Jobs, Inequality and Post-Democracy in Canada

In Fall 2022, it is well worth celebrating some of the recent victories and new efforts at mobilizing by workers in Canada and around the world.

In Canada, the Teamsters are organizing new union drives for drivers and Amazon workers, and workers across the public and private sector alike are setting new highs for days on strike. In the United States too, Starbucks workers are chalking up one victory after another in their nation-wide organizing drive, and young socialists are ’salting’ workplaces by taking jobs at Amazon and elsewhere in their efforts to unionize new new workplaces. These green shoots of new labour movement mobilizing are important to see – and critical to rebuilding the kind of progressive politics we need to transform politics in Canada as well as south of the border.

But if unions, the left, and the environmental movement are to start laying the groundwork for a new and more democratic political future, they will need to be smarter and more strategic. And crucial to renewal going forward is knowing the enemies they are up – big finance and big corporations – and how they are gaming the system to turn their wealth into political power, and power back into wealth.

What Jobs with Inequality shows is that there has been nothing inevitable about the massive power shifts in recent decades that have favoured the rich and drowned out the voices of workers in both the workplace and on the political stage. Rather, these were the result of political choices and policies that aided the rich and boosted finance while sidelining unions and worsening labour laws and employment regulations.

The results? The financialization of the economy that concentrated wealth and power in the hands of the wealthy few, that undermined wages and worker’s living standards, and that now poses an ever-growing threat to democracy itself.

But as Jobs with Inequality concludes, it doesn’t have to be this way. Working people can turn the tide by making new political efforts that restore their voice and developing new efforts to rebuild workers’ power based on a sustainable, low-carbon economy.

Below is an edited excerpt from the introductory chapter. Jobs with Inequality: Financialization, Post-Democracy, and Labour Market Deregulation in Canada (University of Toronto Press, 2022).

The conventional understanding of income inequality in Canada suggests that the gap between the rich and the poor is neither especially extreme nor growing. Indeed, research and commentary often claim that Canada is somewhere in the middle of the pack: inequality is not as high as in the United States, but nor is Canada as egalitarian as Scandinavian countries such as Sweden and Denmark. The typical view of Canada is that of a rich country, one that is relatively generous and fair.

For example, Fritzell (1993), reflecting on income inequality trends in the 1980s, argued that inequality rates in Canada and Germany remained stable while the United States and the United Kingdom saw greater income inequality. In more recent academic literature, scholars such as Card, Lemieux, and Riddell (2003, 27) argued that “unlike the US and UK … overall inequality has remained very stable in Canada over time.” Even in public commentary and research, we commonly read that, despite increases in inequality, Canada has not witnessed increases as dramatic as in the United States (Heisz 2015; Yakabuski 2013).

The evidence contrasts with this perception.

Over the past few decades, income inequality has skyrocketed in Canada while the incomes of average households have deteriorated and the job quality for the majority of workers has plummeted. Indeed, in contrast to the view of Canada’s economy as relatively equitable, Canada has instead closely followed trends in the United States, with inequality increasing in lockstep with the boom of the rich and super rich.

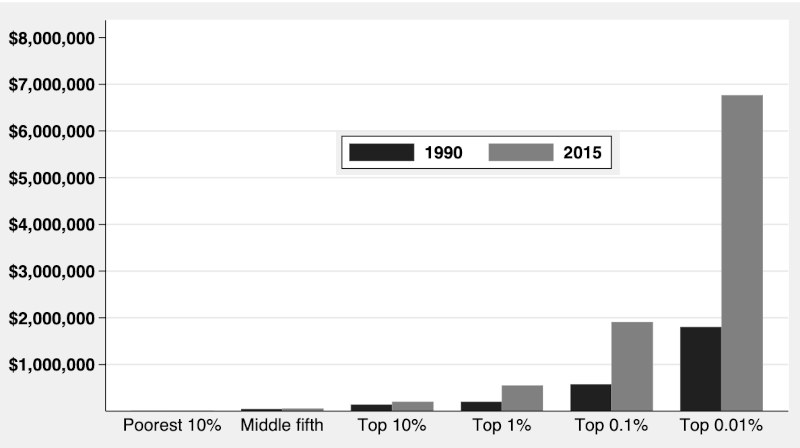

A few observations are particularly telling. Over the 2001 to 2015 period, the number of Canadians whose net worth was at least $50-million (US) nearly quadrupled, from 803 to 2,840. The number of billionaires also grew. At the start of the millennium, there were thirteen billionaires in Canada; as of 2015, there were thirty (Credit Suisse 2015). Similarly, considering just annual incomes, those in the top income brackets saw their pay and capital gains increase exponentially. Between 1990 and 2015, the top 1 percent of income earners across Canada tripled their annual incomes, with average family incomes for this group reaching $729,000 by 2008, then declining slightly after the crisis, before rising again to $842,910 in 2015 (Figure 1).

Figure 1 Average household and top income earner after-tax income in Canada, 1990-2015

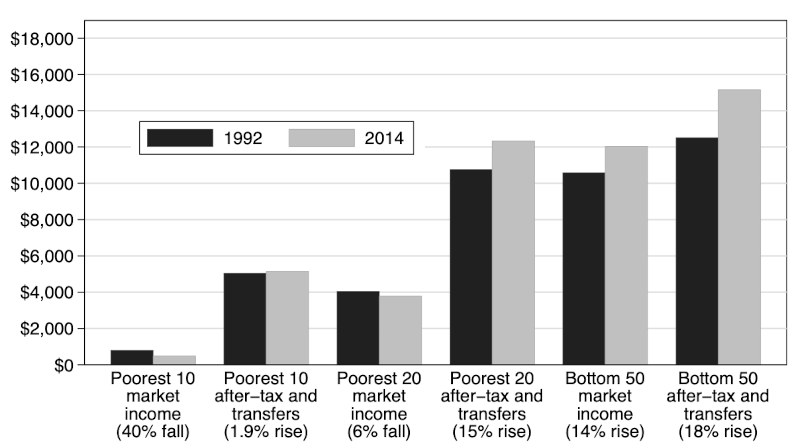

However, if these gains enjoyed by the rich (and the approximately 158,000 individuals in the top 1 percent) are striking enough, the contrasts with the experience of average Canadian households are even more disconcerting. The majority of workers and their families saw their incomes stagnate and had to cope with a rising tide of unemployment, the loss of good jobs, and the expansion of low-paying precarious work arrangements. Indeed, as of 2015, Canada’s labour market had become so polarized that out of a total workforce of more than 17 million people, 8.6 million Canadians (or 49 percent of the workforce) were in jobs that paid them on average less than $17,833 per year. And even though tax and a range of transfers helped shore up the negligible wage incomes of families, for millions of households who were forced to combine precarious jobs with low wages and job insecurity, total average real annual incomes still only amounted to less than $16,000 in 2014 (Figure 2).

Figure 2. Average household real market income and after-tax and transfer income for bottom 50% of Canadian households, 1992–2014 ($)

Strikingly, this widening of the gap between the rich and the poor occurred across the country. In Ontario, for example, deindustrialization led to a significant decline in well-paid and unionized manufacturing jobs. The decline was so steep that by 2015, manufacturing’s share of total employment was 11 percent – a level not seen since the 1930s. Yet this disappearance of good, well-paying jobs occurred at the same time that the province saw billions of dollars in new foreign direct investment and soaring stock and housing markets.

In British Columbia, another province that did extraordinarily well over the course of the first two decades of 2000 through expanding resource exports and the massive influx of new dollars into housing and infrastructure construction, by 2015 some 40 percent of jobs in the province offered low pay and little job security, and 30 percent of workers were in jobs that could be categorized as “working poverty.” In Newfoundland and Labrador, offshore oil brought billions of dollars to the province, and the provincial government implemented measures to lower poverty rates. But more than 42 percent of the workforce was working in low-wage employment, and another 15 percent was unemployed in 2015.

Thus, in stark contrast to the standard view of Canada as a relatively equitable society that has shared its prosperity, in reality the wealthiest in Canada have enjoyed almost exclusive benefit from recent economic growth, while the majority of workers have seen their economic fortunes worsen as they struggle with low-paying and increasingly insecure jobs.

What accounts for this staggering concentration of wealth and income? Why have incomes stagnated and job quality worsened for most Canadians? Is there a connection between the rise of this “super rich” and a growing low-wage labour force? If so, who or what is the cause? These questions are at the heart of this book.

Financialization, Labour Market Deregulation, and Post-Democracy

Over the past decade and more, researchers and policy advocates have asked many questions about the rise of inequality and its causes. Some emphasize technology and how it harms the less educated but allows the well trained to take advantage (Boudarbat, Lemieux, and Riddell 2010; OECD 2015a). Others stress the impacts of a global world economy and its effects on trade and manufacturing employment (Breau 2007; Breau and Rigby 2010). Still others point out how labour markets are segmented by gender and race, and women and racialized minorities are systematically underpaid and routinely hired into poorly paid jobs (Galabuzi 2006; Lightman and Gingrich 2013). But my argument suggests we turn in another direction.

I argue that while all these provide partial – and often very plausible – explanations for the growing gap between the rich and the majority of citizens, they all fall short. And the main reason for their weakness is their neglect of politics – and especially the changes to political power and policy that have lain behind recent economic and labour market outcomes.

Rather, I argue that inequality is the consequence of public policy decisions and how powerful corporations and financial interests have influenced the visible hand of government to tailor the rules of finance, corporate operation, and the labour market – in their favour. Indeed, over the past few decades, what is so notable is how an array of laws, regulations, and institutions have been rewritten to prioritize corporate power and short-term financial gains at the expense of long-term growth and good jobs for Canadians. And looked at over the long run, it is how governments have reshaped the rules governing financial and labour markets that best explains the rise of inequality in Canada – as much for the top 1 percent of earners as for the millions now mired in low-wage work.

Post-Democracy

The first step to understanding the causes of inequality is a process I call “post-democracy”: how recent changes to power dynamics have reshaped public policy to favour corporations and the super rich. Certainly, there is some evidence that – at least in formal terms – democracy continues to function, and citizens have resisted recent increases in inequality. Some citizen groups still question the consequences of an economic system run by and for finance. Occasionally, too, issues of labour law, regulations, and employment policy become matters of public debate, as, for example, in the recent efforts to “Fight for $15” where low-wage workers have launched protests in support of a living wage across the United States and Canada.

But my account suggests we need a more critical eye for how our democracy actually works today. Indeed, I argue if we are to begin explaining why inequality continues to rise, despite citizens’ concerns, we have to look far more carefully at how and why narrow economic interests are routinely intervening and remoulding the outcomes of financial markets, corporate growth, and labour markets (Crouch 2006; Hacker and Pierson 2010a). Also required is close attention to why political parties and public officials are increasingly focused and dependent on business and wealth, and increasingly aware that their political success depends on catering to the better off. Delving further into these two processes takes us part of the way to understanding why public officials have continued to tie themselves more closely to business and finance, and why professional elites have crafted policies to appeal to these elite interests.

At the same time, it is also clear that the majority of working Canadians have become less – not more – organized. Workers and citizens who were once better represented by unions and civic associations have often seen them atrophy. More are cynical of the system. Few have the time to engage in politics. Even fewer have access to the organizations and associations that once brought citizens together and helped them engage in politics. These political variables are the first keys to helping us understand how and why our political system increasingly caters only to those with money and resources.

And nowhere can the outcomes of these political dynamics be more clearly seen than in how governments have changed public policies in favour of business in recent decades. Because over time and across political administrations, organized business and financial interests have overhauled the rules and institutional frameworks governing financial markets, corporate operation, so that Canada’s economic model has become based largely on finance-led growth, with an expanding financial sector and its profits leading the way, and more and more businesses using finance to extract wealth and value from the wider economy as well as workers.

Financialization

Such economic consequences are best characterized as “financialization” – which I argue is a second critical factor explaining Canada’s rising inequality. In the post-war period, and the aftermath of war and depression, the story of finance was largely one of commercial banks turning people’s savings into investments, and governments making significant efforts to ensure that finance was carefully regulated so that financial investments and trading smoothed out the economy’s up and down cycles. In this era, banks lent, people and business borrowed, and credit helped realize long-term investments. Consequently, finance flowed largely in the service of the economy and society.

Today, none of this holds true. To the contrary, in recent decades finance has exploded into an almost limitless system of private credit, and, with wider efforts to loosen regulation by the United States and other countries, investment is more typically channelled into such things as short-term money markets and inflated bubbles in property, equity, and financial products, as opposed to long-term growth (Durand 2017). Moreover, companies are far less tied to long-term investments and capital assets than to the interests of investors and shareholders and their demands for rising profit margins and financial returns, often through the heavy use of debt and debt financing. Consequently, more and more of Canada’s economy is beholden to finance, and much like in the United States, wealth creation is driven by financial markets and incentives, with the “takers” using the market system to enrich themselves at the expense of the “makers” – that is the companies and workers that do create real economic growth (Forhoohar 2016).

For workers and the larger labour market, the consequences of such a shift have been profound. No longer do bigger and more profitable firms ensure good jobs or the wider redistribution of income – but the opposite. Rather, in Canada – as elsewhere – finance-led growth functions more on the basis of “trickle-up” economics, with the corporate pursuit of maximum profit and the redistribution of earnings away from workers and toward executives and investors. Increasingly, corporations focus their growth strategies on maximizing “shareholder value,” and managers seek to implement a whole range of strategies to reduce labour costs, such as downsizing, layoffs, and concessions from their unionized workforces. Or private equity partnerships use debt to take over companies and subsequently strip the firm of assets while terminating higher-paid workers (Batt and Appelbaum 2013; Lin and Neely 2020; Milberg and Winkler 2013).

Making matters worse is how many financialized corporations routinely resort to squeezing their widening global network of suppliers and contractors to produce more with less, making them less able to pay workers and more likely to use non-standard employment contracts to keep labour costs at a minimum (Appelbaum 2017; Weil 2014). Continually sidelined in their efforts, workers and unions alike have been left with eroding bargaining powers, far fewer protections, and widening economic insecurity.

It is these multi-sided developments to finance, firms, and the economy – as well as to how government has directly aided and abetted such financialization – I argue that can help us explain why average Canadians have seen no benefit from the growing power, size, and efficiencies of firms. Indeed, it is because of financialization that the astronomical salaries of the financial sector and corporate CEOs have gone hand-in-hand with low-wage work, precarious employment, and deindustrialization.

Labour Market Deregulation

But a third and final overarching factor to explain why more and more Canadians are struggling to make ends meet is how politics and power dynamics have led to the overhaul of labour laws, regulations, and policies that once supported good jobs and a more equal society – a process called labour market deregulation.

As we will see, financialization and globalization are certainly key parts of any economic explanation for why jobs have worsened and incomes have stagnated. But the other side of the equation is what further policy adjustments public officials have made to accommodate the new financially driven demands of corporations, suppliers, and service industries to lower labour costs and create more “flexible” labour markets. For as financialization has increasingly made big firms less willing and small firms often less able to pay, so governments have sought to increase employer power and enhance managerial discretion at work by changing labour laws and employment policies – or by failing to enforce them – in order to expose workers to the relentless forces of competitive global markets.

This too has been a profound change and helps us account for rising inequality. In recent decades, business has used its demands for “competitiveness” and greater profitability to push public officials to overhaul labour laws and employment policies or simply ignore the growing violations of basic labour standards and norms. Following neoclassical economic theories claiming that any interference in markets leads to less than optimal outcomes, governments have often listened carefully to such appeals and recast public policies to make labour and social policies conform more closely to market and business priorities (Baccaro and Howell 2017). Just as frequently, in an effort to promote better business conditions, as demanded by increasingly aggressive business lobbyists, officials have simply let non-standard employment and labour insecurity grow, fearing that any countermeasures will not be good for business and the economy (Weil 2014).

For labour markets in Canada and around the world, these trends have led to “deregulation” – the unwinding, erosion, and limited enforcement of laws, policies, and regulations governing labour markets that were once oriented to upholding workers’ rights and bargaining power. Routinely, over the past four decades, public officials have sought to deregulate labour markets in order to maximize economic “efficiency” and boost employer profitability, making de-regulation the dominant policy paradigm for government labour market policies around the world (Baccaro and Avdagic 2014; Crouch 2014). As we shall see, such deregulation varies greatly in form and scope, as much for economic reasons as for political ones. But changes to labour market laws and policies such as these also help us explain the growing number of poorer-quality jobs and the proliferation of low-wage work in a number of Canada’s provinces.

Together, I argue it is this interlaced rise of post-democracy, financialization, and labour market deregulation that is the real story behind the rise of inequality in Canada today. Looking beyond how governments shape income distribution through after-tax and transfer policies, I focus my attention on how business and financial markets operate, and how government and policies have reshaped these rules to the benefit of the wealthy few. Front and centre in my account are the political forces and policies that have restructured the operation of financial markets, corporate governance, and firm operation at the expense of good wages and jobs – “financialization.” But of equal importance in my explanation are the complex relationships between class and politics that have reshaped labour markets and labour policies to create a more “flexible” low-cost labour force – “labour market deregulation.” •