Accountable Capitalism or Democratic Socialism?

Elizabeth Warren’s “Accountable Capitalism Act” promises the most radical shift in economic power since the New Deal. It contains four essential components, including campaign finance regulations, an attempt to limit corporate “short-termism” that has supposedly accompanied the rise of finance, and a requirement that corporations serve the “public benefit” rather than just shareholders. Most substantial, however, is the proposal that employees play an enlarged role in electing corporate boards of directors. As Seth Ackerman argued in calling for the left to “take Elizabeth Warren literally, but not seriously,” the Act would in some respects be a step toward greater democratic control of the economy.

Yet even aside from Warren’s proud declaration that “I am a capitalist,” there are many reasons to regard the bill with skepticism. Indeed, given that it is modeled partly on the German social democratic model, the experience of workers in that country – who have increasingly been forced to accept wage restraint in one of the harshest neoliberal regimes in the world – should itself serve as a warning. Developing a clear understanding of the limits of Warren’s proposal can be helpful in forming the vision of economic and political democracy that should be at the center of the current “democratic socialist” upsurge in the United States. Even if unachievable today, is Warren’s vision what democratic socialists should struggle for?

Yet even aside from Warren’s proud declaration that “I am a capitalist,” there are many reasons to regard the bill with skepticism. Indeed, given that it is modeled partly on the German social democratic model, the experience of workers in that country – who have increasingly been forced to accept wage restraint in one of the harshest neoliberal regimes in the world – should itself serve as a warning. Developing a clear understanding of the limits of Warren’s proposal can be helpful in forming the vision of economic and political democracy that should be at the center of the current “democratic socialist” upsurge in the United States. Even if unachievable today, is Warren’s vision what democratic socialists should struggle for?

Congress could never enact Warren’s bill absent a massive working-class mobilization and a major shift in the balance of forces. Even aside from this, the most substantial proposals, those around corporate governance, are aimed not at empowering workers but rather non-financial corporate executives. Indeed, the bill appears rooted in the familiar false dichotomy between “finance” and the “real economy.” The rise of finance is not a cancerous growth on the otherwise healthy body of capitalism, but rather a component of the capitalist globalization of recent decades.

Moreover, while the restructuring of capitalism makes it impossible to simply turn back the clock to the 1950s, postwar managerialism was in any case no less ruthlessly committed to profit maximization than contemporary neoliberalism – though workers were able to maintain rising standards of living through unionization. Similarly, the proposition that corporations act in the “public benefit” sounds good, but in reality this “stakeholder capitalism” leads to the same single-minded focus on profit that it claims to challenge.

In the end, were it to be enacted, the Accountable Capitalism Act could actually be a barrier to working-class consciousness, embedding workers even more deeply within the logic of capitalism and identifying their interests more closely with corporate profitability.

Managerialism and Neoliberalism

Even if they have always been geared toward maximizing profit and outcompeting rivals, corporations have not always looked the same. The corporation was born when investment bankers like J.P. Morgan in the nineteenth century merged small businesses into larger and more efficient firms. These bankers exercised power by acquiring seats on the boards of directors of the firms they controlled, creating networks of interlocking directorates. The decline of these investment banks meant that corporations were increasingly autonomous, and under the control of professional managers. Investors in this era of “managerialism” had little ability to challenge the power of internal managers, who were able to subordinate boards of directors. Of course, these new corporate organizations were just as dedicated to profit maximization as their forbearers had been – and indeed were perhaps even more effective in pursuing this goal.

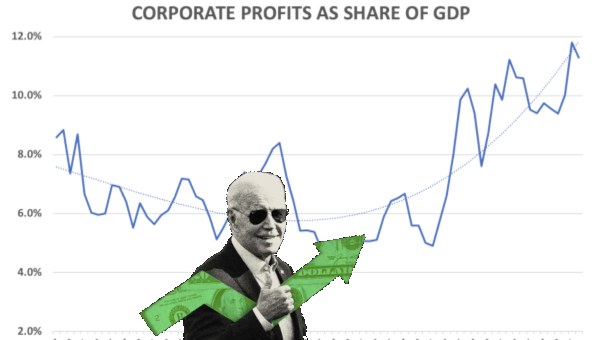

Yet in the neoliberal period, stockholdings have again been concentrated in the financial sector, increasing the power of outside investors to discipline management. Warren’s prescriptions are predicated on the idea that investors have used this power to impose a “short-term” perspective on the managers of non-financial firms, who are now forced to look for a quick buck at the expense of long-term prosperity. Unlike in the earlier managerial period, Warren writes, “the obsession with maximizing shareholder returns effectively means America’s biggest companies have dedicated themselves to making the rich even richer.” This, she argues has been primarily responsible for the increasing social inequality, economic stagnation, and declining wages of the neoliberal period.

Warren claims that financial pressure has led managers to effectively loot their companies by diverting capital from useful investment to “buying back” shares of their company’s stock to manipulate the price. As a result, “good jobs” are disappearing and corporate investment has become a simple matter of handing out money to the super rich. This underinvestment means companies are “setting themselves up to fail.” And given that managers are often compensated with stock, they have every incentive to perpetuate the irrational cycle.

To remedy this, Warren proposes preventing managers and directors from selling shares within five years of receiving them, or within three years of executing a buyback. She also suggests issuing federal corporate charters requiring firms to act as “benefit corporations,” serving a range of stakeholders – including workers, consumers, and communities – rather than just shareholders. By increasing the autonomy of managers from investor discipline, corporations will supposedly again engage in the kind of investment that generated the “good jobs” and rising standards of living that characterized the managerial period. She also proposes granting employees the right to elect 40 percent of corporate boards of directors in order to “give workers a stronger voice in corporate decision-making at large companies.”

To be sure, the rise of finance in the neoliberal period was accompanied by greater pressure to cut costs and increase margins by offshoring production, subcontracting out work, and laying off workers. But these trends were not simply the result of financial parasitism. Rather, this restructuring was rooted in the increasing global mobility of capital, which intensified competitive pressures between firms as well as countries and the workers living within them for investment and jobs.

Managers of non-financial corporations relied on international finance to integrate the global economy and circulate capital all over the planet, helping to resolve the 1970s profitability crisis by opening vast low-wage workforces of the peripheral states to exploitation. They also counted on finance to facilitate globalization by managing the risks associated with world trade, especially through derivatives trading after the final abandonment of the gold standard in 1971. So, too, do these non-financial corporate managers depend upon financial firms to finance mergers and acquisitions, and to maintain consumption in the context of the stagnant wages that have been a primary feature of neoliberalism. All this shows just how deeply entwined the financial sector is with the “productive” economy – and how essential it is to global capitalism.

There is good reason to doubt the idea that the rise of finance has been associated with increasing economic “short-termism.” Rather than executives looting their companies, stock buybacks are more likely the result of historically high profits and low interest rates than supposed corporate irrationality. With corporations sitting piles of cash, and borrowing extremely cheap, why not distribute wealth to shareholders? This also means buybacks have not necessarily come at the expense of investment, which remains at historically normal levels relative to GDP. The problems with this argument are particularly clear in the case of the tech companies, which forego short-term profits to develop the technologies to secure market dominance well into the future. The same long-term perspective is evident when General Motors invests in China and Mexico, building fixed capital infrastructure, brand recognition, and political relationships to control markets and reduce input costs. In fact, management tenures are actually up.

Neither is there any clear reason to associate finance with a fundamental short-term perspective. An estimated 75 per cent of the value of Amazon, for example, is “justified by profits that are expected to be made a decade or more from now,” which makes for “the biggest bet in history on a company’s long-term prospects.” Indeed, since the crisis there has been a historic shift to passively managed investment funds – which hold shares “indefinitely.”

Either way, Warren’s act aims not at empowering workers but restoring managerial predominance. As an editorial by Jesse Fried in the Financial Times pointed out, “when 40 per cent of a company’s board consists of managers or their indirect reports” as required by Warren’s proposal, “investors would need to win almost every other seat to wrest control from incumbent management.” Workers notoriously almost always side with management in conflicts with outsiders. Indeed this was precisely why some of the largest firms encouraged employee stock ownership during the managerial era, alongside strategies to split stocks whenever the share price rose above a certain level: such measures were intended to prevent the emergence of an oppositional bloc of investors that could challenge management.

Especially in the wake of the extreme financial concentration of the post-crisis period, boards have again become key battlegrounds. Activist investors like Nelson Peltz have taken stakes companies like Johnson & Johnson and GE, demanding Board seats to push reforms on often-reluctant management – even forcing the retirement of General Electric CEO Jeff Immelt. But throughout the neoliberal period, managers have engaged in futile efforts to defend themselves from financial pressure by setting up anti-takeover defenses in the form of golden parachutes, poison pills, and state regulations. Warren’s plan (were it implemented) might actually succeed in giving them the protection they have sought.

Contrary to those emphasizing the supposed corrupting influence of financial “short-termism,” the rising living standards and robust economic growth of the “Golden Age” of capitalism rested on more than merely a specific model of corporate governance. It also depended upon relatively high union density. Without this, competitive pressure to allocate capital as efficiently as possible within firms as well as across the economy as a whole would mean that downward pressure on wages would continue to produce economic inequality and precarity. Firms seeking to raise capital need to be able to promise a return. This, in the end, is the primary objective of all corporate management strategies. Though individual managers may have different visions for how to achieve it, that it is the ultimate goal is beyond question.

This of course would be true no matter which specific individuals might be on a given firm’s board of directors. The logic of the firm would continue to be maximizing profits; those empowered within the corporation who fail to achieve this will undoubtedly be seen as ineffective. Indeed one of the dangers of Warren’s proposal is that it leads workers to identify their interests with those of the firm – thereby strengthening the logic of profitability, rather than undermining it.

Finally, the Accountable Capitalism Act attempts to achieve this “back to the future” strategy without challenging global financial integration or imposing controls on the global movement of capital. The question therefore becomes one of why investors would choose higher costs and lower returns. With corporate investment free to circulate anywhere on earth and establish corporations in whatever context in most attractive, why would capitalists willingly take on unnecessary costs? Barring controls that could limit the movement of capital, the only alternative would be increased subsidies and tax breaks for investing at home – which would only further increase pressure for public sector austerity and cutbacks to what’s left of the social safety net.

And in any case, the state cannot engage in such strategies continuously. As others follow suit, generating a race to the bottom, pressure from capital for an “improved investment climate” will return. This has been the fate of even the most robust of European social democratic states. As new technologies are adapted for the relatively low-skill and low-cost workforces of the global periphery, there is less and less reason for capital to produce even high value-added exports in high-tax and high-wage contexts.

The Struggle for Economic Democracy

Warren’s bill is based on what is known as the “stakeholder capitalism” model. Articulated as the antithesis to the “shareholder value” mantra, whereby the fundamental goal of corporate strategy is to increase share prices, stakeholder capitalism envisions corporations serving a broader set of interests, including communities, workers, and consumers. Whereas the idea of shareholder value posits a fundamental opposition between the interests of shareholders and others, stakeholder capitalism would supposedly allow a diversity of interests to jointly benefit from, and help shape, corporate success.

This suggests that the corporation can at least potentially be a neutral force, which impartially arbitrates among different interests that are not necessarily in conflict. Yet corporations are not neutral arbiters among different “stakeholders,” but rather crystallizations of capitalist power; institutional embodiments of the role of “capitalist.” Should a firm fail to perform this function, it will suffer from higher costs and reduced returns relative to its competitors – and therefore less capital available for investment and expansion, leading to cutbacks, layoffs, and possibly bankruptcy. Clearly, no directors – no matter who elected them – would favor a strategy that would end this way.

The stakeholder capitalism model also wrongly implies that capitalists simply plan the economy, and hence that putting capitalist investment in the hands of workers would allow economic production to come under the democratic control of workers – which would make it kinder and more humane. But where shall the employee-appointed director come down on the question of whether to replace “overpaid” workers in the United States or Canada with those in a low-wage zone, or to “flexibilize” labour markets by using precarious subcontract labour? Would they invest in practices that resulted in lower returns and higher prices – and thus the risk of being outcompeted by others?

The stakeholder capitalism model also wrongly implies that capitalists simply plan the economy, and hence that putting capitalist investment in the hands of workers would allow economic production to come under the democratic control of workers – which would make it kinder and more humane. But where shall the employee-appointed director come down on the question of whether to replace “overpaid” workers in the United States or Canada with those in a low-wage zone, or to “flexibilize” labour markets by using precarious subcontract labour? Would they invest in practices that resulted in lower returns and higher prices – and thus the risk of being outcompeted by others?

Rather than always appearing as “too much,” the most obvious sign of exploitation, and the most direct source of class-consciousness, profits must be defended, even increased if possible. While presenting itself as the antithesis to “shareholder value” doctrines, in fact “stakeholder capitalism” reproduces the identical logic: all concerns must be subordinated to the need to produce value for shareholders. Indeed, the Accountable Capitalism Act could potentially tie workers’ interests to the success of the firm to an even greater degree than before, with all the negative effects on class solidarity that would come with this.

The key question we need to ask is what political gains could result from the reforms advanced by Warren. Would they boost progressive political forces, or bring us closer to a system of production organized to serve concrete social needs rather than private profit and the endless accumulation of abstract value? Sharryn Kasmir’s work on the much-lauded Mondragon cooperative in Spain is revealing in this regard. In her essay in the 2018 Socialist Register, she concluded:

“Promoting worker-owned enterprises because capitalist ideology and social relations can accommodate them… capitulates to the hegemony of the market. Lessons from Mondragon are not about the triumph of workplace democracy in worker-owned coops, but they are nonetheless indispensable for socialists. They advise skepticism regarding calls to socialism that set aside politics in favor of quiet, easily sold, or already-existing, everyday forms. This is not to argue that socialist seeds cannot be sewn within capitalism, but it does mean that such planting requires struggle if it is to yield much in the way of radical transformation, either in specific workplaces or in society more broadly.”

As Kasmir has documented, Mondragon workers have failed to formulate a strategy for socialist transformation, or even to participate in wider struggles for social justice. This suggests that co-ops may fulfill their original goal of limiting, rather than promoting, the worker activism that could build momentum toward a qualitative social change. And of course, Warren’s proposals do not even go nearly as far as direct worker ownership of firms.

Like cooperatives, the democratization of corporate governance can indeed play a part in a wider socialist strategy. But unless this is coordinated by a strategy to transform the state, and supported by a socialist party embedded within a class-based workers’ movement, the effect of such reforms could be negligible – if not worse. Even as “socialism” has become more politically relevant in the United States than it has been for generations, its meaning has never been so thoroughly contested.

Today’s left must carefully balance the practical focus on concrete gains for the working class that has played such an important part in its ascent with a broader and more long-term strategy aimed at transcending capitalism. We need to fight for “non-reformist reforms”: that is, reforms intended not merely to fix capitalism, but to build toward socialism, developing the confidence, organizations, and democratic capacities of the working class through struggle. This must go much further than just regulating markets so as to reduce volatility and protect the power of the largest financial institutions. So too must it go further than the Berniecrat call to “break up the banks.” Rather, socialists should look to build the capacity to nationalize finance, and democratize investment by converting the banking system into a public utility. Though we can – and must – work to help the “democratic socialist” insurgency within the Democratic Party, we must also maintain our own, independent socialist organizations capable of building workers’ power at the base and coordinating political strategy.

Democratizing the economy begins with subordinating capital to a logic of the “public good” beyond efficiency, competitiveness, and endless private accumulation. This starts with the expansion of social programs, including healthcare, childcare, education, and public transit along with a massive program of green infrastructure investment. Removing barriers to unionization is also essential. But neither social welfare programs, nor unionization alone are enough. Devising a socialist program for economic democracy requires that we confront the hard questions about what democratic planning might mean.

The state of today is a capitalist state, with no capacities for economic planning or democratic management of social life. How can we create such capacities and institutions? This must be thought through at the workplace and at the community level in terms of schools, healthcare systems, transportation, the production of space, law enforcement, and the like, just as at the national and even international levels. What would it mean to democratize the Federal Reserve, or the Treasury Department, transforming them or replacing them with bodies organized to coordinate a democratic economy?

This of course could include a struggle to democratize corporate governance, but it should by no means be limited to this. And it will not be achieved by Elizabeth Warren passing a bill in Congress alone. We must build working class power – within workplaces as well as outside of and across them, within the state as well as outside of it – if we are to advance the fight for a truly democratic society. •

This article first published on the Jacobinmag.com website.