The Fiscal Deficit, Modern Monetary Theory and Progressive Economic Policy

Modern Monetary Theory or MMT has crept in from the academic margins to become an influential doctrine in progressive policy circles in the United States. Both Elizabeth Warren and Bernie Sanders drew on the ideas of MMT to shape their ambitious public spending platforms. MMT has been cited as one way to fund a Green New Deal, in combination with progressive tax reform.

It is safe to say that most Canadian progressives are not debating the finer points of monetary and fiscal policy. However it is useful to critically consider some of the most important pros and cons of MMT, based on the new book by a leading US advocate, Stephanie Kelton. (The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy. New York: Public Affairs, 2020.) In a nutshell, MMT puts forward a powerful critique of mainstream macro-economic policy but discounts the need for truly radical change if the economy is to be regulated and managed for the public good.

MMT is something of a misnomer. Far from being “modern,” it draws heavily on monetary theories developed in the 1930s by John Maynard Keynes, and since that time, by left Keynesian economists rejecting orthodox finance and the view that government budgets should (almost) always be balanced, that deficits crowd out private investment which should be driving the economy, that monetary policy (changes in interest rates) as opposed to fiscal policies (changes in public spending) should be the key policy tool for managing fluctuations in the economy, and that private investment is much more productive than government spending.

The Government and MMT

The central proposition of MMT is that a state controlling its own currency can readily finance fiscal deficits (resulting from spending increases or tax cuts) at low or no cost through money creation and direct funding of government spending by the central bank. Unlike households or businesses, governments with their own currency and their own central bank can never go broke because they can always create money to fund deficits or to pay off debts. The only real constraint on public spending for countries with monetary sovereignty is real productive capacity. Too much additional deficit financing of public spending or tax cuts in an economy with full employment will push up inflation.

Many countries in fact do not have monetary sovereignty because they do not have their own currency (e.g., individual countries in the Euro zone) or because they carry high levels of debt denominated in a foreign currency such as US dollars (e.g., Argentina). Until the 1970s, the gold standard also constrained the ability of central banks to create new money.

Today, we in Canada and many other countries do have “fiat” money that can be created by central banks “at the stroke of a pen.” Central banks can and do expand the monetary base. Yes, Virginia, Santa has a printing press and it can indeed be used to give money to all the children.

However it should be noted that, in normal times, the great majority of new money is created by the private banking system as loans rather than directly by the central bank to finance the government’s operations. Indeed, in neoliberal times, the state’s capacity to create money has been rolled back and kept out of view. Many mainstream economists accept that government and the central bank can adopt MMT-type policies but argue that it is unwise to use the lever except under extraordinary circumstances.

MMT says central banks can also set interest rates from the short term to the long term through a variety of techniques. Again, many economists would broadly agree.

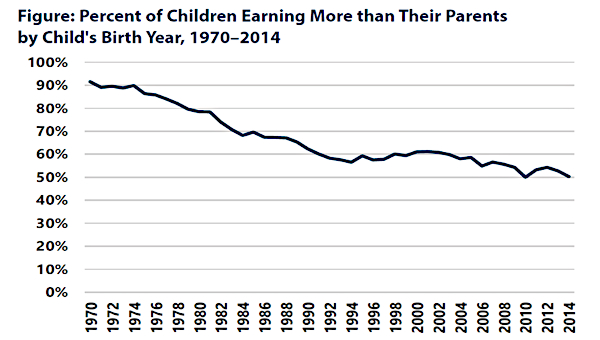

MMT rightly challenges the orthodox idea that government budgets should be balanced and that deficits should be incurred only to fight deep depressions when low interest rates no longer work. As argued by Keynes in the 1930s, deficits will not crowd out savings and private investment if the economy is operating below capacity. Indeed, public investment financed by deficits can “crowd in” private investment. And public investments financed through deficits and debt can create a more robust economy and infrastructure, leaving future generations with greater wealth and opportunities. Keynes, unlike the “bastard Keynesian” wing of mainstream economics, looked forward to the day when the economy would be driven by productive public investment with no need for the state to borrow from the rentiers living off interest income.

In short, the key ideas of MMT are not so much modern as a return to the radical Keynes and the left Keynesian tradition. Both hold that conventional policy results in economies running well below capacity much of the time, and both reject the mainstream view that the macro-economy should be primarily managed through monetary rather than fiscal policy.

Today’s Extraordinary Circumstances

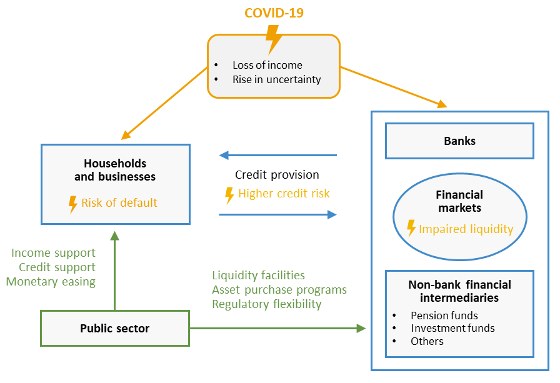

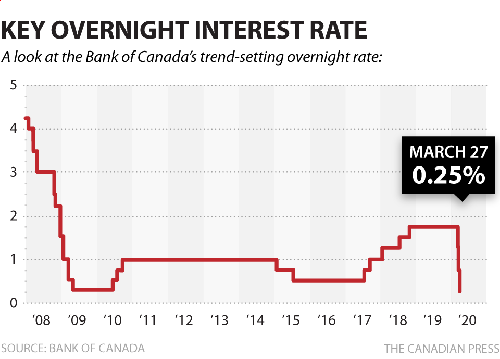

Today – amid the extraordinary circumstances of the pandemic – the Bank of Canada is printing billions of dollars to buy government bonds in order to lower interest rates. For the first time they have moved beyond “quantitative easing” – buying up government bonds in the secondary market to lower interest rates – to direct purchases of government bonds. They are supporting massive federal and provincial government deficit spending. The Bank may not loudly endorse MMT, per se, but they are acting on that basis and demonstrating that the state can indeed always pay for what must be done. Similarly, all kinds of orthodox economists and policy makers have temporarily accepted that a massive increase in public spending can and should be undertaken without raising taxes and almost irrespective of the deficit and debt.

So far, so good. The key question is how long this can go on. Stephanie Kelton calls for much higher levels of public investment and spending to deal with a wide range of social ills, funded directly by the central bank, on a continuing rather than one-time emergency basis. This has understandably appealed to progressives.

So long as we have low inflation and a very depressed economy, the Bank of Canada is unlikely to change course and will backstop massive government spending to deal with the crisis. They will give fiscal policy the latitude to drive recovery in full recognition of the fact that even near-zero interest rates are not enough to deal with the slump. But, as things stand, they still basically control monetary policy.

MMT is rather silent on this, just saying that governments can set the interest rate. It begs the question of who actually controls interest rates, and in whose interests. Dating back to at least the 1970s, the Bank of Canada, which is largely independent of the government, has generally chosen to accept some slack in the economy so as to discipline labour and to maintain low and stable inflation. The federal government and the Bank have consistently argued that the sole objective of the central bank should be to hit the formally agreed 1% -3% inflation target, without a parallel mandate to achieve full employment as called for by progressive economists. It would be a big political change, to say the least, for the government to tell the Bank to promote full employment, let alone to direct it to fund government operations on a non-emergency basis. The whole point of current arrangements has been to isolate the Bank of Canada from democratic political pressures.

Conventional thinking has emphasized setting low interest rates in an economy operating below capacity, as has been the case in the slow recovery from the global financial crisis. But this, as Kelton argues, has starved public spending, while fuelling the destructive and unsustainable growth of household and corporate debt, and fuelling the asset price inflation that has greatly increased inequality of income and wealth. Loose monetary has singularly failed to boost real wages for most workers, and has also manifestly failed to revive private business investment. Indeed, corporations have borrowed at low rates to ramp up unproductive activities such as share buy backs and increases in dividends.

MMT rightly emphasizes that priority should be given to fiscal policy over monetary policy, while taking no single position on what governments should spend on. Proponents such as Stephanie Kelton generally support big increases in public investment – the green economy, education, infrastructure, etc., as well as a federal job guarantee. They also argue that if and when inflation becomes a problem, it could be tackled through selective tax increases on households and business, as opposed to an increase in interest rates which would limit government investment and drive up the carrying costs of the public debt.

Kelton argues that support for MMT should exist across the political spectrum, but she neglects the role of real interests. The banks want to retain their central role in money creation. Orthodox fiscal and monetary policy that is focused on low inflation and balanced budgets is strongly supported by corporate and financial interests. They do not really believe in the need for balanced budgets, as shown by the support of most US corporations for the Trump tax cuts, which have created huge deficits. But they do want small government and lower taxes, and they want to ensure the economy is driven by private investment – which means government deference to the wishes and needs of capital – rather than by public investment.

MMT also tends to minimize real structural constraints on government macro-economic policy in the context of global capital flows. As noted, MMT says that governments can control the interest rate through the central bank. This is true in the first instance but highly problematic in a world of capital mobility if investors fear too much inflation or currency devaluation. The Bank of Canada can maintain low interest rates, but they face the possibility of capital flight on the part of both domestic and foreign capital, which would bring down the exchange rate and fuel inflation. This point is discounted by MMT proponents, who are mainly talking about the US which controls the global reserve currency and is thus in a unique situation.

Many foreign central banks of surplus countries such as China and Japan own huge reserves of US bonds that they would be reluctant to sell quickly since this would raise their own exchange rate, result in large paper asset losses, and cause a major disruption to the global financial system. But fears that the US was making too much use of the printing press could still cause capital flight from the US dollar on the part of private bond holders, and help fuel US inflation.

The ability of the bond markets to punish smaller countries with high levels of public debt and incipient inflation cannot be dismissed. Keynes argued that countries could only control interest rates if currencies were managed and if there were controls on international flows of capital. Dismantling of the post-War Bretton Woods arrangements was intended to set the stage for a shift from nationally controlled economies to a world of international capital flows that constrain governments.

MMT is right to argue that so long as the economy is operating below potential, we can and should run large deficits to fill the gap and to address public policy priorities such as the need for affordable housing, expanded public healthcare and building a green economy. These deficits will have most impact in both social and economic terms if used to finance well-chosen public investments, as opposed to tax cuts. Inflation is not likely to be a problem.

But MMT tends to hide in a technical argument that does not address real political constraints that need to be seriously confronted. We can run large fiscal deficits now, but not indefinitely, without major changes in fiscal and monetary policy and in political direction. In the longer run, we cannot have everything we want just by printing money.

If we want permanently higher public spending, we also need to raise taxes. If we want much more public investment, we will also have to give less priority to private consumption, especially the luxury consumption of the rich. If we want greater control of our economy, we must confront the power of private financial interests.

In short, MMT, based on the theoretical legacy of left Keynesian economics, offers us a way forward, but it does not free us from the very real constraints of capitalism. •