$50-bn in Subsidies has Failed to Secure EV Jobs, Investment or Future

On October 16, 2023, it was all smiles for the cameras in Loyalist Township where politicians and corporate executives gathered for a groundbreaking ceremony to build a new $2.761-billion Electric Vehicle battery parts plant. Loyalist Township, located next door to the Kingston, Ontario, is named after the Loyalists who, 250 years ago, sided with the British King against the American Revolution and crossed the St. Lawrence River to settle in Upper Canada.

The smiling politicians in Loyalist Township included Ontario Premier Doug Ford and his economic minister, Vic Fedeli, as well as Kingston’s Liberal Member of Parliament, Mark Gerretsen, and Trudeau’s federal industry minister, François-Philippe Champagne. Even the Belgian Ambassador was there. The politicians were boasting of 600 construction jobs, 700 permanent positions, and 700 student co-op placements.

The Belgian multinational Umicore was also smiling because they were lined up for $979.5-million in taxpayer subsidies. At almost a billion dollars, the huge taxpayer subsidy came from two sources. The federal Liberals were putting in $551.3-million through the Strategic Innovation Fund, and the Ontario government $424.6-million. The remaining $3.6-million is presumably municipal subsidies, but this has not been confirmed.

Taxpayer subsidies accounted for 35.3 percent of Umicore’s projected costs for the plant. Despite this, the federal and provincial governments gained no equity in the plant. On the day of the groundbreaking, Umicore enjoyed a 14 percent spike in share prices. A few months later, Umicore posted a 2023 profit of €972-million, or about $1.4-billion.

Umicore’s billion-dollar handshake came shortly after automaking giant Stellantis secured a $15-billion federal-provincial subsidy in May 2023. Stellantis, who had partnered with LG, was originally promised $1-billion for its new NextStar battery assembly near Windsor but halted construction after $14-billion in public subsidies was promised to Volkswagen for a new $7-billion battery assembly. Doug Ford and Justin Trudeau quickly paid the ransom, and the Stellantis/LG project continued with a $15-billion subsidy for a battery plant projected to cost $5-billion.

Canada’s EV Strategy Based Entirely on Taxpayer Subsidies

Umicore’s arrival in Loyalist Township was part of a major influx of American and European investment into Canada’s transition to Electric Vehicles and lithium-ion battery production during the first part of this decade. These investments were only made possible through enormous subsidies financed by taxpayers.

Between 2020 and 2024, Premier Ford, Prime Minister Trudeau and Quebec Premier Francois Legault worked together to roll out nearly $50-billion in taxpayer subsidies to just 16 industrial projects, including EV conversion of auto assemblies, “Green Steel” in Hamilton and Sault Ste Marie, an electric furnace for Rio Tinto in Quebec, and tire production. These numbers are largely confirmed in a recent column by Globe & Mail business reporter, Eric Reguly, who states $46-billion in corporate EV/battery investment received $52-billion in taxpayer subsidies.

Ontario and Quebec take the lion’s share of investment and subsidies, but this corporate welfare strategy extends coast to coast. The anti-union Michelin tire plants in Nova Scotia are receiving $105.6-million in federal-provincial subsidies for a $300-million upgrade. E-One Moli in British Columbia is receiving $284.5-million in federal-provincial subsidies for a billion-dollar lithium-ion battery facility. In Manitoba, Canadian Premium Sand is getting $272-million in federal-provincial subsidies for a $880-million silica mine and refinery.

| Select list of subsidies for auto, battery, tire, and mining-related operations, 2019-25 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Corporation | Facility Type | Municipality | Province | Project costs | Federal $ | Provinvial $ | Total Subsidy | % Subsidy |

| E-One Moli | lithium-ion battery | Maple Ridge | BC | $1,000,000,000 | $204,500,000 | $80,000,000 | $284,500,000 | 28 |

| AVL Fuel Cell | fuel cells | Burnaby | BC | $38,500,000 | $15,000,000 | $15,000,000 | 39 | |

| E3 Lithium Ltd | lithium | Calgary | AB | $87,000,000 | $27,000,000 | $27,000,000 | 31 | |

| Canadian Premium Sand | silica mine | Hollow Water | MB | $880,000,000 | $200,000,000 | $72,000,000 | $272,000,000 | 31 |

| Honda | auto assembly | Alliston | ON | $15,000,000,000 | $2,500,000,000 | $2,500,000,000 | $5,000,000,000 | 33 |

| Volkswagen | battery assembly | St. Thomas | ON | $7,000,000,000 | $13,500,000,000 | $500,000,000 | $14,000,000,000 | 200 |

| NextStar (Stellantis) | battery assembly | Windsor | ON | $5,000,000,000 | $10,000,000,000 | $5,000,000,000 | $15,000,000,000 | 300 |

| Umicore | battery parts | Loyalist Twnsp | ON | $2,761,000,000 | $551,300,000 | $424,600,000 | $975,900,000 | 35.3 |

| Ford | auto assembly | Oakville | ON | $1,800,000,000 | $295,000,000 | $295,000,000 | $590,000,000 | 32.8 |

| Stellantis | auto assembly (2x) | Windsor/Bramton | ON | $3,600,000,000 | $513,000,000 | $513,000,000 | $1,026,000,000 | 28.5 |

| General Motors | auto assembly (2x) | Oshawa/Ingersoll | ON | $2,000,000,000 | $259,000,000 | $259,000,000 | $518,000,000 | 25.9 |

| Mitsui High-tec | motor cores | Brantford | ON | $102,300,000 | $3,100,000 | $3,100,000 | 3 | |

| Goodyear | tires | Napanee | ON | $575,000,000 | $44,300,000 | $20,000,000 | $64,300,000 | 11 |

| Linamar | auto parts | Guelph | ON | $1,100,000,000 | $169,700,000 | $100,000,000 | $269,700,000 | 25 |

| ArcelorMittal (Dofasco) | steel mill | Hamilton | ON | $1,800,000,000 | $400,000,000 | $500,000,000 | $900,000,000 | 50 |

| Algoma Steel | steel mill | Sault Ste. Marie | ON | $703,000,000 | $420,000,000 | $420,000,000 | 60 | |

| Northvolt Six | cell, cathode processing | McMasterville | QC | $7,000,000,000 | $4,400,000,000 | $3,000,000,000 | $7,400,000,000 | 106 |

| Ford | cathode processing | Becancour | QC | $1,200,000,000 | $322,000,000 | $322,000,000 | $644,000,000 | 53.7 |

| Ultioum CAM | cathode processing | Becancour | QC | $600,000,000 | $147,692,000 | $152,000,000 | $299,692,000 | 50 |

| Rio Tinto | iron smelter | Sorel-Tracey | QC | $511,000,000 | $222,000,000 | $222,000,000 | 43 | |

| Michelin | tires | Bridgewater | NS | $300,000,000 | $44,300,000 | $61,300,000 | $105,600,000 | 35 |

| *** Totals *** | $53,057,800,000 | $34,234,792,000 | $13,802,000,000 | $48,036,792,000 | 91 | |||

America First Puts Canada Last

Within months of the Umicore groundbreaking, decisions made in the White House began to seriously upset Canada’s corporate welfare EV strategy. On May 14, 2024, as part of his America First economic strategy, President Biden imposed a 100 percent tariff on Chinese-made EVs and a 25 percent tariff on Chinese batteries entering the United States. A month later, on June 12, the European Union followed suit, imposing their own tariffs on Chinese-made EVs and batteries.

Umicore halted construction in July, only nine months after the groundbreaking. The corporation blamed a general downturn in demand from their existing customers but also pointed to the failure to achieve a contract with a Chinese battery parts supplier on June 12, the very day the European Union imposed tariffs on Chinese EVs and batteries.

With massive subsidies flowing into American and European corporate coffers, the Trudeau government followed Washington’s lead in August 2024 and imposed a 100 percent tariff on Chinese-made EVs. By November, Umicore issued 260 layoffs but refused to disclose how many layoffs were in Loyalist. By the end of 2024, Umicore posted a 29 percent drop in revenues, and announced plans to shift its focus to existing operations in Poland and South Korea.

It was reported that no Ontario taxpayer money flowed into Umicore’s coffers, and it appears that federal subsidies would only flow based on employment guarantees, but how many federal taxpayer dollars were sent to Umicore through the Strategic Innovation Fund has yet to be ascertained.

Unlike with Umicore, Quebec taxpayers did get robbed of $470-million with the NorthVolt bankruptcy in March 2025. NorthVolt, an untested Swedish corporation, was set to build a $7-billion battery facility just east of Montreal. With $4.4-billion from the federal government, and $3-billion from the Quebec government, NorthVolt still went bankrupt despite a 106 percent subsidy! As of early September 2025, the Quebec government has only been able to recover $200-million of the $470-million. It is now trying to recover a $240-million loan issued to NorthVolt to help it buy land for the project.

Canadian Workers and Taxpayers Bear the Costs

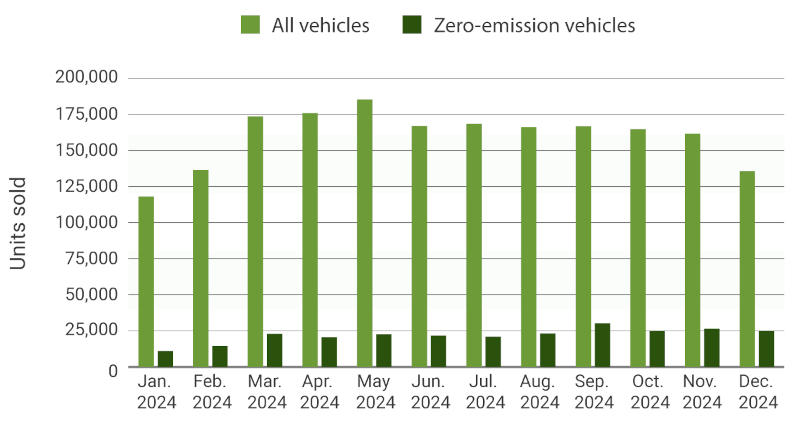

Since the Umicore announcement in July 2024, Canada’s EV conversion strategy has started to crumble. Despite the massive taxpayer subsidies, the auto assemblies of GM, Ford, and Stellantis have issued multi-year layoffs to thousands of auto workers, which has, in turn, led to layoffs across the much wider auto parts industry in Ontario and up through Quebec.

With the onset of Trump’s economic warfare against Canada, the auto giants have been pressing publicly to scrap the federal government’s EV production goals, and now they’re closing down auto assembly plants. In mid-October, Stellantis announced that its EV conversion to Jeep Compass production in Brampton would be halted and the product line moved to one of the corporation’s American assemblies in Illinois. Three thousand Brampton autoworkers had already been laid off since January 2024 for the EV conversion.

A week later, after the Brampton news, GM announced the closure of the Ingersoll CAMI plant’s van line, citing terrible sales, and laying off 1,200 workers. Then Paccar, maker of Peterbilt and Kenworth trucks, announced 300 more layoffs at the suburban Montreal assembly. Paccar has laid off more than 700 workers since December 2024, leaving only 500 on the job.

Premier Doug Ford is very angry at Stellantis and GM, especially after coughing up $5-billion for the Stellantis battery plant ransom in 2023, and has now gone and spent $75-million on TV advertisements in America that have reportedly derailed trade negotiations with the United States.

The situation also means that, for the first time since the great union victories of the 1940s, there are probably more non-union auto assembly workers in Canada than union assembly workers. Toyota assemblies in Cambridge and Woodstock and the Honda Alliston assembly remain non-union. In April 2024, Honda Alliston announced a $15-billion EV conversion, with the Trudeau and Ford splitting the costs of a $5-billion taxpayer subsidy. Yet, even Honda announced a two-year delay on these upgrades back in May 2025. Union or not, Ontario is on the cusp of seeing its auto industry collapse if assemblies remain offline or closed.

Trump’s Tariffs and Canada’s Dilemma

With his threats of annexation by “economic force”, Trump has sustained his tariff attacks on Canada. Job losses and plant closures are underway, and the federal government is now stepping in once more. Taking the Kingston region again as an example, Novelis (formerly ALCAN) laid off 21 workers this past spring at their precision aluminum manufacturing facility, while Koch Industries has closed its Invista plant near Brockville with a loss of 100 jobs and is moving operations to Texas, leaving 500 Invista nylon mill workers in Kingston deeply concerned. Li-Cycle, a battery recycling firm, was a darling of local Kingston elites when they set up shop in town a few years ago, but they went bankrupt and closed in 2023, wiping out 50 jobs. Umicore, Novelis, Invista, and Li-Cycle are all stories from Kingston, a city of only about 150,000.

Meanwhile, the steel industry in Canada has been hammered with tariffs, and the federal government has moved to offer big loans. Having footed 60 percent of the cost of a new $703-million “green steel” Electric Arc Furnace at Algoma in Sault Ste. Marie, the federal government is now getting a $400-million federal loan and $100-million Ontario loan. Meanwhile, ArcelorMittal, which owns the non-union Dofasco steel mill in Hamilton, killed 153 union jobs by closing its Hamilton wire-drawing mill in June. ArcelorMittal has received $900-million in subsidies for the $1.8-billion Electric Arc Furnace at the Dofasco mill.

The federal and provincial governments now face Trump’s job-killing tariffs and the withdrawal of American and European investments and production. The federal and provincial governments are further trapped by their own commitments to following the American lead on blocking Chinese investments and its more advanced and cheaper EV technology. While Premier Doug Ford says “no damn way” to dropping Canada’s tariffs on Chinese EVs, Western Canadian premiers representing the corporate interests of oil and gas, mining, and agriculture are pressing for Chinese tariffs to be dropped.

The situation leaves Canada with few options in securing jobs, developing green technologies, and protecting vital strategic assets such as vehicle manufacturing, steel, agriculture, and the resource industries. The division between Ford and the Western premiers places the responsibility on the Prime Minister Carney’s shoulders.

Canada’s Choices

There have been no signs of Prime Minister Carney’s government abandoning the failed corporate welfare program for EV conversion, even though it is proving incapable of surviving American trade wars and China’s entirely predictable retaliatory tariffs. A choice must be made because the emerging alternative is more deindustrialization, more job losses, and more social devastation.

Two other options do exist. Dropping the tariffs on Chinese EVs and encouraging Chinese investment in Canada’s auto industry is one option. This, however, would not be politically popular until, perhaps, it delivered on jobs as it has with Kingston’s Canada Royal Milk baby formula factory, which is owned by Chinese multinational Feihi. And after a tough fight, the factory is now unionized with UFCW.

A more viable option, one that has not been seriously proposed since the early 1970s, is the creation of a crown corporation for the auto industry: an independent Canadian EV battery and car company, including research and development. The cost of a crown corporation is not an issue. The federal, Ontario and Quebec governments have had no problem putting up $50-billion in taxpayer subsidies for American and European corporations who have no commitment to Canada. Those investments could go directly into capital and labour costs here in Canada. Should it be found to be a wise strategy, a crown corporation would also be a means to partner with the Chinese EV and battery industry.

Back in Loyalist Township, the Umicore construction site, which promised 700 permanent jobs, sits silent. The federal and provincial governments were prepared to put up a 35 percent subsidy and have coughed up billions for other corporations who have turned around and laid off workers and moved production south. Why not continue the EV and battery development projects under public ownership and secure thousands of jobs, Canada’s manufacturing, and develop new technologies? •

This article first published on the Rank and File website.