Trump’s Tariffs Seen from Contradictory Angles

Donald Trump’s paleo-conservative, isolationist attack on global capitalist trade is already having formidable impacts. If tariff levels and targets announced on “Liberation Day,” April 2, are sustained, a full-blown economic catastrophe could result, perhaps reminiscent of 1930s-scale Make America Great Depression Again.

The worst danger: national elites in victim countries will be divided-and-conquered. Even South African President Cyril Ramaphosa – who 15 months ago had bravely challenged Washington’s ‘rule of law’ fakery by authorizing Pretoria’s challenge to Israel’s genocide at the International Court of Justice – apparently feels compelled to dream up utterly irrational deals for Trump, ideally sealed over a game of golf. Ramaphosa’s spokesperson told the NY Times last month that Ramaphosa may soon offer to US Big Oil firms generous offshore leases for methane gas exploration and extraction, in spite of enormous climate damage, Shell Oil’s courtroom setbacks, and widespread shoreline protests.

Transactional Trump

He’s not alone; more than 50 world leaders have ‘reached out’ to Washington in an obsequious manner, leading Trump to brag, “They are coming to the table. They want to talk but there’s no talk unless they pay us a lot of money on a yearly basis.”

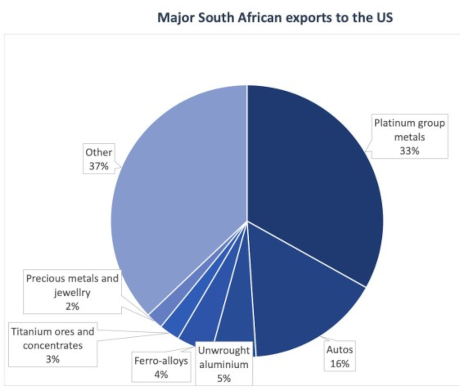

Even before the April 2 announcements, Trump imposed 25% universal tariffs on imports of steel and aluminum (effective March 12) and on cars (and auto parts) (March 26), radically lowering demand for what are traditionally the three main South African exports to the US under the tariff-free Africa Growth and Opportunity Act (AGOA).

According to Business Leadership South Africa’s Busisiwe Mavuso:

“Trump has made it clear that he wants concessions from each country if he is going to reduce or drop the tariffs. He emphasized that the tariffs put the US in a position of power in the series of bilateral negotiations that are to come. Given the transactional nature of US politics, we have to think hard on what is commercially available and viable for all parties. The US has exempted many of our key metal exports, including platinum, gold, manganese, copper, zinc and nickel, because these are considered critical to the US economy.”

Twisted Economic Logic

Setting aside the exemptions on raw materials, which makes the whole operation appear as a neo-colonial resource grab that simultaneously stifles poor countries’ manufacturing sectors, what would justify these highest tariffs on US imports in 130 years? Trump’s chief economic advisor (and investment banker) Stephen Miran, who holds a Harvard doctorate in economics, explained the underlying theory in a November 2024 report, celebrating the potential for a:

“generational change in the international trade and financial systems. The root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade… Tariffs provide revenue, and if offset by currency adjustments, present minimal inflationary or otherwise adverse side effects, consistent with the experience in 2018-2019. While currency offset can inhibit adjustments to trade flows, it suggests that tariffs are ultimately financed by the tariffed nation, whose real purchasing power and wealth decline…”

This is wishful thinking, most experts believe. Currency adjustments are hard to predict, but the dollar’s decline on April 2-3 (about 1%) is already being offset by its ‘safe haven’ status, providing a quick valuation bounce-back. The reason: international financial volatility always encourages global footloose capital’s short-term flight to dollar-denominated assets, no matter how irrational that may be in the medium term.

US consumer inflation will soar, it’s fair to predict. Already, those whose pensions have been invested in the world’s (admittedly way-overvalued) stock markets have suffered major losses, e.g., in South Africa and the US, more than 10% on April 3-4 alone. As nervous money floods out of vulnerable countries, the interest rates investors demand to fund 10-year bonds are soaring, in South Africa’s case by 2.2%, from 8.9% at the end of January to a painful 11.1% in early April (at a time of long-term average inflation of 5%).

And as a distributional matter, left economist Dean Baker of the Center for Economic Policy and Research points out,

“Import taxes are highly regressive, meaning that tariffs will cost ordinary working people a much higher share of their income than for high income people. This is because working people tend to spend most or all of their income, while high income people save a large portion of their income. Also, working people are more likely to spend their money on the goods subject to tariffs, whereas higher income people spend more money on services.”

Splintered Oppositional Narratives

Beyond Miran’s fantasies, five other narratives are generating anti-Trump ideologies that – without a coherent stitching together – risk splintering critics:

1. Mainstream Neoliberalism

The corporate and state elites who in most countries typically back neoliberal trade deregulation, are now in shock as their own personal share portfolios crash. The Economist summed up, “Trump’s mindless tariffs will cause economic havoc.”

In alliance with market-friendly ‘bastard Keynesians‘ like Paul Krugman, the neoliberals are expressing utter disgust at Trump because precepts of free trade are being violated in the most primitive manner. The powers and legitimacy of the Geneva-based World Trade Organization (WTO) to police tariffs and trade are being trampled by Trump – leaving the body’s defense to some of the world’s most aggrieved neoliberal forces, in Beijing.

Because Trump is launching “economic nuclear war on every country,” even Bill Ackman – a strong supporter of the president and a billionaire fund manager – conceded, “We will severely damage our reputation with the rest of the world that will take years and potentially decades to rehabilitate.” Quite right.

(This growing establishment hatred of Washington is extremely useful if progressives want to forge even brief alliances, e.g., to ‘Vote Trump off the G20 Island,’ a true Survivor approach which would be indisputably popular in the bloc’s capital cities, except for Buenos Aires and maybe Rome, and set the stage for the 2026 G20 not to be held in the US but rather be held maybe jointly by Mexico and Canada instead, as should the 2026 soccer World Cup and 2028 Olympics.)

2. Radical Keynesianism Combined with Dependency Theory

Both these approaches are highly critical of international trade, but not for the reasons Trump is. The last century’s leading British economist, John Maynard Keynes, at one point – in his 1933 Yale Review article – firmly advocated tariffs and other forms of protectionism, so as to support domestic industries and thus achieve much more balanced internal development: “Let goods be homespun whenever it is reasonably and conveniently possible, and, above all, let finance be primarily national” (using tightened exchange controls).

As for global economic regulation, Keynes’ last (unsuccessful) major project was to propose penalties for economies that ran trade surpluses: the ‘Bancor’ International Currency Union proposal at Bretton Woods in 1944. His objective was to use trade and currency controls to achieve self-correcting international economic stability, in the wake of a Great Depression and war caused, in part, by extreme commercial and financial volatility.

From the Global South, a different critique of international trade and an even stronger advocacy of tariffs together aim to promote poor countries’ ‘delinking’ from dangerous international circuits of capital, and to protect infant manufacturing industries. Africa’s main contributor to this dependencia school was Egyptian political economist Samir Amin. He understood the differential labour values and ‘unequal ecological exchange’ (resource looting) that are embodied in South-to-North trade as benefiting transnational corporations as well as causing Africa’s underdevelopment.

Amin also criticized trade between impoverished countries and South Africa, which – even after apartheid was defeated in 1994 – he viewed (until his death in 2018) as a malevolent capitalist power on the continent: “Nothing has changed. South Africa’s sub-imperialist role has been reinforced, still dominated as it is by the Anglo-American mining monopolies.”

Indeed AngloGold Ashanti and many similar Johannesburg firms have benefited from the South African National Defence Force’s ersatz quarter-century-long military presence in the eastern Congo. (Last November, these troops were recognized by the UN not for heroism but rather as the peace-keeping force’s worst offenders for sexual exploitation, abuse, and paternity lawsuits.) Pretoria’s troops were recently forced out of the DRC by invading Rwandan forces (and have also lost battles in Northern Mozambique and the Central African Republic since 2013), but the critique of sub-imperial interests remains intact.

3. Climate Consciousness

Opponents of ecocide – surely, all of us who aren’t climate denialists – regret the massive greenhouse gas emissions caused by excessive, often pointless, international trade: 7%+ of all CO2 emanates from shipping and air transport, according to the International Transport Forum.

And while the International Maritime Organization has hosted a decade of talks about its members’ dirty bunker-fuel emissions – which for the sake of ‘polluter pays’ policy, should be costed at $1056/tonne (even the World Economic Forum admits) – these have been futile. The modest $150/tonne tax on shipping emissions demanded by increasingly-desperate Pacific and Caribbean small island states is this week being rejected by rich Western countries and also by an alliance centered on four BRICS members: Brazil, China, Indonesia, and South Africa.

Moreover, genuine ‘Just Transition’ plans are widely recognized as necessary to wean workers and affected communities off CO2-intensive export production, e.g., the West’s (highly flawed yet necessary) Just Energy Transition Partnerships and Carbon Border Adjustment Mechanisms, but these and other climate obligations Trump has simply walked away from. The Pan African Climate Justice Alliance had already called on the world to impose trade sanctions on the US as a result, a call that now has much more purchase.

Indeed, to that end, many would support a ‘degrowth’ approach that would seek to stabilize and indeed diminish much of the high-carbon industrial output exported by many economies into the US. Those include steel, aluminum, and automobiles – now 25% tariff victims – due to the vast waste involved in rich-country consumption. And South Africa is one of the worst, with the ‘Energy Intensive Users Group‘ of 27 multinational corporate exporters guzzling more than 40% of the country’s scarce electricity but hiring only 4% of workers in the formal sector.

4. African Nationalism

African patriots logically perceive Trump’s hatred of the continent (full of ‘S-hole countries‘) as, in part, behind attacks on its trade-surplus countries. Tiny Lesotho was hit by Trump with the highest new tariff on April 2, mainly because of its $240-million trade surplus with the US – mostly Levi’s and Wrangler jeans and diamond exports – whereas imports from the US are indirect, as they first are cleared by customs in South Africa. Trump also imposed 40%+ tariffs on Madagascar and Mauritius because of their trade surpluses.

The context for the continent’s (and world’s) rising anti-Americanism is Trump and Pretoria-born Elon Musk’s halt to financial support for African healthcare (especially AIDS-related – which could lead to 6.3 million unnecessary deaths by 2029 – and maternal), climate (mitigating emissions, strengthening resilience, and covering ‘loss & damage’ relief), renewable energy, and vitally-needed emergency humanitarian food supplies. Some critics here suggest these cuts reflect Trump’s white supremacy, called out by Pretoria’s fired ambassador to Washington, amplified by the fiscal chainsaw wielded by Musk, against whom protest is rapidly rising.

All this means Trump is discarding Washington’s soft power, which notwithstanding the vast destruction in the meantime, could ultimately be very useful for anti-imperialists (in contrast to last November’s internecine squabbling over a controversial National Endowment for Democracy conference held in Johannesburg).

5. Marxist Political Economy

Readers of Das Kapital understand that capitalist crises and the ‘devaluation’ of ‘overaccumulated capital’ (e.g., deindustrialization once businesses addicted to exports to the US shut down) reflect the mode of production’s intrinsic contradictions. In reaction, capitalism often degenerates into inter-imperial and imperial/sub-imperial rivalries, generalized trade wars (often based on tit-for-tat tariffs), and stock market turbulence. The conclusion drawn is that eco-socialist planning of the global economy in the public and environmental interest is the only route out. (Disclosure: that’s my main bias, but I’ll travel a long way with advocates of positions 2-4 as well.)

For those outside mainstream neoliberal logic, can the latter four framings be fused together for not only a coherent analysis but also a clear political response? The danger of not having a strategy linking Keynesians, environmentalists, nationalists, and anti-capitalists is four-fold:

1/ Under a beggar-thy-neighbour ‘reciprocal tariff’ trade war, we all face a new version of a 1930 Smoot-Hawley Act and then a 1930s-style Great Depression (which by the way, was an extremely constructive period for South African capitalism, which grew 8% per year as a result of import-substitution industrialization);

2/ Recognizing the durable power of US economic imperialism, individual governments will go cap-in-hand to Trump to beg for a bit of relief, offering absurd concessions in the process such as Ramaphosa’s invitation to drill baby drill;

3/ Surplus countries will redirect already-produced (or in-production) manufactured goods and commodities away from the now shuttered US market, flooding all other potential buyers, thus further deindustrializing South Africa – whose main anti-dumping measures applied by the International Trade Administration Commission are against various ultra-cheap imports from China; and

4/ Naturally, the mainstream logic of ‘searching for new markets’ – now that the US is closing its trade doors – won’t get at the root cause of the problem. That cause is sometimes termed ‘uneven and combined development,’ in which over the past 40 years, the global trading system became exceptionally volatile and generative of ever worsening inequalities (especially unequal ecological exchange), i.e., depleting, polluting, and emitting against the interests of poor economies and natural environments.

A Long Pattern of Economic Abuse

This extreme abuse of commercial power being exercised with a vengeance by Trump, no matter how self-destructive financial markets have judged his Liberation Day, is only the latest reflection of Western economic chaos. The world has suffered extreme uneven development after the recovery from the early-1980s global recession, as ‘Washington Consensus’ liberalization kicked in everywhere due to debt crises and IMF/World Bank squeezing, and especially via global commerce following the capture by nearly all governments’ policies by the World Trade Organization after 1994.

The limits of trade globalization became clear in 2008 – the peak year of world trade/GDP until 2022 – as did the limits of financialised economies in recent months, in the form of overvalued ‘Buffett Indicators‘ of stock market capitalization, unprecedented debt loads, currency volatility, and recognition of the $’s malevolence after two Fed-led ‘Quantitative Easings’ and interest-rate manipulations, etc.

The damage done to South Africa’s industrial economy was amongst the most severe, as the country lost most labour-intensive industries – clothing, textiles, footwear, appliances, electronics, etc. – which had driven the manufacturing/GDP ratio up to 24%, before the steady decline to less than 13% by the 2010s. So, the challenge is reversing that imbalance – i.e., fighting against uneven and combined development – with progressive policies, not merely relying upon the program of dissatisfied export-oriented capitalists.

Here in South Africa, the de facto retraction of AGOA zero-tariff access for locally-made luxury cars, aluminum, steel, petrochems, vineyard products, plantation nuts, and citrus reminds us that the main losers are capital-intensive extractive industries, carbon-intensive smelters, and super-exploitative plantations, all with mainly white ownership. From Washington, the imperialist Hudson Institute last month even recommended not cutting the tariff-free AGOA trade program, since “[t]he communities that benefit most from the AGOA largely support South Africa’s pro-American political parties.”

In contrast to Trump’s paleo-con isolationism and to neoliberal trade promotion, the four historically progressive ideologies of Keynesianism, environmental justice, African nationalism. and eco-socialism represent countervailing views. Programmatically, to move in their direction can only be assessed once the dust settles a bit and the distinction between those national leaders who are either fighting or who are obsequious, becomes clear.

So far, South Africa’s leaders, under threat of losing their Government of National Unity related to a budget dispute caused by excessive neoliberalism, are decidedly in the latter category.

In contrast, the potential for China to guide the international fightback is not merely witnessed in its WTO complaint against Trump, quickly filed on April 4. The same day, Beijing’s central bank experimented with a much more rapid, blockchain-secured digital alternative to the dollar-denominated cross-border bank settlement and clearance system, with 10 regional and another six West Asian economies now reportedly able to avoid the Brussels-based SWIFT network, even if merely for cost and speed savings.

There have been far too many false alarms and hyped hopes about de-dollarization. If it began in earnest thanks to Trump’s misstep, we’d much more likely see the venal, volatile Bitcoin take over, as Blackrock CEO Larry Fink warns, than the renminbi.

All this suggests a far more durable approach is needed, to get out from under Trump’s thumb and then the dollar’s domination, and then escape the tyranny of capital. A series of non-reformist reforms were offered to Democracy Now! by Indian radical economist Jayati Ghosh, worth mulling over for countries like South Africa, and all others, as a last word:

“There’s a silver lining in this for developing countries, which is that for too long, for maybe three decades, we’ve been told that the only way we can develop is through export-led growth. And that’s really — it’s been unfortunate, because we have never seen giving our own workers a fair deal as a good option. We’ve always seen wages as a cost, not as a source of our own domestic demand and market. It’s now time to actually change, to shift gears, to think about different trading arrangements, more regional arrangements, looking at other developing countries as markets, looking at our own population as markets, and thinking about the things we can do to create sustainable production, that’s not ecologically damaging, that actually provides living wages and decent working conditions within our own countries.” •

This article first published on the CounterPunch website.