An estimated 30,000 public school teachers in Chicago walked off the job on Monday for the first time since 1987, leaving 350,000 students in limbo. Chicago has the third-largest school district in the United States and it is the city where President Obama launched his presidential bid. There are national stakes involved, like the election a mere 50-odd days away.

Odd days indeed. This is the largest strike to be organized since 29,000 nurses and medical staff walked off the job in California back in September 2011. What’s most important to keep in mind here are the national implications of the localized strike.

Mitt Romney, presidential nominee for the Republican Party, chimed in early saying that the Chicago Teachers Union (CTU) was turning its back on the city’s children. He also stated that President Obama was rooting for the teachers. The President has been put in quite the frustrating position.

Enter Chicago Mayor Rahm Emanuel, Obama’s former chief of staff. He has an abrasive disposition and is known to swear and yell a lot. Michelle Obama is reported not to be very fond of him. Why is he important? He happens to be a key operative in the national Democratic Party and is Obama’s point-man and chief fundraiser for his Super PACs. (Its worth mentioning that the Citizens United ruling rendered campaign financing into a corporate free-for-all, with virtually no limit on campaign donations on behalf of corporations – and unions too I should say. The Citizens United ruling was a catalyst for the now year-old Occupy movement.)

Mayor Emanuel was specifically in charge of the Priorities USA Action, the Political Action Committee (PAC) in charge of Obama’s re-election campaign. The Chicago Mayor also stepped away from his duties on the House Majority PAC after Republicans implored him not to put ‘politics’ ahead of the students of Chicago.

Organized Labour’s Role

But organized labourers have been key supporters for President Obama. Labour leaders are going to put their mightiest efforts into avoiding a catastrophic defeat, something Wisconsin (only 1.5 hours away) has already experienced with the recall race against Governor Scott Walker. Governor Walker’s ‘budget repair bill’ in 2011 brought an estimated 100,000 (mainly labour supporters) out in protest.

But the Teacher’s strike is not merely about the teachers. An Auditor General’s report released in June 2012 projects Illinois’ budget deficit to be at $43.5-billion. It has more than doubled in the last five years. Representative Randy Hultgren (R-Ill.) issued a report on the vast fiscal mess the state’s finances are embroiled in, explaining that “…over-spending, tax hikes, and blocking necessary fiscal reform have given Illinois the worst economic reputation in the nation.”

Taxes and Deficits

As for Chicago, the city faces a $665-million dollar deficit. Property taxes are reportedly already at the highest allowed by law and the city has exhausted its financial reserves.

Chicago’s lawmakers are shy when it comes to collecting taxes from its corporate constituency. The Chicago Mercantile Exchange and the Board of Trade are the ignoble organs of the same capitalist accumulation that gave us modern financial derivatives and special investment vehicle-cum-toxic assets. The neoliberal conveners in city hall are there to make sure the big budget shortfalls are going to be made up by anyone who doesn’t hang their hat in a corporate boardroom.

Mayor Emanuel is known as a gruff person, the ‘I want this yesterday!’ type of personality. However, there is a cohort to whom Emanuel is servile to. So much so that Chicago residents presented his office with a golden toilet after he handed over $15-million in tax rebates to the Chicago Mercantile Exchange. This slush fund money had originally earmarked for the renewal of public infrastructure. Once again, the very same people for whom Emanuel claims to be speaking – Chicago’s urban poor – are the one’s who get the least reward.

But let’s continue with the upper crust of Chicago, shall we?

Long ago, supply-sider economists and Jack Kemp (Reagan’s tax guy) told us the rising tide floats all boats and reforming marginal tax-rates would give everyone a larger slice of the pie. Ironically, this is rhetoric reminiscent of JFK, imported into the vernacular of Reagan-era conservatism. But if the mixed metaphors of floating pies and soaring boats are any indication of the clarity of the argument, then we should have recognized we were in trouble right then and there. The ‘New Frontier’ rhetoric is still being served up for our nightly delectation. Cut taxes and spending in Illinois lest worse befall you, they say.

It is from this sort of timber that the Chicago city hall carpentered tax and spending cuts would end up bolstering jobs and capital investment. What came next were skyscrapers and expense-account hotels, the low-wage economy of retail and fast food hamburgers, cheap credit and petty criminality, which they still sit upon.

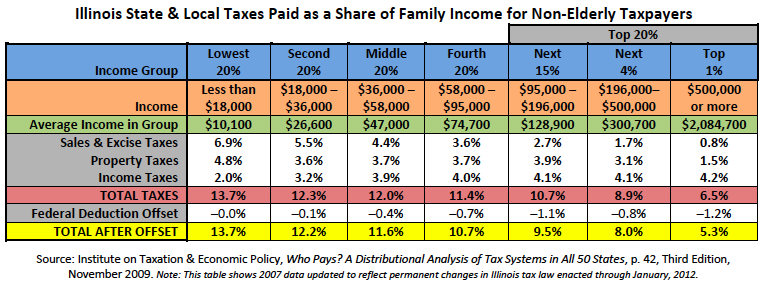

A November 2009 study by the Institute for Taxation and Economic Policy entitled Who Pays? pegged Illinois as having the fifth most regressive tax system in the nation (Washington, D.C. is number one unsurprisingly). The poorest residents “pay up to six times as much of their incomes in taxes as they ask their wealthy to pay.” In an era of depressed profitability on the whole, embattled corporations have sought tax loopholes – justified by the gutter euphemism ‘incentive’ – to squeeze through since about the time Reaganism slouched out of the Sunshine state.

American business, the mighty engines of prosperity sound today like a convoy of old Chevys straining uphill in low gear. The art of capitalism since the credit crisis of 2007 has been

about getting government handouts faster than the next guy rather than the

fabled entrepreneurial spirit and innovation. Here is what we now know about the shambolic financial sector in America:

1. Unscrupulous trading. Make Wall Street Pay Illinois provides a lurid account of the free money given to investment houses that went bust due to unscrupulous trading.

2. Rigged playing field. The obscene revelations of interest rate fixing at the LIBOR (London Interbank Offered Rate) which sets the benchmark for investments worldwide.

3. Loophole artists are skimming the pot. Good Jobs First provides us with a summary of the four well-trod tax loopholes used by corporate Chicago.

4. The well-heeled are publicly subsidized. No one got rich by spending their own money. According to a new report by the Institute for Policy Studies, 627,000 public services workers have been axed since 2009. Oppositely, 25 CEOs took home an average compensation of $20-million, up 24 per cent since 2010. As usual, the U.S. tax code acts as a siphon from the pockets of the lowest to highest.

5. The termites are dining long and well on public infrastructure. The Alliance for a Just Society documents The Cost of Cuts in Illinois, which is to say a high cost to those accustomed to low living.

There is a microcosm point to all this and a connected, macrocosmic one; a Chicago-Washington symbiosis.

Chicago is quickly becoming a state-level Banana Republic. Mayor Emanuel runs Chicago and the Democratic Party backroom – and, for good measure, the White House staff during his off-seasons from electioneering. The city hall give-outs are quid pro quo money for presidential campaign funds and austerity over the teachers is helping to sweeten the deal. Is it not one of the sorely missed news stories of Obama’s 2008 campaign? How the state of Illinois was mutated into one big golden toilet for Obama’s nomination? Look how former Governor of Arkansas Bill Clinton traded Arkansans to American monopolies for political support. Tyson Foods (See Christopher Cook, “Plucking Workers,” The Progressive, 1998). Wal-Mart also emerged from Clinton’s latrine in the south.

Wal-Mart (38 locations received $150-million) is again included in the motley of corporate tree-shakers, according to Good Jobs First. Also included: Sears ($150-million in tax credits over 10 years), Mitsubishi (a $29-million subsidy), Boeing ($17-million in credits, $16-million in property tax abatements). And then there’s Motorola.

Citizens Tax Justice reported that Motorola was given $100-million over ten years in a city-sponsored effort to shore up 2500 jobs in Illinois. They handed over $18.6-million before they realized that Motorola disposed with 700 employees under orders from its parent company, Google Inc. The flight of capital out of Chicago became contagious. Sears, the Chicago Merc, and various holding groups threatened with relocation. Each were paid up.

Now let me, if you will, show what its like at the bottom.

An overlapping of incarceration rates by district in Chicago over its poverty rates by district reveals a remarkably clear fit. Even more, the drop-out rates among public high school kids are borne from low-income families. And on top of it all they bear the paralyzing brunt of the tax burden.

Chicago is imperfectly gentrified. Fifty thousand kids of the luckier families go to charter schools, which are not on strike. Charter schools receive public money and charge no tuition, its students are selected by a random lottery and anyone, in theory, can go regardless of economic status.

These schools are non-unionized zones and according to the National Alliance for Public Charter Schools capture 9 per cent of the ‘market’ for schools in Chicago. Businessweek reports that these collective-bargain free schools in Chicago have doubled since 2005, with 50,000 students now enrolled. A two-tiered school system fit for a two-tiered class

society where mobility between the two is quickly becoming a one-way street (and its not going upward as it were).

Between the charter schools and the ubiquitous office blocks, the Latino and black residents of the city have little space to breath. According to the Chicago Reporter, kids in 472 Chicago public schools have no safe spaces for recess and have class sizes above 35. Some 80 per cent of Chicago public school students qualify for the free lunches program because of the shudderingly low household income of the surrounding districts.

The Teachers fare no better. According to a 2004 article called “Rethinking Teacher’s Compensation” in an issue of American Teacher, new teachers earn $8000 dollars less than recent graduates with comparable levels of education. After just 15 years of work, that pay gap will widen to $23,000 dollars.

And if you think this is just middle-class self-pity, think again. The same article goes on to advocate for standardized testing as part of the incentive structure for teachers. This isn’t your usual, regularly dismissed propaganda sheet for the teacher’s union. The American Federation of Teachers has taken up similar principles in its campaigns. (See this fact sheet on student testing).

Two modest plans reforming public office and servicing have been put forward by people who know what they’re talking about.

First, the Center for Budget and Tax Accountability issued ‘The Case for a Graduate Income Tax in Illinois’ which proposed opening up revenue streams in order to release many from a suffocating tax burden.

The second is an education reform package, derived locally from teachers and students. The Chicago Teachers Union published ‘The Schools Chicago Students Deserve‘, which is a road map to improve the quality of education among the city’s artful youth.

“The really upsetting part about all this is that those who are most heavily taxed are the ones that fill up Chicago prisons. …the plain as day fact that more blacks are in prisons than there were slaves before 1848.”

The really upsetting part about all this is that those who are most heavily taxed are the ones that fill up Chicago prisons. Megan Cotrell’s illuminating book, The New Jim Crow, asks the question “is Illinois a slave state?,” and the engine of the book is the plain as day fact that more blacks are in prisons than there were slaves before 1848. (Ironically the same year that the Chicago Board of Trade and the Democratic Party were founded. And, hell, the Communist Manifesto was published too.)

If anything good could be said of the presidential administrations before the dawn of Reaganism is that the government was concerned ‘for them.’ Roosevelt’s New Deal in the 1930s and Johnson’s Great Society programs in the 1960s were run as organizations by eager upstarts who didn’t feel right about people eating dog food and sleeping in parking lots and on heating vents. Efforts were made, even if they ultimately failed.

By Reagan’s misrule in the 1980s, government became ‘for us’ instead of ‘for them,’ the ‘us’ being privileged insiders, top 1 per cent and party backrooms. Government policy took on the task of keeping the upper and lower classes as separate and non-overlapping as humanly possible. Wealth is now being distributed among a smaller section of the U.S. and the surplus population (the mentally ill, the oppressively poor, single mothers…) are left to fend among their own kind.

The most unfortunate thing about this whole situation is the timing. With the current crisis in Libya, the showdown in Chicago will surely be overshadowed. The attention of the White House will once again be fixated elsewhere. Chicago meanwhile hangs in the balance. •