“One must know how to employ the kairos [right or opportune moment] of one’s forces at the right moment.

It is easy to only lose a little, if one always keeps foremost in the mind the idea that unity is never the trick, but the game.”

— Guy Debord, “Notes on poker.”

1. Introduction

The transitional “bridge Agreement” of the 20th of February is a truce intended by the Greek government and welcomed by the other side (the European “institutions”). Within the truce period (the next four months), the conditions for negotiating the next agreement will

be shaped. This could mean that everything is still open. However, that is not true for two reasons. First, the very transitional agreement changes the balance of power. Second, the “hostilities” will continue in the course of the next four months (i.e. the review of the commitments and the re-interpretation of the terms by each party).

2. The Agreement of February 20: A First Step on Slippery Ground…

2. The Agreement of February 20: A First Step on Slippery Ground…

2.1 Negotiation targets

In the first substantive phase of negotiations at the Eurogroup of the 12th February, the Greek government sought an agreement on a new

“bridge program” stating that it would be impossible to extend the existing program on the grounds that it has been rejected by the Greek people:

- The “bridge program” would not involve conditions, reviews and so on, but should be an official manifestation of the willingness of all parties to negotiate without pressure and blackmail and without any unilateral action.

- In the above context, Greece would forgo the remaining installments of the previous program, with the exception of the return of the €1.9-billion that the ECB and the rest of Eurozone’s national central banks gained from the holding of Greek bonds (programs SMP and ANFA). Greek authorities could issue treasury bills beyond the limit of €15-billion to cover any liquidity emergencies.

- At the end of this transitional period: (a) Greece would submit its final proposals, which according to the program of the government would include a new fiscal framework for the next 3-4 years and a new national plan for reforms; (b) the issue of a sovereign debt restructuring-reduction would come to the negotiating table.

The German government and the “institutions” (EU, ECB, IMF) came to the negotiations with the position that Greece had to request a six-month “technical extension” of the existing program – renamed as the “existing arrangement” – to enable its successful completion.

2.2 The outcome of the negotiation

The agreement of the 20th of February includes a four-month extension of the “Master Financial Assistance Facility Agreement (MFFA), which is underpinned by a set of commitments.” The extension of the Agreement (“which is underpinned by a set of commitments”) means: (a) evaluations by the three “institutions,” (b) commitments and conditions, (c) scheduled installments as they appear in the previous Program, subject to a positive evaluation, (d) return of the profits from holding Greek bonds by the ECB and national CBs, but subject to a positive evaluation by the “institutions” (even given the “independence” of the ECB).

In short there is a rejection-withdrawal of the Greek government’s negotiation targets (1) and (2). In addition, there is no explicit reference to how the government will cover its short term financing needs (e.g. issuing treasury bills to cover bond redemptions, interest payments and other possible emergencies) until the completion of the assessment. In this regard, the reference to the independence of the ECB may imply its “discretion” in assessing the extent to which the Greek government responds positively to the “commitments” that accompany the extension of the agreement (something which undoubtedly will complicate any “interpretative” attempts in relation to the agreement on the part of Greek government).

At the same time, the February 20 Agreement includes the statement: “The Greek authorities have also committed to ensure the appropriate primary fiscal surpluses or financing proceeds required to guarantee debt sustainability in line with the November 2012 Eurogroup statement.” This means that the Greek government refrains from the target of debt restructuring-reduction and adopts the sustainability plan based on debt repayment mostly through primary surpluses. This implies the rollback from point (3b) of its initial negotiating package.

What the Greek government has won (aside from the mere change in terminology, about which there was intense debate) is:

- Part (a) of section (3) of its initial suggestions, namely the right to propose reforms to the “institutions” for approval with regard to fiscal consolidation and growth. The policy measures agreed by the previous government (reduction of pensions and increase of VAT in the islands) were thus taken out. Both sides agreed to give particular emphasis to the “overdue” fight against corruption and tax evasion, public sector efficiency, improving the tax system, etc.1

- Further negotiations on the size of the primary surplus for 2015. Instead of the previously agreed 3% of GDP, the new agreement leaves open the issue of a lower primary surplus for 2015: “The institutions will, for the 2015 primary surplus target, take the economic circumstances in 2015 into account.”

It is clear that the new agreement is a truce, but truce is by no means a tie. The agreement is a first step on slippery ground. The Greek government may have gained time, but the political landscape seems quite tough, having minor similarities with the initial minimum negotiation targets set by the Greek side on February 12th.

3. Is There Still Room to Challenge Neoliberalism?

3.1 The supervision as balance between “political risk” and “moral hazard”

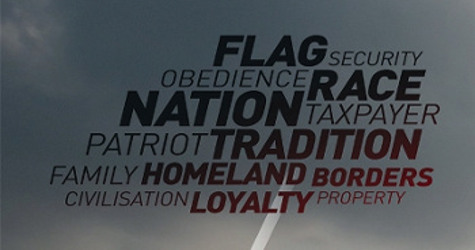

The political strategy of Syriza and the European Left is to overthrow neoliberalism, that is the economic and social regime that seeks to subordinate all social practices (from education and social security to the public finances) to the jurisdiction and regulatory role of markets. The European Left thus seeks to leave to governments the freedom to curtail the power of markets, thereby bringing to the fore the priority of social needs.

Neoliberalism constantly promotes the interests of capital against the interests of the workers, professionals, pensioners, young people and other vulnerable groups. The extreme version of neoliberalism, as expressed, for example, by [German Finance Minister Wolfgang] Schäuble, is not devoid of rational objectives and strategy. It attempts to resolve, and so far it does, two fundamental issues:

First, the social legitimacy of a model of labour without rights and social protection, with low and flexible wages and the absence of any meaningful bargaining power. Such a development is to be pursued in order to create favorable conditions for profitability and capital accumulation.

Second, the organization of the Eurozone (the coordination of fiscal policies, banking union, rescue packages, etc.) on the basis that member states should not succumb to “moral hazard” with the support of social (and other) expenditures that rely on public borrowing. Member States are faced with the dilemma: austerity-cuts-privatizations or the risk of default. By and large, these are commensurate choices. Even in the latter scenario, member states would accept a rescue package, the content of which is again austerity-cuts-privatizations.

This conservative perspective favors debt repayment by way of privatizations and primary surpluses, while it is not opposed to reforms such as those proposed by the Greek government (and possibly needed by Greek society) – such as more efficient organization of tax collections, modernization of the public administration,2 and the fight against corruption. They may even welcome a new political personnel, as they realize that the traditional political staff is in decline, having lost its social legitimacy. A political scene dominated by the traditional political personnel, which has been discredited in the eyes of the social majority, is clearly considered by the neoliberal establishment as a “political risk” since it can easily trigger uncontrolled social outbreaks.

At the same time, neoliberalism recognizes as “moral hazard” any policy that supports the interests of the working-class, expands the public space, supports the welfare state, and organizes the reproduction of society beyond and outside the scope of markets.

In other words, the strategic question for neoliberalism is to define the level of austerity that targets an “optimal” balance between “political risk” and “moral hazard.”

Generally speaking, these two risks, the “moral” and the “political” one, move in opposite directions due to their consequences in the current political conjuncture. When moral hazard increases, political risk declines and vice versa. Therefore, the tension (when they encounter each other) results in an appropriate balance between them. The “independent authorities,” being immunized against any democratic control, especially on issues related to the economy (the main example here is the “independence” of the ECB), create a mechanism for detecting the balance between these two “risks.” Nevertheless, this mechanism remains incomplete.

In the European Union the key role to austerity has now been undertaken by the “evaluation of the agreements.” If we closely inspect the agreement of the 20th of February, we will see that it is not entirely closed to demands that increase “moral hazard,” i.e. to promoting arrangements to the benefit of the welfare state and labour interests. However, the key point of the agreement is that “institutions” will assess, supervise and indicate which particular reforms do not create problems to public finances and do not jeopardize future economic growth and the stability and smooth functioning of the financial system.3 This assessment-surveillance sets a serious impediment to the implementation of the political program and the social transformations sought by Syriza in the first place.

While the question of how the government will be able to meet its financing needs remains open, statements by the ECB and the IMF are eloquent proofs of the continuous assessment stemming from the nature of the agreement: new pledged reforms are interpreted as substitutes for the commitments of the previous agreement. In particular the IMF does not accept any rollback from the completion of reforms mentioned in the previous “Program” with regard to market flexibility, privatizations, and social security reforms. It is worth noting that the non-quantification of objectives, the non-specified deficit, the absence of any explicit estimation of the fiscal gap, leaves widely open the interpretation of the actions with regard to the new agreement as equivalent to those contained in the previous one.4

3.2 How did we get there: On the tactics and strategy of the negotiation

The main question about the importance of the agreement of the 20th of February is what room it leaves to the government to implement its program. To answer this question we need first to analyze the “difficulties” that led the government to the compromise of the 20th of February.

The agreement was apparently determined by external factors – the given and known neoliberal context of the “institutions” – and internal factors, which played finally the most important role.

It was only of secondary importance the weak preparation of the government, along with the contradictory tactics of the Ministry of Finance:

- The absence of any reliable plan based on numbers and analysis. The superficial level is obvious in the technical Annex of the “non-paper” prepared by the Greek government for the Eurogroup meeting of February 16. More importantly, in the same Annex the crucial assumption is made that debt sustainability can be associated with long-term primary surpluses. This argument is an important strategic retreat.

- The release of some general principles of the proposal for debt reduction from London. This was a tactical mistake: Without any prior meeting with the ECB, a proposal is announced from a non Eurozone country that involves a swap of bonds held by the ECB. This proposal requires a change in the ECB rules and invokes, without any second thought, a negative response by the ECB. The negative response by the ECB is related not only to its policy and the existing delicate balance on the board, but also to the criticisms it received for rules violation after the recent decision to embark on quantitative easing. It is also obvious that the ECB does not need to be directly involved in such an agreement. The same result could be reached by alternative ways that are not incompatible with current political balances. The other part of the proposal concerning the loans of the EFSF linked to growth rates is too abstract and vague and definitely concerns the next round of the negotiations.

- It seemed that the government gave too much emphasis to communications management of the negotiation as opposed to other important aspects of it. This was a negative signal, both domestically and abroad. For instance, the incident with [Eurozone finance chief Jeroen] Dijsselbloem apparently stimulated “national sentiment,” but also took away considerable bargaining power: the Greek government spent the whole weekend calming down the markets before Monday’s critical opening. This fact widely signaled that the Greek government might not not have any stable negotiation strategy.

We can easily see that this weakly planned negotiation by the Greek side, despite the time spent by the protagonists, was practically a blind jump. Several mishandlings and shifts showed the partners that the Greek side is susceptible to manipulation.

Nevertheless, what finally determined the outcome of the negotiation was neither the tactical moves nor the “external” front, but the front within the Greek society. What determined the retreat of the Greek side was the strategic decision to represent on the political level the social strata which perceive as unthinkable any disruption of market stability – even though everyone was aware of the actual historical stake of the confrontation. The much discussed scenario of a bank-run should be defined and examined (despite the technical mechanisms available to prevent it) always within the context of the social relations of power. At the same time, it is a fatal mistake to adopt the argument that a Grexit necessarily follows from a supposed “collapse” of banks. This is a zero-probability scenario, which simply was the argument used by the previous conservative Papandreou-Papademos-Samaras governments to present memoranda as the only choice to the Greek society. This argument always remains a “weapon” of extreme neoliberals like Schäuble.5

3.3 The challenge: Nothing can change or another world is possible?

The above analysis leads us to the conclusion that we have an agreement which significantly restricts freedom of action on public finances but also in other areas. Therefore, the economic landscape, which sets the ground not only for the final assessment of the new program in June but also for the new round of negotiations, is slippery.

The fact that the Greek government chooses to present the apparent retreat and forced change of its program as a “victory” is a bad sign for the future. It shows that the government is more interested in communication than in substance. This attitude could gradually become the political ground for a real defeat, especially as long as the message transmitted and received by the society reinforces the belief: “Do not believe the politicians in what they say, their only intention is to stay in the government.”

“The question … is whether the government will insist on superficially presenting the result of the negotiation as a ‘victory,’ disregarding all the critical issues that emerged, or will it attempt to analyze in depth the conditions and the consequences of the retreat?”

Let us consider the following simple fact: The Minister of Finance publicly accepted that 70% of the existing Memorandum is good for the Greek society. Nevertheless, this government did not come to power supporting the 70% of the Memorandum – if Syriza had pledged so, it would probably not be included in the parliamentary map today, playing the key role. The attempt to redefine the mandate so as to encompass the 70% of the Memorandum is practically an attempt to change the social alliances which has supported so far the historical experiment of a left government. Obviously 70% in itself is just an arbitrary number (why not 68% or 72%?; is it based on pages, sub-chapters, or measures?). Its adoption invokes a new political symbolism and paves the way for new social alliances. The question, which remains open even for the government, is whether the government will insist on superficially presenting the result of the negotiation as a “victory,” disregarding all the critical issues that emerged, or will it attempt to analyze in depth the conditions and the consequences of the retreat as long as there is still time (very little, indeed, since the next round of negotiations will soon start)?

In fact the agreement of February 20th leaves the government and Syriza with only one way out of the impasse of neoliberal European corset: storming forward!

- Storming forward with truth as vehicle: to start from the assumption of a retreat in order to seek out ways to avoid any long term damage. The government should instead bring back on the agenda our programmatic commitments to redistribute income and power in favor of labour, to re-found the welfare state, democracy and participation in decision making.

- Storming forward with the vehicle of radical reform of the tax system (so that capital and the wealthy strata of the society finally bear their appropriate burden) and the fight against corruption of part of the Greek economic elites.

A new wave of radical domestic institutional changes is urgently needed in order to build on a new basis the social alliances with the subordinate classes. Metaphorically, what is missing and seems to disappear after the agreement of the 20th of February is any domestic “memorandum against the wealth” which will improve the living conditions of the working people. The goal that “capital should pay for the crisis” has never been more to the point.

In a society where the loss of 25% of GDP and the impoverishment of large part of the population is just the visible aspect of the rapid intensification of social inequalities, in a society where mass unemployment is the numerical complement of a severe deterioration in working conditions, in a society of multiple contradictions and high expectations, the popularity of the government will not be maintained at 80 per cent for a long time.

The policy of the government can only remain hegemonic if it supports the interests of the working majority in a struggle against neoliberal strategy. There is no room for “ethnarch” policy generally and loosely defending everything “Greek” or “European”: such an approach never has, and never will represent the perspective of the Left. •