From Neoliberalism to the New Finance Capital

As the global economy entered another historic crisis in March 2020, the US Federal Reserve implemented a massive support program to stabilize financial markets. In doing so, it expanded upon the already wide range of powers and functions it had developed to deal with the 2008 financial crisis.

Aside from the greater scale and depth of this latest crisis, there was another important difference between 2008 and 2020. While in the former case the Fed had worked closely with the big banks, especially JP Morgan, to reestablish financial stability, this time BlackRock was the crucial partner.

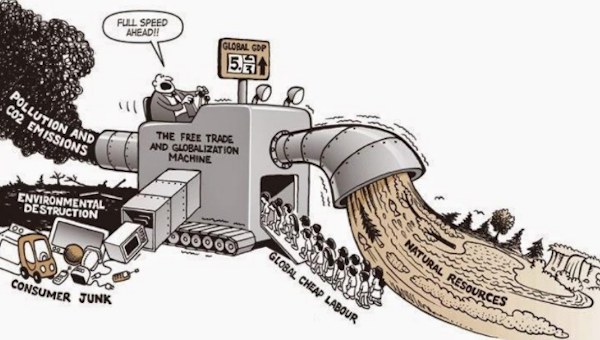

The rise of asset management companies like BlackRock, Vanguard, and State Street reflected a broader and deeper shift that occurred after 2008: from the neoliberal stage of capitalist development to a new form of finance capital. Above all, this phase of capitalist development is characterized by the fusion of financial and industrial capital, both within the non-financial corporation as well as between the non-financial corporation and financial firms. Through this process, industrialists have become financiers, while financiers have become more actively and directly engaged in the governance of industrial firms.

Management of Portfolios

As a result, there is now no longer any clear distinction between financial and industrial corporations. Both the non-financial corporation as well as financial institutions have been restructured around the management of portfolios of financial assets. While asset management companies have replaced traditional banks at the center of the financial system, so too are the internal operations of industrial corporations now seen as competing investment opportunities.

The financialization of the industrial firm was not a matter of the imposition of short-termism by outside investor pressure, but was rather a response to internationalization and diversification. The challenge of managing a vast range of businesses – and international operations – led postwar conglomerates to decentralize the administration of particular businesses, even as control over investment remained centralized in the hands of top managers. Over time, increasingly self-contained divisions began to compete as if they were separate businesses, thus forming an internal capital market.

This led to the growing prominence within industrial firms of financial operations and functions – and ultimately to the restructuring of the industrial corporation from a ‘system of production’ to a ‘system of investment.’ This exerted new pressures to increase efficiency, cut costs, and maximize the exploitation of labor and the production of surplus value. It is in this sense that we can speak of the dominance of finance, and the disciplinary power of abstract capital over concrete production. Consequently, the increasing scale of corporate organization did not stifle, but actually intensified, capitalist competition.

This restructuring of the industrial firm culminated in the early 2000s, with the transition from the multidivisional conglomerate form of corporate organization to the multilayered subsidiary form. The latter performs a “system-integrator” function – organizing a secondary layer of subcontractors, as well as internal business divisions, into highly flexible and competitive global networks of production and investment.

Like their internal operating divisions, the strategies of these subcontractors are totally oriented toward competing for investment from the big MNCs (multinational corporations), whose global power is secured by their possession of two decisive assets: intellectual property and branding rights. Far from being antithetical to production, global finance is therefore especially essential to the organizational integrity of the multilayered subsidiary form.

The development of the multilayered subsidiary form was also encouraged by the rise of external financial institutions during the neoliberal period. In the neoliberal form of financial hegemony, constellations of competing financial institutions exerted broad influence and discipline over industrial corporations – which both supported, and was supported by, the empowerment of financial offices within the industrial firm.

However, it was only in the wake of the 2008 crisis, when a new group of financial institutions developed tighter and more extensive linkages with industrial firms, that outside investors came to play the more active and direct role in corporate governance that defines the new finance capital.

New Financial Institutions

Thus, the crucial factor in the transition to the new finance capital was the development of new financial institutions after 2008. This occurred through three interconnected shifts within the financial system, all of which signalled a move away from the traditional banking system as the center of financial control, and toward a new model based around asset management:

- The historic shift toward passively managed investment funds;

- The emergence of new kinds of more active hedge funds; and

- The significant growth of private equity firms.

Most important among these was the expansion of passively managed investment funds. Such funds hold shares indefinitely, and trade only to reflect the changing weight of firms in a particular index (e.g. NASDAQ, S&P, etc.). Since these funds cannot exert discipline on industrial corporations by trading shares, they have moved to more direct methods of influencing firms in which they hold stakes. The increasing frequency of contacts and institutional connections between these firms and the corporations they seek to influence is a crucial aspect of the new finance capital and differentiates it from the prior neoliberal period.

The tremendous concentration and centralization of assets within these passively managed funds has also supported the rise of a new group of activist hedge funds such as Elliott Management, Starboard Value, Carl Icahn, and ValueAct. Such funds seek to influence underperforming companies by pressuring boards of directors. Since the reforms pushed by these activists benefit all investors, they often meet with approval from the passive funds that hold significantly larger blocs of equity – even representing ideal ‘outside directors’ who can sit on corporate boards and oversee reforms that insiders may resist. As a result, these hedge funds are able to ‘punch above their weight’ and gain outsized influence over corporate strategy.

Reinforcing this new constellation of financial control has been the growing power of private equity funds, managed by firms like Blackstone and Apollo. These firms obtain complete control over the companies in which they acquire stakes, restructuring and often eventually breaking up and re-selling their assets at a profit. This connection between financial managers and industrial assets is the most intimate instance of the fusion that constitutes the new finance capital. Moreover, it parallels especially closely the organizational form and strategic practices of the multilayered subsidiary form, whose relationship to its internal operating divisions reflects a similarly close interconnection between finance and industry.

These changes in the financial system interlock with and support the supremacy of financial units within industrial firms to produce a new constellation of financial control. The consolidation of this regime was crucially reinforced and underpinned by the state. First, as mentioned above, the state constitutes the crucial support for the global dominance of MNCs by guaranteeing the security of intellectual property and branding rights. Similarly, the development of the multilayered subsidiary form was made possible by state regulatory shifts that facilitated the liberalization of global financial flows and made it easier for corporations to organize assets as subsidiary companies.

Role of the State

The state-led reconstruction of the financial system following the 2008 crisis was also an essential factor in the emergence of the new forms of institutional investment comprising the other side of the new finance capital. The liquidity provided by the state in the wake of the crisis, and its temporary nationalization of key bond markets, encouraged investment in riskier assets by inflating asset values across the board – helping to trigger the shift toward passive management. Meanwhile, the re-regulation of banks after the crisis created space for the new group of asset management firms to take the central role in allocating investment across the economy.

The political implications of this are far-reaching. Today, liberal and progressive politicians from Hillary Clinton to Elizabeth Warren, have embraced the view of finance as a corrosive and parasitic force on the “real” economy. From this point of view, the main political task is to implement regulations to rein in the power of Wall Street and restore the independence of industrial corporations from investor pressure.

That finance is not merely an external parasite, but absolutely integral to the globalization of production, means that taking on the power of finance involves going beyond imposing regulations on the financial sector to directly interfering in global capitalism. Similarly, that finance is not a harbinger of decline means that we cannot simply wait for American capitalism to collapse.

In this respect, our argument contrasts sharply with the view, going back to the Second International, that the corporation is a transitional form to socialism. If the emergence of new finance capital does not suppress, but actually intensifies, capitalist competition, then this implies the need for a more thoroughgoing remaking of these institutional forms.

The planning undertaken by corporations is not a neutral instrument or tool to be wielded, but rather a social relation disciplined by the logic of capital. Socialists therefore must imagine and construct an alternative form of democratic economic planning to challenge, rather than reinforce, capitalist competition, and to meet social needs, rather than serve private profits.

At the same time, the political alliance among big capital that is cemented by the structure of the new finance capital around continued global liberalization makes reforms harder to achieve than ever before. While tensions of course remain within capital, the kinds of splits within the ruling class that could produce anything like an opening for radical transformation appear to be remote.

There is also no fraction of the capitalist class that seems willing to support the kinds of class compromises that social democratic parties have pursued throughout the postwar era. The question today is therefore not reform versus revolution, but rather how to patiently build institutions that can sustain and amplify challenges to the power of the new finance capital. •

This article first published on the Marxist Sociology website. This article is based on Stephen Maher and Scott Aquanno, “The New Finance Capital: Corporate Governance, Financial Power, and the State,” Critical Sociology published online March 8, 2021.