The Left, Inflation and Monetary Policy

The return of high inflation after the global pandemic poses a major political and analytical challenge for labour and the left. On top of cuts to real wages resulting from the wide gap between inflation and pay, high and rising inflation has led central banks, including the Bank of Canada, to hike interest rates sharply. This is raising the debt servicing costs of households, businesses and governments and making new borrowing more expensive.

If and as interest rates result in slowing economic growth and a possible recession, unemployment will rise, poverty will increase, and the squeeze on wages will intensify. Workers are being made to pay through inflation the cost of the pandemic which could have been financed through a wealth tax. The International Monetary Fund (IMF) is already forecasting rising unemployment and stalled growth in the major advanced economies and China, while calling for tough monetary policy to deal with inflation.

Many economists and conservative pundits are calling on governments to cut spending so as to offset the rising cost of serving public debt. Already inadequate public and private investments to deal with the climate crisis and the affordable housing crisis will likely be reduced and postponed.

High Inflation, Followed by High Unemployment

As in the 1920s and 1930s in Germany, high inflation accompanied and followed by high unemployment may fuel the rise of the far right. In Canada in the 1980s, high inflation plus high unemployment (stagflation) set the stage for the rise of neoliberal economics, fiscal austerity, the rise in precarious unemployment, and a frontal attack on labour.

In response, the left has understandably attacked the turn toward contractionary monetary policy as damaging and even worse than the underlying disease of inflation (See: Stanford, Seccareccia and Tooze). While this is warranted, we also need a major re-thinking of macro-economic and especially monetary policy.

As Sam Gindin has argued, we must also reflect on how to rebuild the left and the labour movement in the context of a new economic and social crisis caused in part by labour’s long-standing weaknesses. The fight to maintain working class living standards must be informed by the development of an alternative to neoliberalism.

The Current Inflation Surge

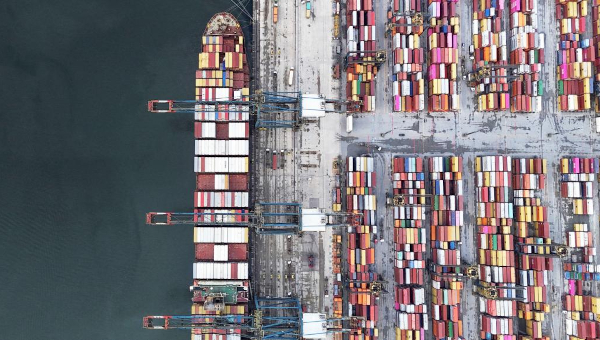

As many on the left as well as more mainstream economists and even central banks have argued, the recent increase in inflation is mainly due, not to too much demand in the economy, but to reduced supply. Interrupted supply chains and shifts in the composition of demand due to the pandemic were recently exacerbated by high energy and commodity prices, particularly in the wake of the war in Ukraine (Stanford). Some of these factors may be transitory.

It would appear that many major companies with some market power have opportunistically boosted prices and profits and caused profit-driven inflation (though it is unclear why they did not exercise such power earlier). As the left has strenuously argued, rising inflation to date has been driven much more by higher profits than by higher wages and workers will and should seek to maintain real wages.

That said, central banks are tightening monetary policy, not because wages are rising rapidly, but because they fear a wage/price spiral similar to that of the 1970s (See: Tooze). They are acting preemptively, hoping to slow the economy just enough to bring inflation back to pre-pandemic levels (the target rate of 2% in the case of Canada). They are, however, seemingly prepared to inflict a serious recession if they deem it to be necessary.

Central banks believe that there is a trade off between inflation and unemployment (the so-called Phillips curve) such that higher unemployment will reduce inflation, mainly through a squeeze on wages. They think that the precise trade-off varies and is not known precisely, but is influenced above all by the bargaining power of labour set by the unionization rate, the degree of centralization of collective bargaining, labour militancy, unemployment benefits, the minimum wage, and other factors influencing the labour market. Milton Friedman explicitly argued that unemployment should not be allowed to fall below the so-called natural rate in order to achieve low and stable inflation.

Monetary policy made by an independent central bank to maintain low inflation has been a central plank of the entire neoliberal economic agenda. It has made macro-economic management a seemingly technical issue and relatively side-lined fiscal policy which involves inherently political debates over distributional issues and the composition of government spending.

Today, it is unlikely that a major recession will be ‘needed’ to bring inflation back to pre-pandemic levels given the continued weakness of labour and the strong deflationary pressures continuing to arise from global economic integration and unregulated international capital flows.

That said, central banks are concerned that fiscal measures to fight the pandemic and demographic factors (the retirement of the baby boomers) have resulted in low unemployment and some tentative signs of a revival of the labour movement, especially in the United States.

Left Keynesian economists in the tradition of Kalecki would broadly agree that there is indeed a trade-off between inflation and unemployment determined by the relative bargaining power of capital and labour within a capitalist economy (See: Seccareccia). They argue that some level of unemployment and slack in the job market is needed within the context of capitalism to discipline labour and to maintain profitability.

A profit squeeze induced by a rising wage share will limit business investment and undermine ‘confidence’. Capitalist control of the investment process thus largely constrains central banks to privilege low and stable inflation over the goal of low or full employment. This is explicitly the case in Canada where the central bank has only one goal, to achieve the inflation target, but still true of countries such as the United States which give central banks a somewhat broader mandate.

Left Keynesians argue that full employment and stable inflation could and should be maintained mainly through fiscal policy, that is, changes to government spending and taxes, and ultimately by socializing the investment process. This entails not just a major increase in public sector investment as a share of the economy, but also expanded public ownership, especially of the financial sector and large firms.

The High Costs of the 1970s Anti-Inflation Turn

In the late 1970s, the Volcker squeeze in the United States, echoed in Canada in the early 1980s, brought down inflation from double digit levels at the cost of a deep recession and very high unemployment which seems to have more or less permanently reduced the bargaining power of labour. Interest rates eventually fell in line with lower inflation in the 1990s and 2000s, but central banks deliberately maintained some slack in the economy to contain any inflationary pressures.

That experience demonstrated that monetary policy can indeed control inflation, albeit at high economic and social costs.

Most progressive economists argued that the strong emphasis of central banks on achieving and then maintaining low and stable inflation in the neoliberal era limited potential economic growth, led to stagnant real wages and a shift in national income from wages to profits, and helped fuel rising income and wealth inequality. A broader political economy perspective would reference the failure of the labour movement and the left to fight back against tight monetary and fiscal policy, maintain bargaining power in the workplace, and make the case for much greater public control of investment.

During the so-called ‘great moderation’ of the 1990s and 2000s, there was an extended, recession free period of low interest rates, steady though not spectacular growth, and low and stable inflation. Unemployment fell from the very high levels of the early 1980s, but real wages stagnated through much of the 1980s and 1990s and there was a marked rise in more precarious forms of work. Fine-tuning ups and downs in the economy through monetary policy seemed to ‘work’ and mainstream economists largely dismissed the need for fiscal policy.

That period came to an end with the global financial crisis and Great Recession of 2008 when governments rescued the banks and the entire global financial system through major injections of capital and fought a global downturn and fast-rising unemployment by increasing government deficits and debt. In the United States and Europe, central banks resorted to ‘quantitative easing’, creating new money to lower both short- and long-term interest rates. Unfortunately, fiscal stimulus was abandoned prematurely in favour of austerity. But governments once again turned to fiscal stimulus and extraordinary monetary measures to fight the new global slump caused by the pandemic in 2020.

While loose and exceptional monetary policies have now kept interest rates at low levels for more than two decades and have played a role in keeping unemployment at bay, they have had important negative effects. These must be taken into account by the left.

As noted, monetary policy and central bank independence serves to depoliticize economic policy making. Cheap credit combined with financial deregulation has helped finance all kinds of speculative activities, from housing bubbles such as that preceding the 2008 crisis, to frothy stock markets, to the exponential growth of the financial sector, to mergers.

Corporations have used cheap credit to finance share buy backs and large dividend payouts, benefiting corporate insiders and shareholders and fuelling income and wealth inequality. Low interest rates have, however, not noticeably raised the level of real business investment in line with a rising profit share of national income.

Low interest rates in combination with weak growth of real wages have also fuelled a huge rise in household debt, even more so in Canada than in the United States. Investment in housing has been a major factor in economic growth, but over-inflated house prices now pose a major threat to financial stability. Cheap consumer credit has also artificially maintained the living standards of ordinary working families as well as the excessive consumption of the very affluent.

Alternatives to Monetary Policy and Austerity

Monetary policy is a poor tool for fighting inflation. The key problem is that central banks rely almost exclusively upon a single tool, the interest rate. Higher rates impact negatively on business and public investment which we need, and not just on financial speculation and asset price inflation. They work against the compelling need to invest more rather than less to fight the climate crisis and to build affordable housing.

The federal government should and can ensure that financing costs for the needed energy transition as well as affordable housing are cushioned from higher interest rates. We should expand public investment banks like the Export Development Corporation and create new ones to extend low-cost credit and/or equity to desired productive investments. These banks could be financed in part by the Bank of Canada subject to agreements between the Bank and the federal government.

There should effectively be a sliding scale of interest rates manipulated by the federal government and the Bank of Canada to maintain a reasonably low inflation rate while protecting and promoting essential investments.

Further, we need to expand credit controls and regulations to limit flows of capital to low priority purposes. We already impose some conditions such as minimum down-payments and maximum debt servicing costs on home mortgage lending and borrowing, but do not adequately regulate corporate borrowing.

While governments do monitor bank lending to the corporate sector, the dominant assumption is that it is up to private financial institutions rather than the state to assess and assume risks, let alone look at criteria other than risk-adjusted rates of return.

On top of these measures impacting on financing costs of new investment, the federal government should cushion the impact of inflation on lower income families by increasing tax credits such as the GST credit, financed by taxes on excess corporate profits and wealth. Interest rates on credit cards should be reduced and regulated. Total borrowing for consumption can be lowered without hurting ordinary working families.

There is also a case to be made for selective price controls on key commodities such as energy where there is strong evidence of excess profits and damaging speculation. However, broader price controls would be very strongly resisted by employers if they did not also cover wages.

The central point is that it is not enough for the left just to oppose higher interest rates. We need to greatly expand the role of fiscal policy relative to monetary policy and address inflation while also promoting low unemployment, needed new investments, decent wages and a much fairer distribution of income and wealth. •