COVID-19 and Public Sector Workers: Tax Justice, the Just Transition and the Care Economy

An Interview with Daniel Bertossa – Public Services International

On Wednesday, March 24, 2021 we caught up with Daniel Bertossa, Assistant General Secretary at Public Services International (PSI), a global union federation that represents public sector workers in about 170 countries and about 650 unions. Daniel leads the Public Services International economic policy work in trade, tax, debt, and the future of quality public services.

This interview is part of a series with the Blended Finance Project, a group of unions, non-governmental organizations, and academics who are concerned about the Canadian government’s embrace of what is called “blended finance.” We argue that blended finance is merely the latest iteration of the privatization and financialization of foreign aid, and we seek to promote more equitable public alternatives.

Adrian Murray (AM), Susan Spronk (SS): Why is Public Services International interested in questions of financing for development, and specifically, tax justice?

Daniel Bertossa (DB): Public Services International is interested in issues of development and public services. First, our members are the people who work in these public services, and they have a very good understanding of what they do and how they work best. But also, as a trade union, we’re interested in workers and ensuring that workers get their cut from the benefits and the wealth that’s produced in society. Public services are a really important way of ensuring that the neediest in our societies and communities get what they need to live happy, healthy, and prosperous lives, but also to redistribute wealth to those who need it and to ensure that those who have the means to pay actually do pay. That’s the tax policy interest that we have: both to fund public services so everybody can enjoy them but also to redistribute wealth.

Blended Finance: An Abysmal Track Record

AM, SS: Blended finance is part of an agenda that entails the use of public money such as foreign aid (which is funded by tax dollars) to leverage sources of private finance for development. Why do you think that this approach to development finance is misguided?

DB: We need to have a very clear idea about how development occurs. When you look at the way in which the developed countries developed their economies and their social systems, it’s not at all the way that they prescribe for developing countries now. A lot of myths have been created that just don’t stack up when you look at history and evidence.

The first myth is that high taxes are somehow bad for development. But, in fact, if you look at the correlation between taxation and development, high taxation is actually highly correlated with higher levels of development. If you look back 100 years ago when some of the rich countries were industrializing, they had high taxes particularly on people who are earning a lot of money. They used those taxes to provide the things that the economy needed to industrialize, such as basic infrastructure, such as roads and ports, electricity, and water, but also education. Second, a lot of the industrialization that occurred in the richest countries in the world occurred under protectionist regimes. Throwing open your doors to foreign multinationals actually crowds out and kills local economic development. So, the US, Europe, Australia, and Great Britain all industrialized under a system of fairly protectionist industrial policy. Third, the idea behind foreign investment and foreign capital is they’ll come in, they’ll create jobs, and the technology will transfer. That’s really not the case. Multinational corporations want to keep their technology and their secrets because that’s how they make money. COVID-19 is demonstrating this problem in a really tragic way. Despite the fact that billions of taxpayer and government funding have gone into vaccine development, the companies that have commercialized the vaccines do not want to give away their intellectual property and lose profits.

More specifically, blended finance is a problem because it’s based on an idea that there just isn’t enough money to fund public goods. That’s just not true. There’s actually a lot of money out there to fund these public goods. PSI and the Tax Justice Network have released research recently that shows that there’s, at the very least, 427 billion annually that’s being taken out of the public coffers through corporate tax avoidance. And this figure does not even include all sources; the actual amount is probably much higher. To put this figure in perspective, that’s the equivalent of 34 million nurses’ salaries annually. It’s more than enough to bring the entire world out of extreme poverty. And yet, that’s the amount of money that our governments are allowing to escape the tax office.

In Africa, the amount of money that’s lost to illicit financial flows is larger than the entire amount of aid that Africa receives. And so, if we just made corporations pay the taxes that they should, we could double the amount of money flowing into Africa. But even more importantly, closing tax loopholes is really important for self-determination. If African governments could collect their own revenue, they could decide what they want to do, what was in their own best interests. Tax revenue does not come with the conditions that are attached to foreign aid.

Second, one of the big problems with blended finance is that it invites markets into areas where all the evidence shows that markets just can’t deliver. Public services are a good example. You only have to look at the health system in the USA to understand that the last thing you want to be doing is inviting corporations to privatize your health system.

Third, developing countries are not asking for blended finance; it is an agenda that’s driven largely by rich western countries and large corporations. It is happening now for some very specific reasons. One of them is that we have very low interest rates, so returns from money saved is low. We are also experiencing very low growth and profit rates in many developed markets. A lot of these [public-private] investments are very attractive because they are government contracts that bring 10 to 15 per cent returns. So, the private sector is really behind this push to have blended finance because it’s very, very profitable for them.

Lastly, the main reason why we’re skeptical about blended finance is that it often just doesn’t work. These are very complex financial arrangements that are very hard to administer and very inflexible. More often than not they’re much more expensive than just providing money to government to do government business. And there are lots of examples, but one that I like is the way that Germany has made a mess of so many of its PPPs and other mixed financial instruments. The PPP to build an airport in Berlin was abandoned because it was over five years late and massively over cost. A concert hall in Hamburg was contracted for €114-million, and in the end, it was delivered at 780 million! If the public sector had just done it themselves, they would have got it done quicker and cheaper. And so, if the governments in countries like Germany can’t manage to control the market forces and the private contracts involved with PPPs, then the idea that that some of these developing countries are going to be able to negotiate equally with some of the largest corporations on the planet is just really, really misplaced.

AM, SS: European development organizations and development finance institutions have been funding projects overseas using blended finance instruments for over a decade. Based on reports by Eurodad, we know that blended finance goes to mostly middle-income countries and profitable sectors such as finance and energy. Trade unions in Canada and globally have worked a lot on what is called the ‘Just Transition’ with respect to decarbonizing the economy. Can you tell us a little bit more about the energy sector in particular, and why you think that blended finance is not going to work? What do you mean when you say that blended finance is going to be limiting in terms of delivering public services for all?

DB: There is a lot of rhetoric in debates on blended financing around being ‘bankable.’ In some ways, the energy sector is very, very bankable. The private companies that are invited in to provide some of these services are extremely profitable. And they are very happy to be involved in the provision of these services with guaranteed revenue streams from developing countries.

The real question though is whether or not it’s serving the social and economic objectives that we want for our aid money, and there, I think that it’s a slightly different question.

First, the market tends to want profitable options, and the public sector exists precisely because markets fail. There are certain things markets won’t do. They won’t provide essential services to people who can’t pay for them. They won’t provide services to places where they’re not profitable. And so, that’s why blended finance initiatives tend to focus on profitable sectors and in middle-income countries, precisely because there are profits to be made.

There’s a second question, however, which is ‘what do we want from our energy policy’. If the answer is simply to produce as much cheap energy as possible for those who can pay, then the market does do a reasonable job at that. But we know now that there are massive externalities from energy policy, and that if we don’t deal with the climate crisis that there will be much bigger aid and development problems all over the world. The people that have created the climate crisis are the large private sector polluters.

If we’re going to make a transition to a green economy and we’re going to head off the worst effects of the climate crisis, then we need radical change. And we need it quickly. The market is not doing it quickly enough at the moment. It is going to require large amounts of public intervention and public energy to shift the way in which we generate electricity and energy. It’s also going to require heavy regulation. All of these measures are opposed by the private sector. If at the same time that we’re demanding radical change in energy markets, we’re also cementing the role of the private sector – often with long-term contracts that can’t be changed for 10 or 20 years, which then stop governments from evolving and innovating and changing their energy policy – blended finance initiatives just lock in the current model, and that is not good for the climate. And it’s not good for people either because what we will find is that the private sector will cherry pick – they will take the most lucrative markets and lock in long-term contracts. But when circumstances change, they won’t adapt; they will demand more money when they renegotiate these contracts and higher prices for users. There is a lot of evidence in the developing world and the developed world that shows that these providers don’t provide water and energy to those who most need it. Rather, they drive up costs and they are very inflexible when circumstances change. Circumstances will change drastically in coming decades because of the climate crises. Getting locked into long-term contracts with the private sector is simply not the way to go.

An Alternative Agenda: Technical Assistance, Debt Restructuring, Industrial Policy

AM, SS: What else do you think governments should be doing, but specifically aid agencies, with respect to pursuing an alternative global agenda centred on justice?

DB: First, aid agencies can provide technical assistance. A country like Canada has a well-developed public sector and has a lot of expertise around running a good public service. You can provide that support to other countries, as it is very, very valuable. There is also a certain amount of support that is required in regard to tax policy, so assisting developing countries develop their own tax policies that are progressive, because all too often the international financial institutions, but also domestic governments, find that it’s politically easiest just to increase value-added taxes or consumption taxes, which are very regressive and particularly regressive in developing countries. So, developing good progressive tax policy is important in assisting those countries to collect tax from corporations.

Another thing governments can do relates to debt. Again, debt is another one of these areas where there have been a lot of myths. Private finance is often provided on the basis that it keeps debt down, that we don’t want countries to get into too much debt. The problem, of course, with a lot of these concession contracts is that they are decade-long contracts that oblige somebody to make payments each year. And so, whether or not you’ve borrowed and you’re paying back debt, or whether or not you’re paying a concession to a private provider for the investment they’ve made, the effect on the budget bottom line is exactly the same. You are locked into long-term payments that you can’t use to spend on your own domestic services and economic development. At the moment, governments can borrow far more cheaply than corporations. So, actually, governments directly borrowing themselves is a much better way to finance a lot of this productive infrastructure. The public sector is also cheaper than the private sector because we don’t need to pay dividends to shareholders or high executive salaries.

The last area is industrial policies. I’ve mentioned that in the global North industrialization occurred with a lot of government intervention to develop infant industries. And if you look at the incredible economic growth in a country like China – probably the fastest industrialization the world’s ever seen and certainly the country that has lifted the most people out of severe poverty, the fastest in the history of the world – all of that economic development was done with industrial policy that created the conditions for accumulation. And I think these are the sort of policies that we should be encouraging the developing world to take up. Currently, there’s this misguided view that export-led growth is the only path to development. But logically not all countries can be exporters. It is much more important for these countries’ path to development – certainly in the initial stages of industrialization – to produce goods for their own domestic markets or trade with their neighbours. And that is a far more sustainable path to economic, and ultimately, social development than throwing open the doors to foreign investment and then having those foreign investors come in and crowd out your local producers.

The push to attract foreign direct investment has also involved all sorts of prescriptions to lower barriers for the foreign multinationals to come into your country and make profit, including driving down wages. Workers suffer because they don’t have as much money, which undermines economic growth, but it also undermines social progress because you don’t have the workers who are creating the wealth benefiting from the wealth they create. The pressure to attract foreign direct investment often comes with a lot of pressure to de-unionise or to have export zones where you don’t allow worker organizations. And it often comes with a lot of pressure to ignore environmental degradation. And so, the model that’s being promoted through blended finance, it is part of a broader agenda to drive down wages, drive down people’s rights to organize, drive up inequality, and ignore environmental degradation. The alternative is a high wage, sustainable path that prioritizes government investment in things that will add value to the economy, such as educating the workforce and creating productive infrastructure.

COVID-19 and Care Work: Public Sector Solutions Needed More than Ever

AM, SS: COVID-19 has exposed many of the inequalities in our societies and, in fact, made them worse. Can you please describe some of these inequalities and talk about the role of the public sector in finding solutions to this health and economic crisis that we’re facing?

DB: I think one of the main things that COVID-19 has done, and particularly the periods of confinement, is to expose the enormous amount of hidden work that keeps our economies running. A lot of that work is unpaid work, such as domestic work in the home. But a lot of it is undervalued work that keeps our society running and has enormous value.

The obvious example is long-term care, where we have taken for granted the fact that some very low-paid workers who are often exploited are looking after some of the most vulnerable people in our societies. Workers in this sector are usually women and often migrants. The association with that work with unpaid, ‘women’s work’ in the home contributes to its being undervalued in the same way that women’s unpaid domestic work is also undervalued. The association with it being ‘migrant work’ and the undervaluing of migrants in our community allows it to go on for so long and not be recognized. But we’ve also seen that these sectors are highly financialized, and where they are financialized, we’ve had much worse outcomes, in terms of death rates in long-term care in Canada but also in other countries around the world.

When you undervalue work it’s much easier to exploit it; it’s much easier to justify making it insecure; it’s much easier to pay lower wages. A lot of the workers in long-term care have had multiple jobs. They’ve had to go from workplace to workplace, and that’s spread COVID-19. Due to the precarious nature of their work, they have often been unable to say no to coming into work. We’ve seen a lot of cases where people who are sick have gone to work, not because they wanted to go to work sick or were somehow negligent but, quite simply, they’re worried that if they don’t take this shift that the boss might not give them another one.

COVID-19 has also shone a very, very bright light on the amount of unpaid domestic work that is done largely by women in households, such as child care and housework, which again, is often, outsourced to migrant communities very cheaply and often informally, and also the care work that families do, looking after older people (e.g., making sure that nana’s okay) or providing support to people in our community who are living with disabilities or have underlying health conditions.

But at the same time, Covid has also shone a light on the answers. The public provision of social care work has held up well under the strains of COVID. I think a lot of people were quite shocked at what it was like to have to have their kids home from school. I think they have a new appreciation of what teachers, education support workers, and after-school care workers actually do for them in terms of looking after their kids. I think it’s also been quite shocking for people who’ve had to make very difficult choices about looking after aged relatives or friends or family with disabilities, and also a lot of people have had to do their own cleaning and other associated care work. And so, I think it’s driven a renewed understanding that the answer to most of these problems is to value social care work and to understand that it is a social exercise, it’s not an economic activity. If we treat it like an economic activity, then we’re exploiting the people who do it and we’re leaving ourselves vulnerable, as COVID-19 has shown.

And because care work is a social activity, we have a collective responsibility. We should provide these things as much as possible through the public system. We need public healthcare. We need public disability care. We need public long-term care. We need to be providing good public schools and good after-school care so that everybody, men and women and non-binary folks, can enjoy access to work and the independence that that that brings with it. And that that is both socially good but also economically good, as we’ve seen with our response to COVID. If we’re going to re-value social care work, these workers must have decent, permanent, well-paid jobs, which will mean that they can focus on providing the care to the community that we need and not just trying to get through the day and scrape out a living.

AM, SS: Do you see any momentum in favor of public financing of the essential services we’ve talked a lot about? And what do we need to turn the tide in favor of public financing of these services?

DB: I think there has been a big appreciation of the sacrifice of public-sector workers over the course of the COVID-19 pandemic. In many countries you’ve seen people clapping from balconies, and that’s really critical. And often they get called “heroes.” But we say these people aren’t heroes, these people are just doing their job, and if you really want to support public sector workers to make sure that we’re all safe, then we shouldn’t just clap. What we should be doing is supporting them in their work and into the future. And I think there’s a lot of support for that.

I think people are realizing that when the pandemic hit a lot of the myths we’ve been told about the private sector – that it’s ‘flexible,’ and ‘innovative,’ and it will help us when we need, and the government is bureaucratic – they realize that just wasn’t the case, that the personal protective equipment that they were meant to be providing wasn’t being provided, that a lot of the privatized long-term care facilities weren’t keeping old people and vulnerable people safe. The government had to step in to make sure that things like transport and waste collection were being provided by public workers. And that when everybody else was trying to keep themselves safe, it was public sector workers who were actually keeping the community running.

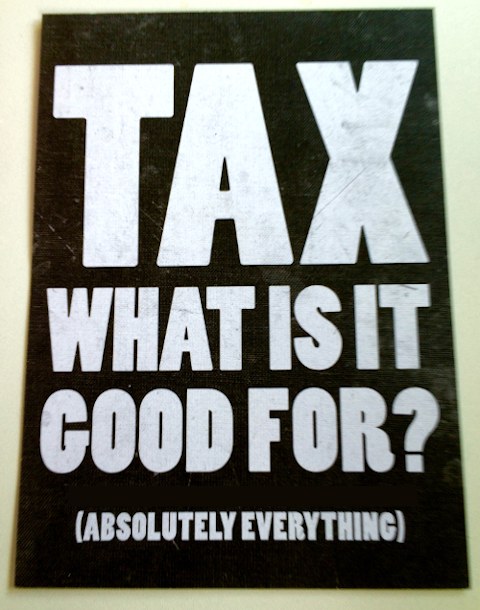

I also think there’s a bigger appreciation of the need to provide finance through taxation to fund these services. I think everybody’s seen the massive profits that big pharma is making and the way in which they aren’t actually providing the vaccines fast enough, even though they’ve received enormous government subsidies. I think everybody’s seen the way in which the digital economy and big tech has made massive profits out of the COVID-19 pandemic. These tech giants are still paying almost no tax in most places in the world. And I think people are pretty angry about that and can see that these large corporations need to be paying their fair share.

The combination of people appreciating public services and also getting angry about tax dodging has the potential to create change. But it’s not enough, in and of itself. We’ve seen this with the global financial crisis. There was a great surge of hope after the global financial crisis that we would do things differently, that finance would be made to pay, that somehow we would de-financialize our economy. None of that happened. The risk is that when things go back to normal or to some semblance of normal, people will stop being angry and allow these things to continue. So, it’s really up to trade unions like PSI, but also all of our partners in countries around the world, to keep on reminding people of the sacrifices that were made by these workers, to keep on reminding people of the way in which these large corporations are still not paying their taxes, and that when they don’t, working people pay more. We pay more through value-added taxes (VAT) and we often pay more through income tax that’s too high. We working people don’t get the opportunity to avoid paying our income tax by routing our money in Luxembourg, Switzerland, or the Caribbean. But a lot of these corporations do, and I think every time we talk about that, every time we make these cases and we talk about these stories and we show the injustice of it, workers get really angry. So, one of the most important things we can do is just tell those stories and keep on reminding people who kept them safe.

In a place like Canada, part of this agenda must be about transparency. I think a lot of people don’t realize that Canada is one of the most opaque of the developed countries in the world in terms of corporate transparency. It’s easier in the UK and in Europe, and even in the US in some, to get good information about what corporations are doing than it is in Canada. And in Canada, there is a lot that can be done just introducing corporate transparency because when you see what these companies are doing, when you understand the amount of money they’re making and how little tax they’re paying, most people are pretty outraged, and the conclusions are pretty simple. And the real problem is that it’s legal, and our politicians don’t necessarily want us to know what’s going on because if we were angry about it, we would demand they do something. And that’s a bit hard for them. Some of them are actually bought in to that system, so we need to keep on telling the stories, we need to keep on reminding people of how it could be better, and keep on reminding people of why it’s in their interests to have less of the tax burden fall on workers. We all need quality public services. And if the rich aren’t paying for them, we won’t get the services that we deserve. •