The Coronavirus and the Class Character of German Politics

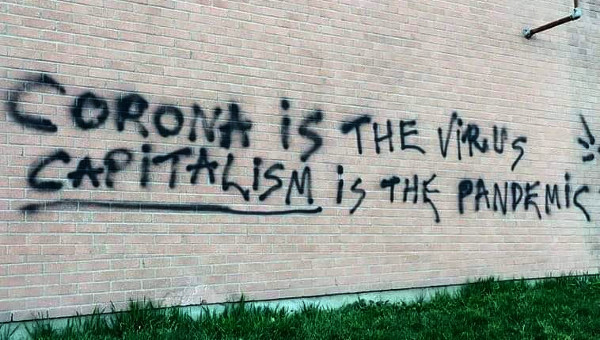

The Pope, former UN General Secretary Ban Ki-Moon, Madonna and many others are in agreement: we’re all in the same boat with regard to the ‘Corona crisis’. But as the saying goes, some are rowing while others steer the boat. This article looks at German policies during the crisis from the perspective of how they affect different classes.

On 27 February 2020, Germany’s government established a crisis-management committee and started to take measures to contain the pandemic. Shortly thereafter, a series of economic and fiscal policies followed, designed to offset the economic effects caused by the restrictions placed on gainful employment. The latter are analyzed here as a mere snapshot, since policies during this crisis are constantly evolving and rest upon the always shifting power relations between social classes and class fractions. The crisis policies are a momentum as well as a result of class struggle.

On 27 February 2020, Germany’s government established a crisis-management committee and started to take measures to contain the pandemic. Shortly thereafter, a series of economic and fiscal policies followed, designed to offset the economic effects caused by the restrictions placed on gainful employment. The latter are analyzed here as a mere snapshot, since policies during this crisis are constantly evolving and rest upon the always shifting power relations between social classes and class fractions. The crisis policies are a momentum as well as a result of class struggle.

I concentrate on an analysis of the measures decided upon by the German government and the fractions in the governing coalition beginning with the decisions of the Coalition Committee on 8 March 2020. The Coalition Committee comprises Chancellor Angela Merkel, the party leaders, the leaders of the parliamentary groups and the general secretaries of the governing parties, the Christian Democratic Union (CDU), the Christian Social Union (CSU) from Bavaria, and the Social Democratic Party (SPD). It has become the decisive governing body through which conflicts between the governing parties are settled and compromises are forged. I leave out the various measures and policies pursued by the individual federal states, as well as the international dimensions of the federal government’s policies, including its policies regarding the European Union.

Who exactly benefits from the ‘aid packages’ decided upon by the government? Whom do they help and who comes away empty-handed? There are five social classes which can be distinguished in German society: the capitalist class, the middle bourgeoisie, the petty bourgeoisie, the wage-earning middle class and the working class.1

1. The Capitalist Class

These are the people who, due to their ownership of capital, that is, of the means of production, are able to live from the appropriation of the labour of other people without themselves having to work. This includes those who function as the bearers of capitalist social relations and have the authority to directly exert the power that results from the ownership of capital, the top management of corporations. The first and most important measure the German government undertook for the benefit of the capitalist class was similar to that of the crisis of 2008-09, the generous extension for the provision of short-time work. This enabled the capitalists to adjust their need for labour power according to the dynamics of the crisis. They are able to suspend regular labour contracts and reduce costs without having to lay off workers. They can reduce working time as they wish and exempt a portion of or all workers. Compared to using layoffs, short time has the advantage that capitalists can immediately fall back upon their workers when the situation turns around. During the 2008-09 financial and economic crisis, the policy of short-time work proved successful in avoiding mass layoffs as much as possible and to binding workers with company-specific skills to corporations, thus allowing a rapid resumption of production after the crisis.

The German state covers a part of the wages for workers on short-time work, hence capitalists are able to partially or wholly transfer their labour costs to the state, i.e., the funds of the unemployment insurance or – if this gets exhausted – the taxpayer. Compared to the last financial and economic crisis, the recourse to the short-time benefit has been once again made easier. It is now sufficient that ten per cent of the workers in an enterprise are affected by a loss in hours (and not one third of the workforce, as before). This time the state is also exempting companies from paying their share to the social insurance system. Unlike previously, short-time work can now also be utilized for temp-agency or contract workers.

The capitalist class is also profiting from state credits and guarantees that the government has put in place. To begin with, three new credit programs have been set up through the state-owned Kreditanstalt für Wiederaufbau (KfW – Credit Institute for Reconstruction) to assist firms having difficulties meeting their obligations during the crisis.

First, a credit program for firms with revenues of up to 500 million euros that have been in existence for more than five years can receive credits of up to 1 billion euros at favourable interest rates; second, a credit program for younger firms that can take advantage of the same favourable terms; third, a further special program in which the KfW participates in a financing consortium (many large banks collectively providing funding) that offers credit starting from at least €25-million.

In its role as a state-owned development bank, the KfW can, in principle, issue unlimited credit, since it can be refinanced and its liabilities guaranteed by the German state, as long as it (the state) remains solvent. For the special program for the corona crisis, the KfW has initially estimated that between 50-100 billion euros will be provided.

No scrutiny is required for the provision of credit of up to 3 million euros; for sums up to 10 million, a simplified review process is required. Nevertheless, the firms must demonstrate that their financial difficulties originated with the corona crisis, that they were solvent at the start of the year and that the credit issued will be enough to finance them until the end of the year. The credits in the framework of both first-mentioned programs run for five years; during the first year, no repayments accrue; in each of the following four years, 25 per cent of the credit is to be paid back. The consortium’s financing runs up to six years. There is a huge catch with this state credit program: companies cannot apply directly for the credit through the KfW but only through their local or house bank. Credit issuance by the KfW requires that the house/local banks of the firms participate. The KfW assumes 80 per cent of the liabilities for large companies, 90 per cent of the liabilities for small companies, and the rest is assumed by the respective local banks.

State credit is thus additionally dependent upon commercial banks being willing to provide credit. Yet it is precisely during a crisis that the willingness of banks to allocate credit diminishes, since many loans turn out to be ‘non-performing’, i.e., cannot be repaid because many firms become insolvent during the crisis despite the provision of credit. Even large firms with better credit ratings will have to face paying higher interest on capital markets.

The spreads on corporate bonds, i.e., the difference in interest that the federal government pays on bonds raised on capital markets – lower than for corporations – due to its better ability to repay, have doubled. The market for riskier high-interest bonds has practically evaporated, hence making the credit programs for capitalists all the more important.

From 23 March, the day the programs were instituted to 2 April, 3200 requests for credit with the KfW were submitted for a combined volume of €11-billion. Some 2700 requests for a total volume of €960-million have already been approved in this period. It is unclear whether the requests were processed in the order they arrived or what criteria was used to approve or reject them. The number of credit requests rejected by banks that were not forwarded to the KfW is unknown.

There is, meanwhile, clear evidence that despite the state assistance, a credit crunch has developed because private banks are massively curtailing the issuing of credit. This credit crunch is impacting small- and medium-sized companies above all. As a reaction to this, on 6 April, the government devised another program for the KfW in which the federal government will assume 100 per cent of the liabilities. This program is designed for firms with more than ten employees, requires no risk assessment and has a lifespan of ten years. The maximum amount of credit granted is to be equivalent to three months of their revenue in 2019. Companies with up to 50 workers may receive up to €500,000; companies with over 50 workers receive up to €800,000. The total volume of liabilities assumed by the KfW in the framework of the program will be up to €300-billion.

It is apparent that a few large firms are taking advantage of the lion’s share of the money from the KfW, while the mass of small and medium-sized firms are allotted a smaller portion of the credit volume. Of the 443 applications for credit up to 25 March for a combined volume of €7.4-billion, €7.2-billion were allocated to only 11 requests, while the remaining 432 applications together received only €220-million. Alone, at present, Daimler AG is negotiating with numerous banks for a credit line of €10-billion. In May, the German government decided to subsidize the stumbling airline Lufthansa with €9-billion. €3-billion are paid through a credit of the KfW. These examples make clear that the credits and guarantees the state is mobilizing are indeed mammoth compared to other state expenditures, and yet, in comparison to the credit required by the large private companies look small and could be quickly exhausted.

The government’s “Economic Stabilization Fund” (WSF) designated exclusively for large companies amounts to €600-billion and is slated to last to the end of 2021. Of this, €400-billion are loan guarantees to ease the financing of large companies on capital markets for loans with a maximum term of five years. The lion’s share of the program is designed to counteract the tendency for large firms to have to pay higher interest during the crisis for their refinancing on capital markets. A further €100-billion flows into the KfW to support its own refinancing. The remaining €100-billion is reserved for the direct participation by the state in firms that have run into financial difficulties.

However, as in the previous financial crisis, the state has opted to be a ‘silent investor’ and consciously relinquish any say in the management of the firms involved. The purchase of shares which grant voting rights is, however, possible. In return, the companies must accept some conditions for the use of the funds such as limits on manager salaries and dividend payments. The example of Lufthansa is significant in this regard. As I said before the state subsidizes the airline with €9-billion, but used only €300-million to buy a 20 per cent share in the company. Moreover, the government declared that it would not intervene in Lufthansa’s business – unlike the French government that at least wants to realize some ecological goals while subsidizing Air France.

The decision by which companies receive equity assistance is made by the Ministry for Economic Affairs and Energy in consultation with the Ministry of Finance. To take advantage of the WSF funds, firms must have fulfilled at least two of the following three criteria during the two business years before 1 January, 2020: first, total assets must be more than €43-million; second, revenue must be over €50-million; third, firms must have an average of more than 249 employees during the year. Smaller start-up companies can avail themselves of the assistance if at some point earlier they were able to raise at least €50-million of capital from private investors.

On 1 April 2020, the government launched an additional support program for Start-ups and the funds to finance them to the tune of €2-billion. In addition to the already mentioned measures, tax relief in the form of deferrals on income and corporate tax is now also added. The government is not only supporting the companies financially but has also temporarily altered the market-based rules of the game. For firms facing bankruptcy, the government is temporarily suspending the requirement to file for insolvency until 30 September 2020. In normal times the failure to file for insolvency would be an indictable offence, but at the moment it is permissible. Additionally, the right of a creditor to initiate insolvency proceedings has been restricted until 30 September 2020. This provision can be extended up to 31 March 2021 by decree.

Additionally, the temporary opportunity was created to conduct online shareholder meetings. In this way, executive boards and major shareholders, among others, can avoid dramatic actions that occasionally were used in the past by some shareholders or others critical of the corporations to intervene in meetings. In Germany’s leading conservative newspaper, the Frankfurter Allgemeine Zeitung, the call was made to maintain these new rules and not to ever return to the status quo ante.

2. The Middle Bourgeoisie

This class comprises entrepreneurs who, though they do exploit wage-earners, do so on a scale too small to be able to accumulate sufficient capital and are thus compelled to themselves work in their firms. The number of employees or the size of capital that is necessary to make the jump from middle bourgeoisie to the capitalist class cannot, in general, be specified and varies from sector to sector. In general, it can be said that the program the federal government directs toward firms with more than ten employees benefits, above all, the capitalist class, while the program directed to firms with one to ten employees is directed more toward the middle bourgeoisie.

From a class analytical perspective, it is no coincidence that some of the programs of the government are directed toward firms with up to ten employees and other programs toward firms with more than ten employees. Just like the capitalist class, the middle bourgeoisie can apply for the implementation of short-time work. It can also formally take advantage of the KfW credit programs, with the state assuming 90 per cent of liabilities. In practice, however, they should first fail at securing financing from private banks. In contrast to the capitalist class, the middle bourgeoisie cannot take advantage of the credit program initiated on 6 April that provides for the 100 per cent assumption of liabilities by the state.

In March 2020, the federal government decided to provide grants in total amounting up to €50-billion for small entrepreneurs with up to ten employees (full-time equivalency). Businesses of up to five employees were able to receive a one-time payment of up to €9000 for three months; firms with six to ten employees were eligible for a one-time payment of up to €15,000 for three months. These grants were specifically not designed for the personal sustenance of the entrepreneur but to make possible for the payment of ongoing operating costs such as rent for the business premises, credit and leasing rates.

The grants were paid out on the basis of the information provided by the applicant without further testing. False information from the applicant is, however, considered a criminal offence (subsidy fraud). Local state authorities responsible for the payments have announced, in part, the implementation of random checks with regard to false information or inappropriate use of the funds, and the grants are to be taxable. Provided that a landlord reduces rent by at least 20 per cent, unused grants can also be used for a further two months when necessary. The state governments have also launched additional aid programs which differ in the amounts provided. The extent to which the subsidies from the federal and state governments are able to cover the fixed-costs of firms belonging to the middle bourgeoisie depends primarily on the level of the costs themselves, which vary tremendously from sector to sector and place to place. It can be assumed that for many firms the subsidies will not suffice for long.

For their private subsistence costs, small entrepreneurs can, indeed must, where necessary apply for social assistance. The governing coalition estimates that this could affect up to 300 000 of the roughly 1.6 million owners of small businesses with one to ten employees. For this reason, access to social assistance has been eased. Means testing for social assistance is no longer required of the recipient for new applications made between 1 March and 30 June 2020 for the first six months. The real costs for accommodation are acknowledged and included in the social assistance for the same time period (and not just a part of the costs as usually). When applying for a child supplement, only the last month of income is the determining factor, not the usual last six months of income.

On 22 April, the Coalition Committee decided on further tax relief for small and medium-sized companies. Among other measures, it reduced the value-added tax for catering businesses from 19 to 7 per cent from 1 July 2020 to 30 June 2021. This measure will benefit those sections of the middle bourgeoisie and the capitalist class that are active in or have invested in the catering industry.

3. The Petty Bourgeoisie

This class comprises the “solo” or independently self-employed, who do not have employees, and hence, do not exploit wage-labour, but rather live exclusively from their own labour. A portion of these self-employed are, however, only pseudo-independent, since they do not own means of production and are dependent on one contractor or client, thus designating them more as wage-earners than petty bourgeoisie. The petty bourgeoisie were able to obtain a one-time payment of up to €9000 for three months for their business expenses. This payment was expressly not to be used toward covering the private costs of living. The petty bourgeoisie can also benefit from the relaxed access to social assistance. The same rules apply as mentioned above for the middle bourgeoisie. The federal government estimates that some 700,000 of the roughly 1.9 million self-employed might be compelled to apply for social assistance to cover their living expenses. The self-employed can also apply to have their contributions to social security or to the artists’ social insurance programs temporarily decreased or deferred.

4. The Wage-Earning Middle Class

This class includes, on the one hand, all wage-earning employees who are not exploited by capital social relations, above all public sector employees as well as workers in the non-profit sector or in private households. On the other hand, the wage-earning middle class also includes wage-earners who occupy management positions within firms and exercise the authority granted to them by capitalists over workers, i.e., foremen, overseeing technicians and engineers, as well as middle management in firms.

Specific sections of the wage-earning middle class have been affected in very different ways by the crisis. While, for example, public sector employees for the time being have secure employment and are not affected by wage reductions, hundreds of thousands of workers in private homes, who are migrants, and often in informal or temporary work arrangements and commute between Germany and their homeland, are tremendously affected by the shutting of borders and the quarantine measures of different countries. This is the case, above all, in the elderly homecare sector. Loss of income also affects the section of the wage-earning middle class that worked in private companies and is now facing short-time work or even unemployment.

For these wage-earners, unlike for the self-employed, there is no additional government financial assistance during the crisis – apart from easier access to the short-time work benefit. Potential loss of wages due to the care of children under the age of 12 can be partially compensated if the worker joins in, meaning the worker pays the costs and then applies for reimbursement with the relevant local state agency. Additionally, rental agreements cannot be abrogated for wage-dependent and self-employed workers, nor can basic services such as electricity, gas and telecommunications be denied if payments are temporarily in arrears. These regulations are, however, only in place until 30 June, 2020.

5. The Working Class

This is the class of wage-earners exploited by the capital relation who are not in positions of authority within a firm. The working class is massively affected by the loss of income due to short-time work and increasing unemployment. Except for the self-employed, there is no additional state assistance other than the easier recourse to the short-time work subsidy. However, this is also only available to those who are part of the mandatory unemployment insurance system from which the short-work benefits are paid.

The so-called marginally employed, the mini-jobbers, are excluded from the short-time work scheme. Households with children can, at best, take advantage of a still broader access to child benefits of up to €185 monthly per child provided that their gross income is higher than €900 per month for couples or €600 for single parents.

The working class is entitled to little from the less restricted access to social assistance that is instead directed toward the petty and middle bourgeoisie. Workers who now find themselves unemployed are eligible for the first stage of unemployment benefits, which last for up to 24 months of joblessness, depending on the duration of prior employment and the age of the workers. The unemployment benefits during this first stage amount to 60 per cent of the prior net wage (67 per cent for workers with children). After this stage, the unemployed can receive a small fixed amount of money, a kind of social assistance which is not related to the prior wage. At present, this “unemployment benefit II” amounts to €432 per month for a single person plus a housing allowance to cover at least a part of the rent. The partner of a worker in the same household and their children receive even smaller amounts of money. Those workers who were already unemployed before the present crisis and receive social assistance are subject to continuing repressive means testing. At best, those whose earnings have sunk so low under the short-time work scheme that they must supplement it with social assistance can now take advantage of the new easier access to it.

On 22 April, the Coalition Committee adopted a series of decisions that slightly improve income security for wage-earners. The short-time work allowance, which previously amounted to 60 per cent of the net wage (or 67 per cent for households with children), will be increased to 70 per cent of the net wage (or 77 per cent for households with children) until 31 December 2020 for everyone who is on short-time work for longer than three months, and to 80 per cent (or 87 per cent for households with children) from the seventh month. The federal government has thus, to some extent, met a demand of the trade unions and the Left Party. The necessity of this measure is also due to the large low-wage sector in the German economy. For workers with low wages, the short-time allowance is not sufficient for basic subsistence.

Unemployed persons whose entitlement to unemployment benefit would end between 1 May and 31 December 2020 can now receive unemployment benefit for three months longer. The Federal Government is also making €150-million available for schools to enable the acquisition of terminal equipment for digital teaching for needy pupils.

Normally, income from secondary employment is offset against the short-time work allowance, i.e., deducted from it. The Federal Government had already decided in March to temporarily suspend this regulation for employees in “systemically relevant areas” from 1 April to 31 October 2020. These included the health and care sector, the agricultural and food industry and the food supply. As long as the sum of short-time work compensation and income from secondary employment does not exceed the previous net income from full-time employment, income from secondary employment is not deducted from the short-time work compensation. On 22 April, the Coalition Committee decided to drop this restriction to ‘systemically relevant areas’ and to improve the additional income opportunities in the event of short-time work for employees in all occupations from 1 May to 31 December 2020.

The Economic Stimulus Package of June 2020

On 3 June 2020, the Coalition Committee decided on an economic stimulus package that comprises altogether 57 measures in various policy areas and has an overall volume of €130-billion. It is not possible to present and analyze this here in detail. However, the class character of this package did not differ substantially from earlier measures. Numerous measures are primarily aimed at stabilising the turnover and profits of companies. Therefore, they primarily benefit the capitalist class.

Probably the most important measure is the temporary reduction of the value-added tax (VAT) rate from 19 to 16 per cent and the reduced VAT rate from 7 to 5 per cent from 1 July 2020 to 31 December 2020.2 A reduction in VAT had been called for by Michael Hüther, Director of the Institut der deutschen Wirtschaft (Institute of the German Economy – an economic research institute close to the employers’ associations), and by the oppositional liberal party FDP, among others, and was then introduced by the Christian Democratic Party into the negotiations in the Coalition Committee. The distribution effect of a rise in the VAT is particularly regressive in comparison to the income tax or corporate taxes. It accrues when goods are purchased, i.e., the income – individual or productive – spent through consumption is taxed. However, as household income increases, the share of income spent on consumption, and thus, the share of VAT in household income decreases. Poor households are disproportionately burdened by VAT. However, it is short-sighted to believe that, conversely, a reduction in VAT automatically benefits poorer households in particular, for this would presuppose that companies pass the VAT cut on to consumers in the form of falling prices. Since many sectors are characterized by oligopolies, i.e,. monopolistic competition, companies there have considerable leeway in pricing. They can lower prices if they expect this to increase demand or market share and, by increasing capacity utilization, also a higher profit rate. However, if they do not expect demand to increase significantly and if they cannot gain market share by lowering prices because their competitors would then also lower prices, it may be more attractive for them not to lower prices and thus to immediately capture a higher profit per product sold. Thus, lowering the VAT first increases the profits of the companies and, since most goods are produced capitalistically, especially the income of the capitalist class. The VAT is a fine example of the asymmetric effect of state policy: the capitalist state can influence distribution to the detriment of the working class more easily by raising the VAT than conversely relieving the working class by lowering it. This asymmetrical effect of state policy is rooted in the structure of capitalist relations of production.

Probably the most important measure is the temporary reduction of the value-added tax (VAT) rate from 19 to 16 per cent and the reduced VAT rate from 7 to 5 per cent from 1 July 2020 to 31 December 2020.2 A reduction in VAT had been called for by Michael Hüther, Director of the Institut der deutschen Wirtschaft (Institute of the German Economy – an economic research institute close to the employers’ associations), and by the oppositional liberal party FDP, among others, and was then introduced by the Christian Democratic Party into the negotiations in the Coalition Committee. The distribution effect of a rise in the VAT is particularly regressive in comparison to the income tax or corporate taxes. It accrues when goods are purchased, i.e., the income – individual or productive – spent through consumption is taxed. However, as household income increases, the share of income spent on consumption, and thus, the share of VAT in household income decreases. Poor households are disproportionately burdened by VAT. However, it is short-sighted to believe that, conversely, a reduction in VAT automatically benefits poorer households in particular, for this would presuppose that companies pass the VAT cut on to consumers in the form of falling prices. Since many sectors are characterized by oligopolies, i.e,. monopolistic competition, companies there have considerable leeway in pricing. They can lower prices if they expect this to increase demand or market share and, by increasing capacity utilization, also a higher profit rate. However, if they do not expect demand to increase significantly and if they cannot gain market share by lowering prices because their competitors would then also lower prices, it may be more attractive for them not to lower prices and thus to immediately capture a higher profit per product sold. Thus, lowering the VAT first increases the profits of the companies and, since most goods are produced capitalistically, especially the income of the capitalist class. The VAT is a fine example of the asymmetric effect of state policy: the capitalist state can influence distribution to the detriment of the working class more easily by raising the VAT than conversely relieving the working class by lowering it. This asymmetrical effect of state policy is rooted in the structure of capitalist relations of production.

A second central measure of the stimulus package that benefits the capitalist class is the government’s promise to prevent social security contributions from rising to over 40 per cent of gross wages. As unemployment rises during the crisis, social security spending rises while revenues of the social insurances fall. The resulting financing gap is now to be closed by additional payments from the state budget so that entrepreneurs and employees are not burdened by rising social security contributions. This relief can initially be financed by additional government debt, but in the longer term, tax revenues will also be due for the interest payments and, if necessary, the redemption payments. Since the taxes are paid to a greater extent by wage earners, this is redistribution in favour of the capitalist class as opposed to the equal financing of the social security system.

The economic stimulus package of 3 June contains numerous other measures for tax relief and for improving the depreciation conditions of companies, as well as subsidies which cannot be listed here in detail for reasons of space. Families with children get a one-off payment of €300 per child, which benefits households with lower incomes because this one-off payment is offset against the specific tax relief for families with children, which is more relevant for households with higher incomes. Furthermore, single parents will receive an additional tax relief for the years 2020 and 2021.

Conclusions: From the Unacceptable to the Necessary

The measures undertaken by the federal government are structured in a class specific manner. The capitalist class can look forward to over €600-billion of state support as well as credit from the KfW in potentially unlimited amounts and substantial tax relief. The middle and petit bourgeoisie receive €50-billion from the state, while the wage-earning middle class and the working class gets very little, in comparison, from the packages of measures initiated by the government.

To be sure, in part, the state programs do not apply to just one class but to several classes simultaneously. For instance, certain credit programs from the KfW do benefit formally (but not necessarily in reality) the capitalist class as well as the middle bourgeoisie. The one-time subsidies for fixed costs up to €9000 are potentially to the benefit of the petty as well as the middle bourgeoisie. The short-time work benefit, in principal, benefits both the members of working class as well as the wage-earning middle class.

Hence, state policy is aiding the formation of a cross-class bloc; differing class interests are being catered to and unified by the state programs, and the hegemony of the capitalist class is articulated through this state-assisted bloc formation. This is an essential aspect of its rule. In this, the structural selectivity of the state apparatuses naturally plays an important role of implementing the respective class interests according to the differing potentialities of the class positions.

The top executives of the leading corporations and the representatives of the important business associations usually have direct access to the government and can directly influence its decision-making process. The business associations have differing degrees of influence; the Federation of German Industry (BDI), for instance, carries more weight than the various associations of small and medium-sized businesses, and in the BDI, in turn, the interests of the largest corporations dominate.

The interests of the capitalist class and the middle bourgeoisie are combined in the associations of the small and medium-sized firms. From the petty and middle bourgeoisies, different petitions quickly emerged that demanded income support in the form of some type of a temporary basic income. The benefits and subsidies for the petty and middle bourgeoisies as well as the easier access to social assistance for these classes is likely the result of public pressure from these classes.

The economic interests of the working class are, first and foremost, represented by the trade unions, who, for instance, criticized by means of official policy briefs and newspaper advertisements the lack of a further increase to the short-time benefits. This was also a demand of the Left Party (Die Linke). The criticism appears to have produced results, and the Christian Democratic Workers Association and the Social Democratic Party (SPD) both put forward different ideas for augmenting the short-time work benefit.

The measures undertaken by the government aim, above all else, to prevent the collapse of the credit system; and to attenuate the social dislocations of the crisis so that a portion of lost income is replaced by the state and payments can be temporarily postponed. State income support is, however, highly imperfect. While for the middle classes (middle bourgeoisie, petty bourgeoisie, wage-earning middle class) personal savings are probably still available that can now be used, the working class has relatively little savings available and suffers in this respect directly from the loss in income.

The state measures stand partly in contradiction to one another. For instance, the temporary loosening of rules regarding insolvency could counteract the efforts, by means of state guarantees and the KfW credit participation, to encourage banks to continue to provide credit to companies. The state measures, for the most part, will only displace the problems into the future, since at some point deferred payments will have to be recouped and credits repaid. As lost production cannot not be easily made up, a wave of insolvencies looms in the future.

The governing coalition has so far succeeded in presenting itself as ready to take the necessary measures in the interest of the common good, after careful consideration of the different interests and courses of action. The extreme crisis and the emergency measures have strengthened the discursive figure of speech on its side of ‘we’re all in the same boat’. This creates a situation that makes it difficult to oppose the measures taken by the government without risking a lack of understanding in the public. Nevertheless, it was wrong, in my opinion, that Left Party members in Parliament introduced some amendments and additional resolutions to the government’s package of measures but ultimately voted for the government’s draft bill on 25 March, although many Left Party deputies expressed their concerns. Meanwhile, on television, it seemed that the far-right Alternative for Germany (Alternative fuer Deutschland – AfD), which abstained, was the only opposition.

From a left perspective, it is unacceptable that corporations, through the short-time work measures, are relieved of up to 100 per cent of their wage and social insurance costs, while the working class and, to an extent the wage-earning middle class as well, must accept significant losses in income from short-time work. It is also wrong to finance lavish credit programs for large companies that earned giant profits in the last ten years and in some cases have reserve funds available amounting in the billions of euros. During the crisis, these companies should first of all use up their own capital. If the state steps in to rescue companies, then it should be only in exchange for corresponding ownership rights. The rescue of companies and the socialization of private losses should only take place in accordance with democratic and social-ecological policies.

The crisis is also a chance to undertake the already necessary social-ecological restructuring of production. Military production should, by way of example, be ended; automobile production should be significantly reduced, particularly the branch with the ecologically highly destructive SUVs and luxury vehicles. The freed-up production capacity should be used for the manufacture of socially useful products. The current crisis displays in a dramatic fashion that social infrastructure in healthcare and elderly care and other areas needs to be considerably expanded and that much more labour power must be deployed to these sectors, while we can indeed reduce work in socially and ecologically damaging branches without having to give up a high standard of living. •

This is the updated and revised version of an article which was published originally online in German language in the journal LuXemburg in April 2020. Translation by Sam Putinja.

Endnotes

- For the class-theoretical concepts see John Milios and George Economakis (2011). “The Middle Classes, Class Places, and Class Positions: A Critical Approach to Nicos Poulantzas’s Theory,” Rethinking Marxism, 23:2, 226-45.

- The reduced value-added tax rate applies to food, books, newspapers, local public transport, railway tickets, museums, concerts, etc.