Rosa Luxemburg and Debt as an Imperialist Instrument

103 years back, Rosa Luxemburg was shot dead and her body flung into Berlin’s Landwehr Canal. However, she could not be wiped out from history as her life and works are extremely relevant in our quest to find a better world. We reprint this article to pay homage to her legacy that continues to inspire millions even today – CADTM.

In her book titled The Accumulation of Capital, published in 1913, Rosa Luxemburg1 devoted an entire chapter to international loans in order to show how the great capitalist powers of the time used the credits granted by their bankers to the countries of the periphery to exercise economic, military and political domination on the latter. She sought to analyse the indebtedness of the newly independent states of Latin America, particularly, following the wars of independence in the 1820s, as well as the indebtedness of Egypt and Turkey during the 19th century, without forgetting China.

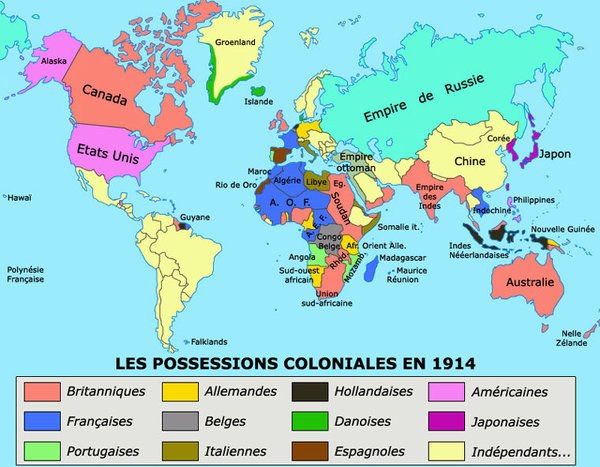

She wrote her book during the period of an international expansion of the capitalist system, both in terms of economic growth and geographical expansion. At that time, inside the Social Democracy, of which she was a member (the German Social Democratic Party and the Social Democratic Party of Poland and Lithuania – territories shared between the German and the Russian Empire), a significant number of socialist leaders and theorists supported the colonial expansion. This was particularly the case in Germany, France, Great Britain and Belgium. All these powers had developed their colonial empires in Africa, mainly in the late 19th and early 20th centuries. Rosa Luxemburg was totally opposed to this orientation and denounced the colonial plunder and destruction of the traditional (often communitarian) structures of pre-capitalist societies by expanding capitalism.

She was opposed to these same socialist leaders who claimed that this expansionist phase of strong capitalist growth demonstrated that capitalism had overcome periodic crises, the last of which had occurred in the early 1890s. Rosa Luxemburg denounced this view which gave a false interpretation of the functioning of the capitalist system. Rosa was all the more vehemently opposed to it since this vision of an influential part of the social-democratic leadership served as a basis and justification for an increasingly collaborative attitude with the capitalist governments of the time.2

While writing The Accumulation of Capital, Rosa Luxemburg aimed to construct a substantive argument to counter the pro-colonialist and class-collaborationist orientations within social democracy that she had been fighting since the late 1890s. She also pursued another objective, which had its origins in 1906-1907, when she taught a course in Marxist economics at the SPD – the Social Democratic Party of Germany – school, in Berlin. In fact, on that occasion, in order to prepare her lectures, she had gone back to read Capital and had deduced that there was a mistake in Marx’s substantiation of the extended reproduction scheme of capital.3 In order to find a solution, particularly, to this problem, she made an enormous effort to analyse capitalism’s evolution during the 19th century. It should be pointed out that Marx, in Capital, develops his actual theoretical explanation assuming that the capitalist society has reached a stage in which only capitalist relations exist. He analyses capitalism in its pure state.

Rosa Luxemburg starts from the observation, made even by Marx in a series of writings like in the Grundrisse4 (which she did not have the opportunity to read because these works by Marx had not yet been published during her times) or chapter 31 of the first volume of5 which says that capitalism, in its expansion, destroys the traditional structures of non-capitalist societies that were conquered during the colonial phase.

Concerning the role of colonial plunder, it is worth quoting the Marx of Capital:

“The discovery of gold and silver in America, the extirpation, enslavement and entombment in mines of the aboriginal population, the beginning of the conquest and looting of the East Indies, the turning of Africa into a warren for the commercial hunting of black-skins, signalised the rosy dawn of the era of capitalist production.”

It is also in this chapter that Karl Marx puts forward a formula indicating the dialectical link between the oppressed in the metropolises and those in the colonies: “In fact, the veiled slavery of the wage workers in Europe needed, for its pedestal, slavery pure and simple in the new world.” He ends the chapter by saying that “capital comes dripping from head to foot, from every pore, with blood and dirt.”

Marx describes the destruction of traditional textile producers in India during British colonial expansion. He also analyses the destruction of non-capitalist relations that existed in Europe before the massive expansion of wage labour. But when he comes to highlight the laws of operation of the capitalist system, he assumes that capitalism totally dominates all relations of production and has, therefore, already completely destroyed or/and absorbed the pre-capitalist sectors.6

What is very enriching in Rosa’s approach is her enormous capacity for critical thinking and her willingness to confront theory with practice. She takes her inspiration from Karl Marx by expressing a fundamental agreement with him, but this does not prevent her from questioning, rightly or wrongly, some of his conclusions.

One point on which Rosa Luxemburg agrees completely with Karl Marx is the question of the unequal relations between the capitalist powers and other countries where pre-capitalist relations of production are still largely present. These countries are subject to the former, who exploit them in order to continue their expansion. Rosa Luxemburg, like Marx, shows in particular that the capitalist powers find an outlet for their manufactured products by imposing them on pre-capitalist societies, particularly through the signing of free trade treaties.

The Latin American countries that gained their independence, in the 1820s, against the Spanish empire

If we take the example of the Latin American countries that gained their independence in the 1820s, we see that they imported massively, manufactured goods, mainly from Great Britain, from whom they had taken out international loans to make these purchases. The governments of Latin American countries that borrowed from London bankers spent most of the money they borrowed, on the British market, buying all kinds of goods (military equipment ranging from weapons to uniforms, capital goods for mining and agriculture, and raw materials). Then, to repay their international loans, indebted states resorted to new loans that were used both to repay previous loans and to import even more manufactured goods from Britain or other creditor powers.7

Rosa Luxemburg states in her 1913 book that loans “are yet the surest ties by which the old capitalist states maintain their influence, exercise financial control and exert pressure on the customs, foreign and commercial policy of the young capitalist states.”8

To illustrate the penetration of manufactured goods from old European capitalist countries such as Britain into the newly independent countries of Latin America we can cite George Canning, one of the leading British politicians of the 1820s.9 He wrote in 1824: “The deed is done, the nail is driven, Spanish America is free; and if we do not mismanage our affairs sadly, she is English.” Thirteen years later, the English consul in La Plata, Argentina, Woodbine Parish, could write of a gaucho (herdsman) on the Argentine pampas: “Take his whole equipment – examine everything about him – and what is there not of rawhide that is not British? If his wife has a gown, ten to one it is made at Manchester; the camp-kettle in which he cooks his food, the earthenware he eats from, the knife, his poncho, spurs, bit, all are imported England.”10

To achieve this outcome, Great Britain did not need to resort to military conquest (although, when it considered it necessary, it did not hesitate to use force, as was the case in India, Egypt or China). It used two very effective economic weapons: international credit and forcing these newly independent states to discard protectionism.

Rosa Luxemburg insists on the role of international loans to colonial countries or “independent” states (such as the young Latin American republics or Egypt and China) to finance major infrastructure works (construction of railways, construction of the Suez Canal, …) or purchases of expensive military equipment in the interest of the big imperialist powers. This is how she wrote: “Public loans for railroad building and armaments accompany all stages of the accumulation of capital.”

She also asserts that “The contradictions inherent in the modern system of foreign loans are the concrete expression of those which characterise the imperialist phase.”

Rosa Luxemburg, as Marx had done a few decades earlier, insists on the role of financing the railways all around the world, especially in peripheral countries subject to the economic domination of the imperialist powers. She speaks of the frenzy of loans used to build the railways: “In spite of all periodical crises, however, European capital had acquired such a taste for this madness, that the London stock exchange was seized by a veritable epidemic of foreign loans in the middle of the seventies. Between 1870 and 1875, loans of this kind, amounting to £m. 260, were raised in London. The immediate consequence was a rapid increase in the overseas export of British merchandise.”

At the end of the 19th century, after the London bankers came those of Germany, France and Belgium

German, French and Belgian imperialism appeared in conjunction with Great Britain and began to lend massively to the countries on the periphery.

Rosa Luxemburg describes this evolution:

“The following two decades made a difference only in so far as German, French and Belgian capital largely participated with British capital in foreign investments, while railway construction in Asia Minor had been financed entirely by British capital from the fifties to the late eighties. From then on, the German capital took over and put into execution the tremendous project of the Anatolian railway. German capital investments in Turkey gave rise to increased export of German goods to that country.

“In 1896, German exports to Turkey amounted to 28 million marks, in 1911 to 113 million marks. To Asiatic Turkey, in particular, goods were exported in 1901 to the value of 12 million and in 1911 to the value of 37 million marks.”

Rosa Luxemburg shows that colonial and imperialist expansion allowed the old European capitalist countries such as Great Britain, France, Germany, Belgium (we can add Italy and the Netherlands), where there is a surplus of capital, to use this unused capital to lend it or invest it in the peripheral countries, which then constitute a profitable outlet. She writes: “There had been no demand for the surplus product within the country, so capital had lain idle without the possibility of accumulating. But abroad, where capitalist production has not yet developed, there has come about, voluntarily or by force, a new demand of the non-capitalist strata.” It’s only by destroying traditional local small-scale production, European manufactured goods took the place of pre-capitalist domestic production. Impoverished peasant communities or craftsmen in African, Asian or American countries were forced to start buying European products, for example, British, Dutch or Belgian textiles. Those responsible for this situation are not only the European capitalists but also the local ruling classes in peripheral countries who preferred to specialise in import-export trade rather than invest in local manufacturing industries (as I have shown with regard to Latin America in the Debt System in chapter 2 and chapter 3). They preferred to invest their accumulated capital to extract raw materials (e.g. mining) or to grow cotton and sell these products in their raw state in the world market, rather than to process them locally. They preferred to import manufactured goods from old Europe rather than invest in local processing industries and produce for the domestic market.

Egypt, a victim of international borrowing

In the case of Egypt, which Marx had not studied in-depth, Rosa points her finger at another phenomenon. In order to repay the foreign debt contracted with bankers in London and Paris, the indebted Egyptian government subjected the Egyptian peasantry to overexploitation, either by forcing it to work for free on the construction of the Suez Canal or by levying taxes that severely degrade the living conditions of the peasants. Rosa Luxemburg thus showed how the overexploitation of the peasantry by methods that are not purely capitalist (i.e. not based on wage-labour relations) benefits the accumulation of capital.

Rosa Luxemburg describes the process summarised above. She explains that the Egyptian workforce,

“This was throughout the same forced peasant labour over which the state claimed to have an unrestricted right of disposal, and thousands had already been employed on the Kaliub dams and the Suez Canal and now the irrigation and plantation work to be done on the viceregal estates clamoured for this forced labour. The 20,000 serfs who had been put at the disposal of the Suez Canal Company were now required by the Khedive [ÉT: the Egyptian sovereign] himself; and this brought about the first clash with the French capital. The company was adjudged a compensation of 67 million marks by the arbitration of Napoleon III, a settlement to which the Khedive could all the more readily agree since the very fellaheen whose labour power was the bone of contention were ultimately to be mulcted of this sum. The work of irrigation was immediately put in hand. Centrifugal machines, steam and traction engines were therefore ordered from England and France. In their hundreds, they were carried by steamers from England to Alexandria and then further. Steam ploughs were needed for cultivating the soil, especially since the rinderpest of 1864 had killed off all the cattle, England again being the chief supplier of these machines.”

Rosa Luxemburg describes the numerous purchases of equipment and the entire projects carried out by the Egyptian sovereign through British and French capitalists. She asks the question: “What had provided the capital for these enterprises?” and herself answers: “International loans.” All this equipment and projects were used to export raw materials, mainly agricultural (cotton, sugar cane, indigo, etc.) and to complete the construction of the Suez Canal in order to promote world trade dominated by Great Britain.

Rosa Luxemburg describes in detail the succession of international loans that gradually dragged Egypt and its people into an endless abyss. She shows that the conditions imposed by the bankers make it impossible to repay the capital because it was necessary to borrow constantly to pay the interest. Let us leave the pen to Rosa Luxemburg, who lists an impressive series of loans granted on abusive terms to the benefit of the lenders:

“One year before his death in 1863, Said Pasha11 had raised the first loan at a nominal value of 68 million marks which came to 50 million marks in cash after deduction of commissions, discounts, etc. He left to Ismail Pasha the legacy of this debt and the contract with the Suez Canal Company, which was to burden Egypt with a debt of 340 million marks. Ismail Pasha12 in turn, raised his first loan in 1864 with a nominal value of 114 million marks at 7 per cent and a cash value of 97 million at 8¼ per cent. What remained of it, after 67 million had been paid to the Suez Canal Company as compensation (…) In 1865, the first so-called Daira-loan was floated by the Anglo-Egyptian Bank, on the security of the Khedive’s private estates. The nominal value of this loan was 678 million marks at 9 per cent and its real value 50 million marks at 12 per cent. In 1866, Fruehling & Goschen floated a new loan at a nominal value of 60 million marks and a cash value of 50 million marks. The Ottoman Bank floated another in 1867 of nominally 40 million marks, really 34 million marks. The floating debt at that time amounted to 600 million. The Banking House Oppenheim & Neffen floated a great loan in 1868 to consolidate part of this debt. Its nominal value was 238 million at 7 per cent, though Ismail could actually lay hands only on 142 million at 13½ per cent. This money made it possible, however, to pay for the pompous celebrations on the opening of the Suez Canal, in presence of the leading figures in the Courts of Europe, in finance and in the demi-monde, for a madly lavish display, and further, to grease the palm of the Turkish Overlord, the Sultan, with a new baksheesh of 20 million marks. The sugar gamble necessitated another loan in 1870. Floated by the firm of Bischoffsheim & Goldschmidt, it had a nominal value of 142 million at 7 per cent, and its cash value was 100 million at 13 per cent. In 1872/3 Oppenheim’s floated two further loans, a modest one amounting to 80 million at 14 per cent and a large one of 640 million at 8 per cent which reduced the floating debt by one half, but which actually came only to 220 million in cash since the European banking houses paid it in part by bills of exchange they had discounted.

“In 1874, a further attempt was made to raise a national loan of 1,000 million marks at an annual charge of 9 per cent, but it yielded no more than 68 million. Egyptian securities were quoted at 54 per cent of their face value. Within the thirteen years after Said Pasha’s death, Egypt’s total public debt had grown from £m. 3.293 to £m. 94.110, and collapse was imminent.”

Rosa Luxemburg rightly claims that this seemingly absurd series of borrowings has paid off for the bankers:

“These operations of capital, at first sight, seem to reach the height of madness. One loan followed hard on the other, the interest on old loans was defrayed by new loans, and capital borrowed from the British and French paid for the large orders placed with British and French industrial capital.

“While the whole of Europe sighed and shrugged its shoulders at Ismail’s crazy economy, European capital was in fact doing business in Egypt on a unique and fantastic scale – an incredible modern version of the biblical legend about the fat kine which remains unparalleled in capitalist history.

“In the first place, there was an element of usury in every loan, anything between one-fifth and one-third of the money ostensibly lent sticking to the fingers of the European bankers.”

Then she shows that it was the Egyptian people, especially the mass of poor peasants, the fellahs, who repaid the debt:

“Ultimately, the exorbitant interest had to be paid somehow, but how – where were the means to come from? Egypt herself was to supply them; their source was the Egyptian fellah–peasant economy providing in the final analysis all the most important elements for the large-scale capitalist enterprise. He provided the land since the so-called private estates of the Khedive were quickly growing to vast dimensions by robbery and blackmail of innumerable villages, and these estates were the foundations of the irrigation projects and the speculation in cotton and sugar cane. Like forced labour, the fellah also provided the labour-power and, what is more, he was exploited without payment and even had to provide his own means of subsistence while he was at work. The marvels of technique that European engineers and European machines performed in the sphere of Egyptian irrigation, transport, agriculture and industry were due to this peasant economy with its fellaheen serfs. On the Kaliub Nile dams and on the Suez Canal, in the cotton plantations and in the sugar plants, untold masses of peasants were put to work; they were switched over from one job to the next as the need arose, and they were exploited to the limit of endurance and beyond. Although it became evident at every step that there were technical limits to the employment of forced labour for the purposes of modern capital, this was amply compensated by capital’s unrestricted power of command over the pool of labour-power, how long and under what conditions men were to work, live and be exploited.

“But not alone that it supplied land and labour-power, peasant economy also provided the money. Under the influence of the capitalist economy, the screws were put on the fellaheen by taxation. The tax on peasant holdings was persistently increased. In the late sixties, it amounted to 55 marks per hectare, but not a farthing was levied on the enormous private estates of the royal family. In addition, ever more special rates were devised. Contributions of 2.50 marks per hectare had to be paid for the maintenance of the irrigation system which almost exclusively benefited the royal estates, and the fellah had to pay 1.35 mark for every date tree felled, 75 pfennigs for every clay hovel in which he lived. In addition, every male over 10 years of age was liable to a head tax of 6.50 marks. (…)

“The greater the debt to European capital became, the more had to be extorted from the peasants. In 1869 all taxes were put up by 10 per cent and the taxes for the coming year were collected in advance. In 1870, a supplementary land tax of 8 marks per hectare was levied. All over Upper Egypt people were leaving the villages, demolishing their dwellings and no longer tilling their land – only to avoid payment of taxes. In 1876, the tax on date palms was increased by 50 pfennigs. Whole villages went out to fell their date palms and had to be prevented by rifle volleys. North of Siut, 10,000 fellaheen are said to have starved in 1879 because they could no longer raise the irrigation tax for their fields and had killed their cattle to avoid paying tax on it.”

Rosa Luxemburg shows how British capital grabbed at bargain prices what still belonged to the State, and once this was achieved, how it gets the British government to find a pretext to militarily invade Egypt and establish its domination, which we remember, lasted until 1952. She explains,

“an opportune pretext for the final blow was provided by a mutiny in the Egyptian army, starved under European financial control while European officials were drawing excellent salaries, and by a revolt engineered among the Alexandrian masses who had been bled white. The British military occupied Egypt in 1882, as a result of twenty years’ operations of Big Business, never to leave again. This was the ultimate and final step in the process of liquidating the peasant economy in Egypt by and for a European capital.

“It should now be clear that the transactions between European loan capital and European industrial capital are based upon relations that are extremely rational and ‘sound’ for the accumulation of capital, although they appear absurd to the casual observer because this loan capital pays for the orders from Egypt and the interest on one loan is paid out of a new loan. Stripped of all obscuring connecting links, these relations consist in the simple fact that European capital has largely swallowed up the Egyptian peasant economy. Enormous tracts of land, labour, and labour products without number, accruing to the state as taxes, have ultimately been converted into European capital and have been accumulated.”

As I wrote in The Debt System about Egypt: “Egypt’s 15 year-long pursuits for a partially autonomous development came to fruition when progressive young soldiers led by Gamel Abdel Nasser overthrew the Egyptian monarchy in 1952 and the Suez Canal was nationalized on July 26, 1956.”

Conclusion

Rosa Luxemburg’s analysis about the role of international loans as a mechanism for exploiting peoples and as an instrument for subjugating peripheral countries to the interests of the dominant capitalist powers is highly topical in the 21st century. Fundamentally, the mechanisms that Rosa Luxemburg has laid bare continue to operate today in forms that must be rigorously analysed and fought against.

In the second part, I will address Rosa Luxemburg’s analysis of the debt and the submission of the Ottoman Empire to the interests of European big business. I will also point out some errors and weaknesses in Rosa Luxemburg’s analysis with regard to the debt and the international financial crises of the time that she analyses.

I would like to point out that it was an invitation to participate in September 2019 in a conference in Moscow on Rosa Luxemburg that gave me the opportunity to look again at her work and to prepare the material that we find in this article. The conference was organised by young university professors completely independent of the government and was supported by the Rosa Luxemburg Foundation. •

This article first published on the CADTM website.

Endnotes

- Rosa Luxemburg, born on 5 March 1871 at Zamość in the Russian Empire (now Poland), was murdered during the German Revolution by soldiers on 15 January 1919 in Berlin on the orders of members of the Social Democratic government presided over by Friedrich Ebert. Rosa Luxemburg was a socialist, communist, internationalist activist and Marxist theorist. It is recommended to read the biography of Rosa Luxemburg written by one of her fellow fighters, Paul Frölich, first published in 1939 and republished by L’Harmattan in French in 1999, ISBN: 2-7384-0755-2, May 1999.

- Rosa Luxemburg, like others, fought against what was called “ministerialism,” which had been the subject of major debates within the Second International, notably at the Congress of 1907. A resolution condemned ministerialism following the experience of the participation of Alexandre Millerand, the French socialist leader, in the Waldeck-Rousseau government from 1899 to 1902. Judged too moderate, he was excluded from the French Socialist Party in 1904. Despite the resolution of the 1907 Congress of the Second International, many social democratic leaders who had voted for it hypocritically did not hesitate to enter governments during the First World War.

- For a presentation of the problem of capital reproduction patterns and the contributions of Rosa Luxemburg, Nicolas Bukharin, Rudolf Hilferding and others, read the chapter 1 (The Laws of Motion and the History of Capital) of Late Capitalism by Ernest Mandel, first published by New Left Books, London in 1975. The Verso edition was published in 1978 followed by a reprint in 1980 and the second edition in 1999.

- Grundrisse, Foundations of the Critique of Political Economy (Rough Draft), first published in English by Penguin Books in association with New Left Review, 1973.

- Karl Marx. 1887 Capital, Volume I, Swan Sonnenschein, Lowrey, London. See in particular the eighth section titled: Primitive Accumulation (chapters XXVI to XXXII).

- Rosa Luxemburg writes: “Marx’s diagram of enlarged reproduction cannot explain the actual and historical process of accumulation. And why? Because of the very premises of the diagram. The diagram sets out to describe the accumulative process on the assumption that the capitalists and workers are the sole agents of capitalist consumption. We have seen that Marx consistently and deliberately assumes the universal and exclusive domination of the capitalist mode of production as a theoretical premise of his analysis in all three volumes of Capital. Under these conditions, there can admittedly be no other classes of society than capitalists and workers; as the diagram has it, all ‘third persons’ of capitalist society – civil servants, the liberal professions, the clergy, etc. – must, as consumers, be counted in with these two classes (…) This axiom, however, is a theoretical contrivance – real life has never known a self-sufficient capitalist society under the exclusive domination of the capitalist mode of production.” (The Accumulation of Capital, the beginning of chapter 26). Marx would have certainly agreed with Rosa Luxemburg’s affirmation: “real life has never known a self-sufficient capitalist society under the exclusive domination of the capitalist mode of production.”

- I analysed this in The Debt System: A History of Sovereign Debts and their Repudiation, Haymarket Books, Chicago, Chapters 1 and 2.

- Rosa Luxemburg, Chapter 30 entitled “The International Loans” of The Accumulation of Capital. All quotations from Rosa Luxemburg in this article are unless otherwise indicated, from chapter 30.

- Rosa Luxemburg, Chapter 30 entitled “The International Loans” of The Accumulation of Capital. All quotations from Rosa Luxemburg in this article are unless otherwise indicated, from chapter 30.

- Sir Woodbine Parish, Buenos Ayres and the Provinces of the Rio de la Plata, Their Present State, Trade and Debt, London, 1839, pp 338.

- Said Pasha (1822-1863), became the Egyptian sovereign (khedive) from 1854-1863.

- Ismail Pasha (1830-1895) became the Egyptian sovereign from 18 January 1863 – 8 August 1879.