The Case For Keeping Our Hydro Utilities Public

Most people don’t pay much attention to electricity, except when the lights are out or when they get their bill. But, they soon will. The most valuable asset in virtually every Ontario municipality is its hydro utility. For 90 plus years, local municipal hydro utilities ran at cost and returned ‘profits’ to residents in the form of lower and stable rates. They were well run and virtually debt free.

Debts created by cost overruns at Ontario Hydro’s nuclear power stations were no worse than privately-owned nuclear power stations everywhere else. Yet the debt level of Ontario Hydro opened the door for the Harris Conservatives to ram through a plan to deregulate and privatize Ontario’s power system.

In 1998 the Mike Harris Government in its plan to privatize Ontario Hydro made municipal utilities “for profit” corporations under the Ontario Business Corporations Act. They were essentially being packaged up to sell. The Harris/Eves Government lost the election in 2003 and the plans to privatize electricity systems were temporarily slowed.

In 1998 the Mike Harris Government in its plan to privatize Ontario Hydro made municipal utilities “for profit” corporations under the Ontario Business Corporations Act. They were essentially being packaged up to sell. The Harris/Eves Government lost the election in 2003 and the plans to privatize electricity systems were temporarily slowed.

Since that time provincial and municipal hydro utilities have provided a steady stream of revenue to governments to pay for other public services now and into the future. It would be extremely short sighted to sell them off, using the revenues as a quick fix to get elected and resulting in long term pain as many other jurisdictions found out the hard way.

During the 2003 election Liberal Party leader Dalton McGuinty stole the main campaign plank from the NDP and promised public power. On September 5, 2003 McGuinty said, “Deregulation and privatization hasn’t worked and we can’t go back there. I’ve drawn a lesson from that. Number one, we’ve got to keep Hydro Public.” (See some other quotes by the Liberals on privatization at the end of this Bullet.)

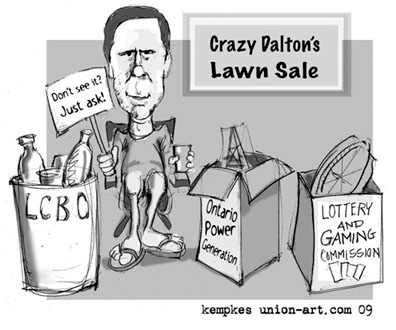

McGuinty won the 2003 election and quietly continued deregulating and privatizing Ontario’s power system until December 15, 2009 when he announced that the government was considering selling Hydro One, Ontario Power Generation, the Liquor Control Board of Ontario (LCBO) and the Ontario Lottery and Gaming Corp (OLG). Two days earlier former Liberal Party National Director and current Toronto Mayoral Candidate Rocco Rossi declared that he would sell Toronto Hydro to solve the city’s financial crisis.

What People Don’t Know

Most people don’t know that McGuinty did not repeal any of Harris’ legislation regarding deregulation and did not abandon plans for privatization.

Most people don’t know that McGuinty claims that Ontario is a “hybrid” system, a combination of public and private. There is no such thing as a “hybrid” system. The rest of the world considers Ontario a deregulated free-market jurisdiction.

Most people don’t know that Enron sat on the market design committee and that the wholesale market designed by Enron and their friends is still open. That market is hidden by the fact that the Ontario Energy Board adjusts the estimated usage to actual usage or “trues” it up twice a year.

Most people in Ontario would never accept water privatization. Bay Street knows this. However, hydro privatization is much worse than water privatization. You can’t store or stockpile electricity and as we witnessed with Enron’s market manipulation in California. It’s very, very easy to manipulate electricity markets to make obscene profits. This is one reason why business interests are so eager to see privatization succeed.

Most people don’t know that under McGuinty’s Bill 100, Ontario Power Generation has been forbidden to get into green power generation.

Most people don’t know that the main tool of Hydro privatization and deregulation to make profit is “time of use” or “smart meters.” Smart meters create enormous room for private profits. Claims that smart meters are the answer for conservation is just a cover for a massive rate increase. Its sole purpose is to create a mechanism for private power pricing and to funnel those profits into the phony electricity market.

Ontarians were promised that smart meters would save them money. They were also promised that a “deregulated (free) market would lead to lower rates” in 2002. That market was closed after six months because of skyrocketing rates. Smart meters are going to affect low income Ontarians, people on fixed incomes, pensioners, farmers, small business and the economy very adversely.

Most people don’t know that early in the 1900s, it was a Conservative Government backed by business groups (who were sick of gouging by the private owners of electricity) who won the fight for public power. Rates dropped from 8 cents per kwh to 4 cents per kwh.

Small businesspeople think that competition and private power will benefit them. But if they look closely at the issue, they’ll realize that it will result in higher costs. Private ownership of Hydro is great, if you’re the private owner. It’s going to cost everyone else dearly.

The fact of the matter is that for over 90 years public power was a basis for everyone’s prosperity including every business, with the exception of private power interests. Public power benefits more than 99% of the people of Ontario, while private power would benefit far less than 1% (those who will own the privatized companies).

Privatization Claims

Let’s look at the two main claims pro-privatization forces are making. They claim: “It doesn’t matter who owns Hydro, it’s heavily regulated.” Unfortunately, claiming that the electricity system is regulated while the government continues with deregulation is to talk out of both sides of your mouth.

Private companies have shown enormous political power to get regulations changed in their favour. According to TURN, The Utility Reform Network in the U.S., private companies spend millions of dollars a year, hiring an army of lobbyists to undermine consumer protection laws so they can take more of your money. They claim: “Introducing competition and free markets into Hydro will lead to lower rates.” Let’s look at the record of privatization and unregulated free markets.

When the former Premier Ernie Eves opened the electricity market in Ontario in 2002, he had to close it again six months later because rates skyrocketed and the public howled. When the Alberta government opened the electricity market, prices tripled.

In the state of Montana, when they opened the electricity free market, prices went up five times. When they opened up the free market in California, prices went up ten times and resulted in blackouts because of Enron market manipulation.

Around the world the story is much the same. In Auckland, New Zealand, prices skyrocketed and parts of the city experienced a record 94 day blackout. In Great Britain where proponents of privatization still maintain that free market deregulation was a success, the British government has had to bail out British Energy to the tune of £5-billion (more than $10-billion Canadian at the time).

Yet, there are signs that the privatization movement tide is being reversed. Some municipalities in Europe are buying back the electricity utilities they sold to private investors in the late 1980s and early 1990s.

In Germany, numerous city and regional governments have already ended the privatization of their electricity facilities, or are in negotiations with the private owners. Around the Bavarian capital of Munich, some 600 km southeast of Berlin, “the local governments are now convinced that municipal utilities are public goods that belong to state hands,” Christoph Goebel, Mayor of Graefelfing, told Inter Press Service.

In Ottobrunn, another town on the outskirts of Munich, the local government has just grounded a city-owned electricity provider. It says “the selling of the municipal utilities to private companies, which only obey the shareowners’ interest, has proven to be a mistake.” In the federal state of Bavaria alone, some 2,000 licenses for municipal utilities given to private companies 20 years ago are due to end this year. Most cities are unwilling to extend these licenses, according to mayors and law counselors. Instead, city governments are planning to take back the management of electricity and water facilities.

We can ensure that we do the same here in Ontario and avoid the disastrous Hydro rates set by private utilities across the border which are much, much higher.

There is not much of a case to be made for privatization.

The Environment

The number one reason to keep both municipal and provincial hydro companies public is the environment. People are recognizing that the planet is in real trouble and most environmentalists agree that your local municipal public Hydro is an important place to start combating climate change.

Hydro companies are where conservation, retrofitting and green energy programs are implemented. Franz Hartman of the Toronto Environmental Alliance argues that “Public ownership of electrical utilities is critical to curb global warming and clean the air.”

Private companies by law have to act in the best interest of their shareholder and that means they place profits number one, not the environment. The over $1-billion spent on smart meters would have been far better spent on real conservation measures and green power initiatives.

Where is the Pressure to Privatize

Our Hydro Utilities Coming From?

There are no public demonstrations outside city halls across Ontario demanding that their local Hydro or provincial Hydro be sold. The pressure is coming from Bay Street and their investors who are in the middle of “A flight to quality.”

After the “free market” collapse in the U.S. and the economic downturn, they are looking for a place to put their money that guarantees a good return. And they have turned their eyes to our public services. If these services are going to benefit private companies that much, shouldn’t we keep them public to benefit us?

The propaganda campaign is very much in full swing. The financial wizards are coming up with all kinds of scenarios to try to extract private sector profits from our public services. They use the word “monetizing.” Monetizing is the same thing as privatization. Bankers know people don’t like the word privatization.

One strategy the privatizers try is an outright sale to a pension fund like OMERS or the Teachers’ Pension Plan. Except the problem is that once utilities are sold, they are likely to be sold again and again. You never know who will end up as the owner, nor do we have any control. Even if ownership stayed with pension plans, these are still private money funds and the public will lose control of our utilities forever.

If that strategy is not palatable to the public then they’ll try leasing. What happens when you lease a truck for four years and then return it? The truck is a mess! Again, look at how many municipalities in Europe are trying to regain control of their leased utilities because leasing was a huge mistake.

Then there’s the P3 model or partly privatized 10% to 49%. There is also a suggestion to create a ‘super-corporation’ that would hold all our public assets and then sell shares.

Whether they slice privatization razor thin or make it into a super-corporation, the record is very clear: it does not benefit the public interest.

It is very interesting that McGuinty has hired Goldman Sachs Group Inc and CIBC World Markets to come up with a “Blueprint” for privatizing Hydro One, Ontario Power Generation, OLG and the LCBO. Since when did banks become the guardians of the public interest? Isn’t that the job of our governments? These corporations are hardly disinterested parties. It’s like letting the foxes count the chickens. Goldman Sachs made a lot of money in the asset backed commercial paper speculative bubble in the U.S. that caused the current economic crisis. What we are witnessing is the packaging and repackaging of privatization by the same corporate interests who caused the economic crisis.

Goldman Sachs appeared before the Financial Crisis Inquiry Commission in Washington, D.C. on January 13, 2010. Goldman CEO Lloyd Blankfein, in response to questions from Commission Chair Phil Angelides, admitted that the firm’s actions in connection with the sale of mortgage-backed securities were “improper.” Goldman Sachs is also very much involved with the economic meltdown going on now in Greece and the rest of Europe.

Articles in Der Spiegel on February 8, 2010 and the New York Times on February 13, 2010 describe how Goldman Sachs helped Greece to mask its true debt. Goldman Sachs used similar techniques during the sub-prime meltdown in the U.S. to enable European countries including Greece to hide debt far into the future making the crisis much worse.

In the same New York Times article it notes that, “One deal created by Goldman Sachs helped obscure billions in debt from the budget overseers in Brussels.” And now Goldman Sachs is going to come up with a blueprint to privatize and profit from the sale of our public assets? Hiding debt and inflating value is exactly what Enron used to do. The people of Ontario should be outraged.

Public Hydro Utilities Benefit All of Society… Hands off!

Not only is a locally-owned public electricity utility a potential lever to begin the shift to environmental policies it’s also an economic lever. The last thing Ontario needs right now is private power and it’s accompanying high rates. Gigantic rate increases under the guise of “smart meters” are already undermining Ontario’s economic growth.

How can banks claim that public hydro utilities are not a good deal for the public when they are trying to buy them for themselves? Turning public monopolies that serve the public interest into private monopolies like Highway 407 will only make a few people very, very rich.

Hydro privatization is worse than the privatization of Highway 407 because there is no public alternative. It’s worse than water privatization because you can’t store or stockpile electricity. Ontario’s experiment with privatization and deregulation failed in 2002. It was a bad idea then and the evidence is clear that it’s a bad idea now.

It’s very simple, if you have private investment you’ll have private pay-off. If you have public investment, you’ll have public pay-off, in many different ways. McGuinty would be well advised to keep his election promise of 2003 and restore public power in Ontario.

When Ontarians get their first “smart meter” bills people will be paying close attention to the deregulation and privatization policies of the McGuinty Government.

Hydro privatization may not seem as attractive as fighting for public healthcare, public education or public transit. However, if Hydro One, Ontario Power Generation and Toronto Hydro are sold, it will set off a tsunami of privatizations everywhere in the public sector which will take out everyone on the beach. Right now the front line in the fight against privatization of all our public services is the fight against hydro privatization. This is a fight that must be won. •

Liberal Quotes on Electricity Privatization

October 31, 2001 – An Invitation letter from energy sector reception for McGuinty:

“Throughout Ontario’s electricity restructuring process, Dalton and the Ontario Liberals have been consistent supporters of the move to an open electricity market in Ontario.”

April 20, 2002 – McGuinty on Hydro One Court decision:

“This is the single biggest IPO of shares in the history of the country and the government didn’t even take the time to figure out if they were legally entitled to sell the shares. I’m asking Ernie to put the whole thing over until the next election.”

November 12, 2002 – When Eves closed the electricity market and paid Ontarians back for the higher rates they paid in the summer, McGuinty said:

“Ernie’s trying to buy himself the next election.”

November 19, 2002 – After Eves closes the retail electricity market, McGuinty said:

“We didn’t have any choice. I didn’t create this mess; My job is to clean it up. The market is dead, deregulation is dead, privatization is dead” (McGuinty and the liberals voted for Bill 35, the bill to deregulate Ontario’s electricity sector).

September 5, 2003 – In an exclusive interview with the Toronto Sun’s Editorial Board McGuinty said:

“Deregulation and privatization hasn’t worked and we can’t go back there. I’ve drawn a lesson from that. Number one, we’ve got to keep Hydro Public.”

August 9, 2004 – In a speech to the Empire Club, Energy Minister Dwight Duncan declares:

“All new generation will be private.”

December 5, 2006 – On CBC Morning Radio Energy Minister Duncan declares:

“I’m struggling everyday to keep the price of electricity down.”

August 30, 2007 – The Liberals release their new electricity plan “The integrated power supply plan” (IPSP). Hidden away in the 4,000 page document are plans to expand and open the electricity market again.

Excerpt from Ontario’s Integrated Power System Plan (IPSP):

“2.0 REDUCING RELIANCE ON OPA CONTRACTS

“Q. How will the Integrated Power System Plan and/or the Procurement Process facilitate evolution toward a workably competitive electricity market that will reduce reliance on procurements by the OPA?

“A. Both the Integrated Power System Plan (the “IPSP” or the “Plan”) and the Procurement Process (the “Process”) will help facilitate evolution of Ontario’s electricity sector toward a workably competitive market.”

And…

“By increasing the ‘supply’ of service providers (i.e., the number and proficiency of the service providers) it will lead to increased competition among suppliers, lower costs…”