Economic Recovery Fund as Cover for Neoliberal Reforms

One usually has the impression that European mills grind slowly, but this is not always the case. For instance, the Commission’s proposal to subsidise Europe’s munitions industry with European money could be approved in a matter of weeks. Very different is the case with the European Recovery Fund. In May 2020, the European Commission launched the proposal for a major recovery plan for the European economy, ravaged by the corona crisis. The recovery plan (“Recovery and Resilience Facility”) was embedded in an even more ambitious set of modernisations and digitalisations of the economy, called Next Generation EU.

In December 2020, the European Commission and the Council of Ministers reached an agreement in principle to borrow €750-billion, a historic first. About half of it would go to member states in the form of grants, the other half as long-term loans.

Recovery in No Hurry

The agreement came only after marathon sessions and acrimonious discussions among member states. In particular, Austria, the Netherlands, Denmark, and Sweden (the ‘frugal four’) saw granting subsidies to southern and eastern European member states as an unacceptable concession to their ‘profligacy’ and the beginnings of a ‘debt union’. A compromise could only be reached by making disbursements conditional on economic ‘reforms’, the code word for further tightening of the neoliberal straitjacket, as everyone knows. In doing so, not only Dutch Prime Minister Mark Rutte and his associates got their way but also the European Commission itself, which now had a stick in its hand to impose its neoliberal model.

The package of measures, known as “European Semester,” introduced in the 2010 crisis, did give the Commission a firm grip on national economies, but without sanctions, docility was still only relative. Things change when a major money lock only opens on condition that reform plans are written down in black and white and followed up on their implementation.

In February 2021, the European Parliament gave its approval, and the recovery plan could finally get underway. But ‘hurry slowly’ seemed to be the motto. To call on the Recovery Fund, member states first had to submit detailed plans of how the money would be spent, and also of the “structural reforms” they were willing to implement. The Commission then took two months to examine these plans. Finally, in July 2021, the first approvals were granted to 12 member states, and the disbursement of the first tranches of the recovery money could begin.

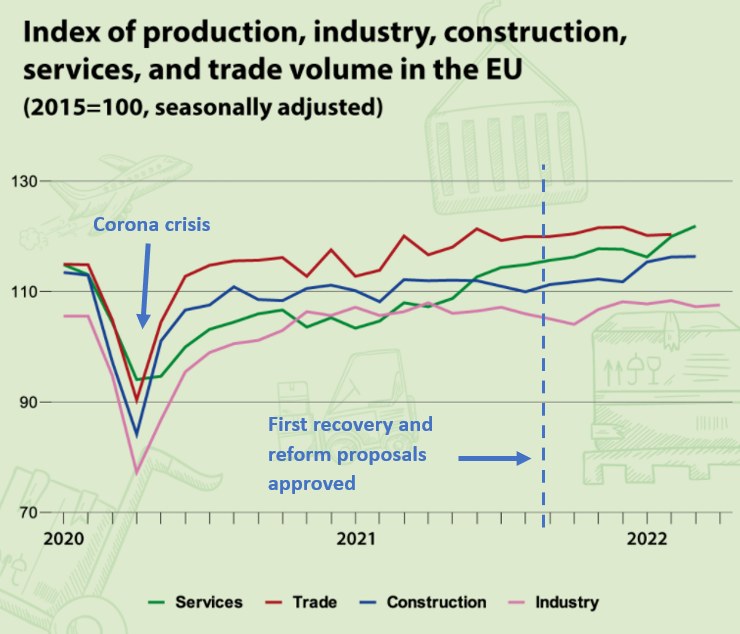

As one can see from the chart above, the macroeconomic consequences – the social ones are another matter – of the corona lockdowns were actually largely behind us by the time the first payouts could begin. But one should not conclude from this that the economy recovered by itself. In fact, it was not the EU Recovery Fund, but rather public money from the member states themselves that was largely allocated to their own industries, and partly, to social relief (temporary unemployment, etc.). The amounts are rather impressive. Between the onset of the crisis and the end of 2021, €940-billion worth of state aid was granted to industry by member states: €226-billion by Germany, €223-billion by France, €205-billion by Italy, €123-billion by Spain, etc.

The EU, on the other hand, has yet to spend most of its Recovery Fund in the coming years. It is estimated that €75-billion was disbursed in 2021, €139-billion in 2022, €188-billion is planned for 2023, similarly in 2024, €113-billion in 2025, and the remaining €49-billion in 2026.

Recovery as an Alibi?

In terms of both timing and financial firepower, the ‘recovery fund’ can hardly have contributed anything to the recovery. This is so glaring that Eurocommissioner Gentiloni, responsible for the economy, said the money is not meant as an emergency measure in response to the corona crisis but rather to ensure “qualitative growth, in relation to the green and digital transition and reforms.”

Surely this is a very curious state of affairs! Despite much opposition, concluding a monster loan to combat the economic and social consequences of the corona crisis, delaying its implementation so that the member states themselves have already done the job before the first euro is granted, and then claiming that the intention was different after all… It looks too much like a conspiracy theory to see a deliberate manoeuvre by the Commission in this, yet the result effectively is that the Commission now has a tool in its hands to get governments to implement the reforms it wants. Moreover, the final destination of the ‘recovery fund’ is conveniently hidden from view by the one-sided highlighting of the threat to the ‘rule of law’ in Hungary and Poland as an obstacle to the disbursement of the recovery money to those countries.

Intentional or not, the European Recovery Plan, announced with much fanfare, turns out to be a €750-billion carrot with which the Commission can reinforce its reform drive.

Follow the Money: Harder than Thought

Financial investigative journalists at Follow the Money recently published a report on the spending of the recovery fund’s billions and came up with some curious findings.

To this day, only €153 out of about €700-billion has flowed to member states. Part of the explanation is that disbursement is made only after proof that the agreed reform plans have been implemented. Disputes between a member state and the Commission over such plans can drag on for a long time, although the theoretical limit is two months. Nevertheless, a dispute with Romania took six months…

Furthermore, it is not so easy to define multi-billion projects in a limited time period. Take Italy, which is entitled to €69-billion in grants and €122-billion as loans. To meaningfully spend almost €200-billion requires serious preliminary studies. However, all projects must be formulated by the end of this year in order to receive the money over the next three years. Some politicians have therefore called for more time, but the Commission seems to have no ears for it. Does Commission President Ursula von der Leyen want to come out at the end of her legislature (2024) with a monster score of “aid to member states”?

It also appears that quite a few member states are not in a hurry to submit payment requests. Nine member states, including Belgium, Germany, and the Netherlands, have not yet submitted any requests,1 11 others made one request. The reason for this is unclear. Have the promised reforms not yet been implemented? Do they shy away from unpopular measures in an election period? Either way, less and less money is being made available from the Recovery Fund each semester. While in the second half of 2021, it was still more than €60-billion, in the first half of 2023, it was only €15 to €16-billion.

Who are the ultimate beneficiaries of the recovery money? Little is known about that, as it is only since this year that member states have to report on it. In any case, who will benefit for sure are consultancy firms like Deloitte, McKinsey, PwC, etc. They are hired by ministries to formulate their projects and reform plans. In another report, Follow the Money mentions an amount of €13-million that the French government spent on consultancy for its recovery plan in 2021, Romania budgeted €240-million in consultancy costs for the next few years, also for that purpose. The Commission itself plans to spend €374-million on consultancy over two years, largely related to the Recovery Fund.

To Laugh or to Weep?

Indeed, it is almost laughable that the European Union (EU) is faring so badly when it comes to its overriding aim of keeping the capitalist economy running smoothly and the market economy as undisturbed as possible by inconvenient state intervention. It succeeded in taking on a common debt for the first time, through a huge loan whose ultimate responsibility lies with the member states. This was to serve to absorb an ‘external shock’ caused by an unpredictable corona crisis. Fine. However, the whole operation only comes into play once the shock has already been absorbed, and that is through a drastic increase in the sovereign debts, so abhorred by the Commission. Moreover, the strongest member states can afford the greatest support, leading to a distortion of ‘free competition’, the ‘level playing field’. The whole story shows that restoring the economy was not the real purpose of the operation, but rather it was to put pressure on governments to implement neoliberal reforms.

If one then takes stock of a hypothetical contribution to restoring the economy, and an established contribution to damaging it through a rash policy of sanctions against Russia, this EU and this Commission have failed miserably. Unfortunately, it is citizens and sound climate politics that are the victims of this failure. •

Endnotes

- The Follow the Money article appeared on 7 July 2023; Belgium submitted its first request on 20 July. It concerns a modest €264-million loan.