“On the eve of the crisis, the bourgeois, with the self-sufficiency that springs from intoxicating prosperity, declares money to be a vain imagination. Commodities alone are money. But now the cry is everywhere: money alone is a commodity! As the hart pants after fresh water, so pants his soul after money, the only wealth.”

— Capital, Karl Marx.

When bankers, industrialists and their lobbyists talk about debt, they have state debt in mind. When politicians of powerful states talk about debt, they have the debt of less powerful states in mind. This is how the concentrated power of money and politics push countries like Ireland, Greece, Italy, and now Cyprus, toward the precipice of collapse, force changes of government and the sale of public assets to foreign creditors. That a debt problem exists in these countries is beyond doubt. Yet this is not just a problem of public, but also of private indebtedness. Indeed other countries, among them some of Italy’s and Greece’s creditors, are themselves even deeper in the red.

In 2009, the year of the global economic crisis, the debt-to-GDP ratios of Greece and Italy were 243 and 315 per cent, respectively. This comprises not only state debt but also the accumulated debts of industrial and financial corporations, as well as that of households. In other words, in order to free itself from debt, the entire net production of the Greek economy of the next two and a half years would need to flow into debt servicing. In Italy more than three years of economic production would be required exclusively for debt reduction. This is of course not possible. Even the austerity commissars in Berlin, Brussels and Paris realize that at a minimum necessary repairs to capital stocks and infrastructure must be undertaken, if the repayment of outstanding debts is not to come to a standstill.

In 2009, the year of the global economic crisis, the debt-to-GDP ratios of Greece and Italy were 243 and 315 per cent, respectively. This comprises not only state debt but also the accumulated debts of industrial and financial corporations, as well as that of households. In other words, in order to free itself from debt, the entire net production of the Greek economy of the next two and a half years would need to flow into debt servicing. In Italy more than three years of economic production would be required exclusively for debt reduction. This is of course not possible. Even the austerity commissars in Berlin, Brussels and Paris realize that at a minimum necessary repairs to capital stocks and infrastructure must be undertaken, if the repayment of outstanding debts is not to come to a standstill.

For the same reason, workers must at least receive some minimal payment for their labour, and, in any case, the profits of Greek and Italian capitalists are not being targeted for elimination. Accordingly, only a portion of current production can be put toward debt reduction. Even the sale of state assets contributes little to this end since the market for such assets at a time of debt crisis is glutted and the going prices are correspondingly low. That all the efforts at savings and austerity contribute little to reductions in debt is of course also due to the fact that such measures lead to reduced demand and with it to further contractions in the economy. Value creation, from which the largest portion of debt service must be diverted, is reduced.

The 2009 recession in Greece, due not the least to a considerable expansion in state expenditure, resulted in a relatively mild economic contraction of -3.2 per cent. In Germany economic growth contracted by -5.1 per cent. While most countries of the capitalist north once again recorded slightly positive economic growth in 2010, the austerity measures decreed by the EU and IMF drove the Greek economy further downwards: -3.5 per cent in 2010, -2.8 per cent in 2012, and for this year a contraction of -5.1 per cent is predicted. It is to be expected that these estimates will be revised further downwards.

Haircuts?

In view of such dim prospects, demands for a debt haircut are also being heard from creditor circles. Indeed it’s better to write-off a portion of outstanding debt while still being able to pocket repayment and interest on the rest, than to risk state bankruptcy and lose it all. The latest rescue package agreed upon by the EU for Greece, that is to say, for its creditors, even provides for debt relief of 50 per cent. Though concretely on this score, in contrast to the required budget cuts also negotiated, debt relief is still not in the cards. One reason why is that private creditors are still haggling over the assistance from state coffers granted by German Chancellor Angela Merkel and former French President Nicolas Sarkozy. So long as this keeps working for them, any planned debt relief transforms into a detour of debt servicing from Greece to the taxpayers of Germany and France – for the benefit of Deutsche Bank, Société Générale and Co.

With corresponding demands the bankers are creating the type of debtor liability within the Eurozone, which according to the Maastricht Treaty – the blueprint for European monetary union – was not at all to be permitted, and against which right-wing populist politicians zealously shriek. Finance capital, which Europe created in the 1980s in the name of free trade and democracy, is fostering a right-wing populist surge, which promises to halt the transfer of debt from one country to another in the name of national sovereignty.

Debt Redistribution

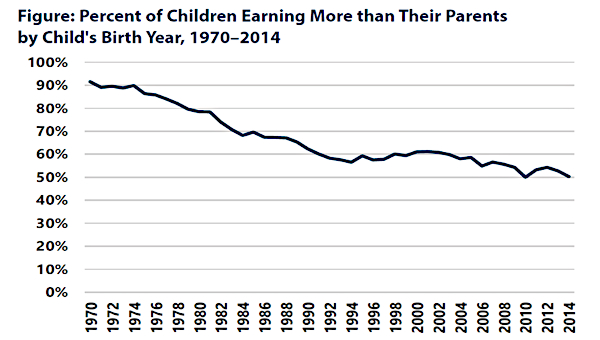

A hopeless undertaking, to say the least. Compared to the total debts accrued during the decades of neoliberal capitalism, the state debts of Greece and Italy look rather modest. A few figures help to illustrate the point. Japan’s debt-to-GDP ratio was 471 per cent in 2009, for the United Kingdom it was 466 per cent, of which 194 per cent comprised that of the financial sector, for France it was 323 per cent, for the United States 296 per cent, and for Germany 285 per cent. As noted above, Greece’s debt-to-GDP ratio stood at 243 per cent. If we take a glance at the growth of this mountain of debt over time, it becomes clear that this mountain cannot be paid off. In 1980, at the beginning of the neoliberal era, Japan’s total indebtedness was 244 per cent of GDP, ten years later it was 391 per cent; Japan’s economy has been stagnant since the start of the 1990s but its debt load increased to the already indicated level of 471 per cent. Instead of debt reduction, a redistribution of debt has taken place in the last decade. While private households, industrial and financial corporations managed to reduce their share of total debt, the portion of state debt has steadily increased.

To take another example: during the twenty years of Japanese stagnation China recorded economic growth rates of between 7 and 14 per cent. Yet even these world record growth rates sufficed only to prevent debt levels from increasing further. In 2000 they stood at 156 per cent of GDP, in 2009 they were at 159 per cent. Compared to other countries this is a very modest level. When we consider however that it was only in the 1980s that China set out on its long march toward capitalism, when the older capitalists in other countries had already laid the foundations for the accumulation of debt, this 159 per cent also appears in a different light.

However we may wish to twist or turn it the fact remains that in neoliberal capitalism, though the talk is of debt reduction, the actual practice has been the accumulation of debt. As long as stock markets continued their upward trajectory this fact could be concealed, or rather, sugar-coated. The more credit that one took on, the more stocks and financial securities one could buy. Rising stock markets were taken as proof of growing wealth. That the increase in the prices of stocks and financial securities was, in the first instance, the result of credit-financed demand for such investments; and secondly, at best an expression of the increasing creation of value (economic growth), disturbed no one in the heat of the stock market surge. Debt service? Not a problem. One could simply borrow against the rising value of stock market wealth and with this money meet every payment obligation – at least until things become too hot for some banks and they demanded higher interest for further credit. At this point the demand for credit for the purchase of stocks and financial securities collapsed, as well as the readiness of banks to extend such credit. All at once borrowers – be they private companies, households or the state – realized that their wealth and income no longer sufficed to fulfil their existing payment obligations. This realization struck at the beginning of the crisis as incomes sank, and attempts to meet debt service obligations with money raised from the sale of assets failed, as all at once the entire world tried to hawk its junk assets. Only the bold absorption of new loans by the paternal state, and the stated promise to service outstanding loans with tax money as required, prevented the total collapse of the global economy; or rather, confined the economic crisis to smaller countries like Greece.

Chill Out Room

The shaken power of money and politics has now reached the point where it knows that the extension of austerity à la grecque to the rest of the world would lead to global economic collapse, but it is nevertheless at a loss for ideas. A few audacious individuals dream of a new stock market rally. The transformation of state debt into tradable securities, as was discussed in the context of the euro rescue package under the term ‘leverage,’ points in this direction. Yet the mood is not conducive to inspiring any partying. Most investors are taking their money, which was rescued with state credit and guarantees, off the dance floor of the stock market and into the chill out room. A few stalwart Keynesians are calling for inflation to help reduce debt. But the investors in the chill out room would quickly awaken and demand monetary policies that defend the value of their money; yet nevertheless the total value of their assets already suffered greatly from the crisis. If they were to start screaming bloody murder at the slight loss in value a 5 per cent inflation rate would bring with it, their approval for further debt haircuts is certainly much less to be expected. They would much rather freeze their assets, that is to say, withdraw them from financial circuits than to have them pruned by finance ministries. Outside of these circuits, which after all open access to the surplus values produced annually, these assets are indeed worth nothing, but unsettled investors do not wish to think so far ahead.

The rest of society however might want to take a chance on this. If private financial circuits are unreliable at best, and at worst they collapse and real economic growth gets buried under a stack of newly worthless financial assets, then it is time to build an economy independent of private financial wealth. A first step in that direction would consist in the socialization of the financial sector so that access to financial resources for investments in socially necessary economic sectors no longer depend on the hopes for profit, and the fears of collapse of the holders of private wealth.

One problem with this is of course that sections of the working-class, particularly in the Anglo-Saxon countries where pension contributions flow entirely into financial markets, will be as unenthusiastic about a socialization of the financial sector as the richest ten thousand. Those who prohibit reductions in pensions in the name of socialism, but want to adhere to the idea of debt relief, must also discuss the equitable distribution of socially produced wealth. Socialism in one sector, indeed in one as important as the financial sector, will not work; except as the first step to a socialist transformation of production and distribution of socially necessary goods and services. Until the way there is found, the sword of Damocles of the next financial crisis hangs over Athens, Rome and the rest of the world. •

This article originally appeared in German. Translation by Sam Putinja.