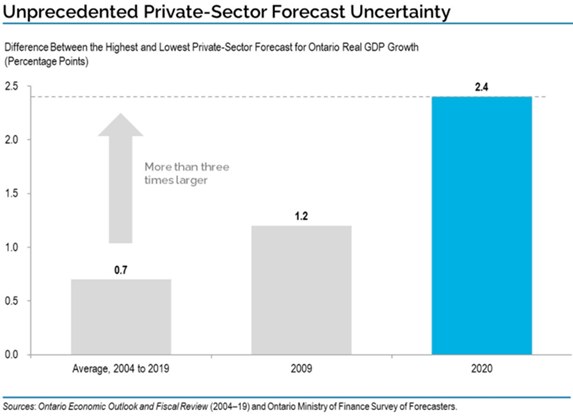

The government has also (wisely) highlighted the tremendous uncertainty in economic forecasts (and, as a result, in deficit forecasts):

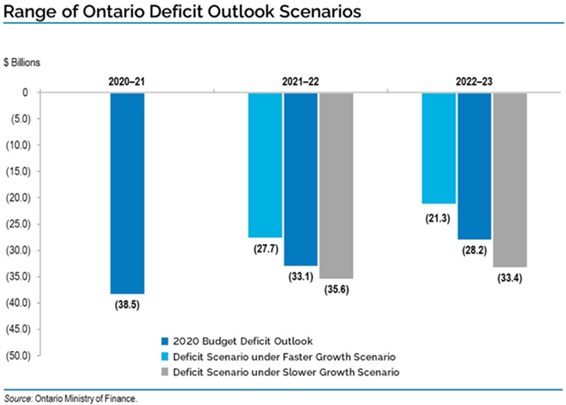

While a range in deficit forecasts results from this uncertainty, they are all pretty bad:

Under their main forecast, tax revenue will not return to 2019/20 levels until 2022/3. (Note the “increase” in health care funding in this chart is deceptive as the special funds – which are reported in a separate line item – are being cut, leaving an overall decline in healthcare funding in 2021/22 and 2022/23, as noted earlier.)

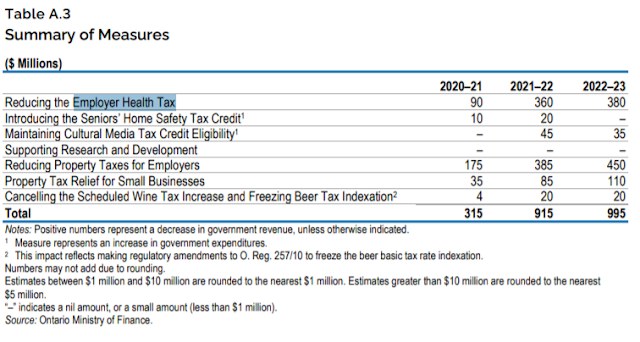

Despite the sharp decline in revenue and the big deficit, the PC government has proposed various new tax/revenue cuts. The government’s summary of tax cuts indicates that business could get $300-million in what remains of this fiscal year, $875-million in tax cuts in 2021-2, and $975-million in 2022-3. It’s as if we had no debt or deficit at all!

On top of all this, the government is also reducing electricity costs for business, “saving medium-size and larger industrial and commercial employers about 14 and 16 per cent respectively, on average, on their electricity bills (at an additional expense of $1.3-billion over three years).”

This tips the government’s hand about how they will deal with the fat structural deficit that will remain after COVID. They will oppose tax and revenue increases on the wealthy and corporations and in fact are more likely to cut their taxes and other costs further.

Money for Business, Restraint for Workers

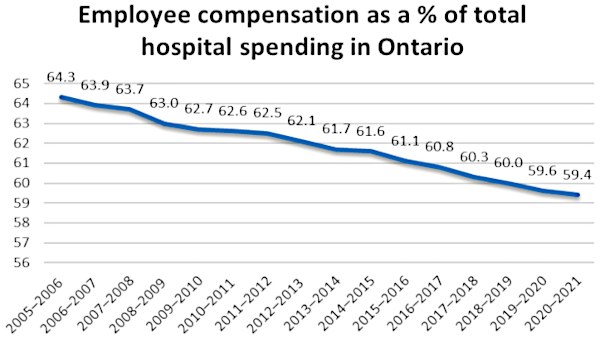

In sharp contrast to the largesse afforded business, government plans to cap broader public sector wage increase at 1%, likely a real wage cut.

The Budget claims in passing (table 3.7) that each 1% change in employee compensation leads to $995-million in extra expense. In other words, “employee expense” for the provincial government is about $99.5-billion per year. So reducing settlements from (say) 1.75% (which would almost keep workers wages level with inflation) to 1% should save them about $750-million. That will almost pay for the business tax cuts discussed above.

It is also fairly small change in the scope of a $180-billion annual budget – about 0.4%. (Of course, it would grow over three years – to $2.25-billion or about 1.25% of the annual Budget.)

By way of comparison, over half way through the fiscal year, the government still has a $2.912-billion operating contingency fund for unexpected spending (and another $99.3-million for capital contingency). This is a larger than usual contingency fund – but even smaller contingency funds (say $1-billion) are often not spent. I wouldn’t be surprised if this year’s contingency funds are not spent (we will know for sure when the Public Accounts are released at the end of September). $2.912-billion is almost four times the size of $750-million.

The contingency fund this year is bigger than the biggest annual saving from Bill 124 wage restraint. •

This article first published on the OCHU LeftWords website.

Ontario’s 2020 Budget – a “Practical Freeze” for Education

School boards are strapped for cash, but the $31-billion 2020 Ontario Budget released last week by the Ford government isn’t going to help them much. According to economist Ricardo Tranjan, of the Canadian Centre for Policy Alternatives (CCPA) it’s essentially a “practical freeze” on spending- one that will likely continue for the next couple of years. There is an additional $200 per child up to 12 years old to cover pandemic related costs like buying computer equipment and internet access – $250 per child with disabilities. But overall, Mr. Tranjan says this is a stand-pat budget. He added that because of the COVID-19 related recession, “inflation projections are low” which reduces some added costs to school boards across the province.

Looking Closer

There are some details that need a closer look. One is that the province says it’s “making $1.3-billion available for the education sector.” That’s only true if you understand it in the sense of passing it from one hand to another. Back in October Premier Doug Ford said the province was going all the way, to provide schools what they need to stay safe: “We have done absolutely everything, everything. We’re sparing nothing. Every idea possible, we’re putting into the classrooms.” Actually, much of that money, about $380-million by Ricardo Tranjan’s reckoning, comes from the federal government, with about $390-million coming from the province. He adds that there is another roughly $380-million due from Ottawa in January as the second instalment.

The rest of it – up to $496-million – comes from school board reserves. This is not money provided by the province, but funds held by school boards to meet future obligations like health and safety requirements, according to NDP Education Critic, Marit Stiles. Half of that amount was already available to school boards; the province just upped the amount they could use, which she adds comes to about $91-million so far. Not only is this not new money, Ms. Stiles says, cutting into reserves “destabilizes the school boards for years ahead” making it appear that they have money to spend when they really don’t. “Will the province restore those funds?” she asks.

As for the woefully small $200 – $250 per child the province plans to spend, she agrees that a lot of families could use a hand, but why not invest that money in schools which could make more effective use of it. School boards could also make sure that the dollars are spent equitably in areas where the need for extra funds are highest.

The province says this money is for safety measures covering COVID-19 including: $100-million for more teachers to keep class sizes down; $90-million for personal protective equipment (PPE), $79-million for more custodian and cleaning supplies and $100-million “supporting a broad range of activities” which look a lot like the other initiatives it announced. School asked Ministry of Education media reps for details, but got no response. Elementary Teachers Federation of Ontario is concerned that there was no new money announced to pay for additional health and safety measures beyond this school year.

Is this even enough to cover current extra expenses? For example, the Toronto District School Board released a budget update recently noting the extra costs of running two school systems: one for kids attending class and one for those going to school online. It’s spent an additional $15-million on technology, cut into its reserves to pay for 280 more teachers and overspent its budget by $59-million to help special needs students. It was allotted $460,000 for PPE and cleaning supplies, but has spent $8-million. It still has to tackle a longstanding backlog of $3.5-billion in building repairs which include problems with ventilations systems.

Tax Cuts in a Time of COVID

Another aspect of the budget lost in the fog of numbers, is that it contains about $1-billion tax cuts, according to Ricardo Tranjan. This, at a time when the government is projecting a deficit of $38.5-billion for 2020-21 and $33.1-billion for 2021-22. Most of this tax cut is meant to help out businesses, but for those that are struggling, they probably need relief rather than a tax cut for money they aren’t generating. For others, like the Loblaws grocery chain, that have seen revenues increase during COVID-19 by $824-million (7.4 per cent) – what’s the need for a tax cut?

Tax breaks just add pressure on future budgets to cut programs. It will be easy to forget, in 2021 or 2022, that the deficit over which the Tories are crying wolf as they cut services, includes of $1-billion in tax reductions. Add that to the fact that they aren’t keeping up with costs of education says Marit Stiles, when the pandemic is over “we’ll see more brutal and painful cuts.”

It certainly makes your head spin – a budget freeze during the most severe pandemic to hit the country in a century, all underscored by tax cuts for businesses. For a little while, Doug Ford put on a folksy performance as he claimed he was “sparing nothing to fight COVID-19.” The money his government puts out says something different. •

| Tax cuts include – in millions of dollars (Table A3 Ontario Budget 2020) | |||

|---|---|---|---|

| 2020-21 | 2021-22 | 2022-23 | |

| Reducing Employer health tax: | $90 | $360 | $380 |

| Reducing property tax for employers: | $175 | $385 | $450 |

| Property tax relief for small businesses: | $35 | $85 | $110 |

| Total (note that this includes all tax cuts): | $315 | $915 | $995 |

This article first published on the School Magazine website.