Tackling Inflation in Canada: For Corporations or Workers?

On July 13, Governor of Bank of Canada (BoC) Richard “Tiff” Macklem announced a 1% increase in the BoC’s interest rate.

First, it was Chrystia Freeland, Canada’s Finance Minister, telling us that it was a global problem, almost beyond our control and that responsibility for tackling inflation was the job of central banks. Now, following Freeland’s lead, Macklem is guiding Canada and Canadians into the swamp of ever deeper economic dislocation.

Both economic ‘experts’ have cause and effect and the way the economy works mixed up. The job of social science is to determine what exactly “cause” is and what “effect” is. If we can’t accurately ascertain what causes inflation, then we can’t hope to solve it.

We certainly know the effect of rising prices, but raising interest rates is definitely not the way to solve the inflation dilemma. In fact, it is most likely going to make matters worse, hastening a recession while adding to inflation.

Global Economic Crisis

The first examination of cause and effect must start with a look at the global economy, and in this sense, Chrystia Freeland is partially correct. But again, Ms. Freeland is only looking at a few “effects” of a new global economic paradigm. The War in Ukraine, the pandemic, and global supply chains are all symptoms.

The problem facing the central bankers is that they do not control the real economy. They only control money supply, albeit an important tool in a capitalist market economy, but not the central aspect of the production and exchange of commodities from which value, price and money (itself a universal commodity) must obediently follow.

If the pain at the gas pumps, grocery stores and rents and mortgage payments is palpable with rising inflation, the raising of interest rates is about to feel like economic water boarding.

A recent poll of Canadian homeowners indicated that raising interest rates even more will place fully one quarter of home mortgages “under water”; and their owners “will be forced to sell their homes” (assuming they can then find a buyer). To make matters worse, interest rate hikes come at a time of record Canadian and global indebtedness: government, corporate, personal, student and mortgage debt.

In a previous essay, I found it necessary to challenge the underlying assumptions of neoliberal capitalist doctrine about inflation. That doctrine is spread far and wide by mass-media talking heads and corporate economists who either know better, or should.

Their views, unfortunately, sink deep into our consciousness, and have us lapse into passivity, i.e., nothing can be done as we must choose to either watch our wages, salaries, and pensions depreciate (as purchasing power), or fall into recession and the added misery of unemployment for working people.

Now, central banks in America, Europe, and Canada are choosing for us: we face a looming recession. How deep the recession becomes remains a guessing game for corporate ‘expert’ economics pundits.

Big business governments argue that nothing can be done by them because the cause of inflation lies beyond government control. “Besides,” they say, “managing inflation is the responsibility of central banks, operating at arm’s length from government. Inflation is, therefore, your sole responsibility, Mr. Macklem.” So say the ‘experts’. And they speculate as to whether the Bank of Canada has waited too long to start hiking interest rates.

Just so we’re clear, one such ‘expert’, Chrystia Freeland, our Finance Minister and Prime Minister-in-waiting, delivered precisely this prescription, as expected, on the subject of inflation to the Empire Club last month, signaling to Macklem that soaring inflation was now his responsibility. Freeland’s arguments about the causes of inflation and the central bank’s sole function to control inflation are bogus.

Unfortunately, Mr. Macklem fell into line. His speech of July 13, delivering an additional 1% interest rate hike, is precisely the “economic water boarding” of Canadians warned about last month. Just as worrying for most working people, Mr. Macklem says he isn’t finished raising rates as he tries to race “ahead of the inflation curve.”

Spike in Interest Rates

His logic for such a draconian spike in interest rates is as follows, and these are his exact words:

“First, inflation is too high, and more people are getting more worried that high inflation is here to stay. We cannot let that happen. Restoring price stability – low, stable and predictable inflation – is paramount.

“Second, the Canadian economy is overheated. There are shortages of workers and of many goods and services. Demand needs to slow so supply can catch up and price pressures ease.

“And third, our goal is to get inflation back to its 2% target with a soft landing for the economy. To accomplish that, we are increasing our policy interest rate quickly to prevent high inflation from becoming entrenched. If it does, it will be more painful for the economy – and for Canadians – to get inflation back down.”

To summarize, the Bank of Canada’s solution to high inflation is the choice of a lot of pain today or much worse pain tomorrow. I would respectfully disagree and suggest that what Macklem proposes will be a lot more pain today and even more pain tomorrow. His reasoning is wrong on virtually every count.

His premise on the cause of inflation is wrong, and therefore, his solution of raising interest rates must be wrong. Both Macklem and Freeland’s thinking is aimed at disciplining the working class of Canada, who may be thinking that significant wage increases are justified.

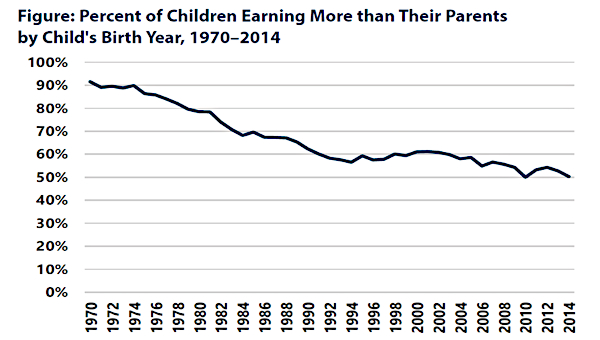

As we learned four decades ago when we were hit with stagflation (a stagnant economy and continuing inflation) the workers need to prepare for what comes next, and theories of cost/push cycle of wages pushing up prices, followed by more wage increases and more price increases. This theory, too, is bogus, but it was used forty years ago by a previous Trudeau (Pierre) administration.

The premises upon which the central bank is basing its actions can’t stand up to intense scrutiny regarding what it will do to society and most especially working people.

First, is the economy over-heated and is it possible to enter a recession at the same time as we have a tight labour market? That’s what mainstream corporate economists say. History tells us the answer is “of course it is possible for unemployment rates to be low at the start of a recession.” Unemployment numbers always lag behind the boom part of the business cycle, just before the crash landing.

Moreover, official statistics don’t tell the real story about the percentage of adults of working age actually working (“labour force attachment,” an economist euphemism for the labour commodity market place), nor the numbers of workers who are now working multiple jobs to make ends meet.

No matter how economists (e.g., former US Fed Chair, Janet Yellen, and Nobel Laureate and New York Times columnist Paul Krugman) now studiously avoid talking about the formerly used technical definition of a recession (two consecutive quarters of negative GDP), as a gauge of the economy’s health, the reality is gloom. These same folks now point to other considerations about whether or not we are heading into a recession or not.

Reality tells working people that we are already entering an even deeper economic hole, and the central bank’s actions, in face of global conditions, over which they have no power, will guarantee not a “soft landing” but rather an extremely hard one and a much deeper hole for workers and their communities.

What many mainstream economists are now peddling is that, if it’s a choice between a recession and high inflation, the recession, despite the pain it will cause, is the preferred route.

While they hope the central banks will get the interest-rate hikes’ calibration right so that the recession won’t cut as deep, they simply don’t know or don’t want to know how to deal with inflation.

This inflation problem stems from a market economy, tightly controlled by a handful of oligarchs, led by the fossil fuel industry either manipulating or taking advantage of, supply shortages and society’s demands. Going cap in hand to the Saudi Royal family, as the US President did two weeks ago, to plead for release of more oil was a failed choice. So is more fossil fuel extraction and pipeline construction in Canada.

Governments, including the Canadian federal and provincial governments, can do something about the stranglehold over the economy by domestic oligarchs. It’s a matter of political will and changing the power relationship between them and the people.

What is it really going to take to get back to the 2% target, or Mr. Macklem’s definition of “normalization” rate of inflation? Certainly, there will be no soft landing. Mr. Volker of the US Fed, in the late 1970s, led the capitalist world the last time stagflation reared its ugly head.

“Wrestled inflation to the ground,” with ruinous interest rate hikes on already heavily leveraged individuals and countries meant people and whole countries went broke. Mexico’s banks still won’t lend money for home ownership after that country went financially belly up – thank you, Mr. Volker!

Allow me to offer these historical bits of context on inflation and stagflation from our labour history. Here is how one trade union researcher placed the issue of inflation in the mid to late 1970s after the Canadian Labour Congress called one million Canadian workers off the job on October 14, 1976, to protest wage controls.

Research Director, Eric G. Adams, in a summary of his report to his union, the United Electrical and Machine Workers (UE), entitled “Understanding Inflation,” had this to say:

“The market system is not working well, not only in Canada but throughout the capitalist world. Inflation and unemployment provide the evidence of internal trouble. Although inflation has been virtually dormant over extended periods in the past, post-war conditions have allowed the inflation sickness to surface in many countries and persist obstinately.

“What seems to distinguish the current inflation is the increasing power and effectiveness of corporate ‘price-makers’ in important markets. We date the contemporary inflation era in Canada from the mid-1950s, after the lull which followed the Korean War boom. For a decade, inflation moved up steadily at a rate averaging under two per cent a year. Then they started to accelerate, hitting double-digit figures in 1974. The results have become so serious for so many people that inflation has taken on a moral and social, as well as economic, implications.

“Changing conditions in the post-war period have facilitated the development and spread of inflation – but conditions should not be confused with causes. The prime responsibility for mounting prices rests upon corporate ‘price-makers’. Government policies, however, have reinforced and legitimized their actions and governments have not done much to lighten the burden of the unfortunate majority who are unavoidably ‘price takers’.”

Too familiar! As the younger Trudeau reads from the playbook advanced by business oligarchs of that day and used by his father and passed on to his Finance Minister, Macklem is fully endorsed by current Canadian and western global oligarchs.

But raising interest rates, not only won’t cure inflation, but rather will make it worse, raising the specter of inflation continuing, alongside a stagnant economy, i.e., ‘stagflation’. This time around, stagflation will be more disastrous and hurtful because global capitalism is in deeper crisis in so many other ways, climate, health, and an ugly war seemingly without end in the Ukraine, as oligarchs fight it out for supremacy.

In a capitalist economy, where profit is king, and supply-and-demand rule prices, where demand is high and supply is low, prices and profits in a marketplace controlled by monopoly business are designed to go up, up, up, according to what the market will bear, certainly not tempered by the central banks fiddling with interest rates!

Monopolistic Pricing Policies

This sudden inflationary spiral is not caused (as Eric Adams pointed out 40 years ago) by supply-and-demand problems, but rather by monopolistic pricing policies, either creating, or taking advantage of, supply-and-demand realities. It doesn’t have to be this way.

Governments could intervene to prevent price gouging. But Macklem, Freeland, Trudeau, Biden, and corporate governments don’t want to go to the only possible solution to inflation. Furthermore, they will continue with this madness until people insist that they stop and take meaningful action.

Now Conservatives attack Liberals by saying the government is printing “too much money.” Printing too much money can contribute to inflation, especially in an economy which is not expanding. But the Conservatives (of all stripes) are really talking about cuts in services and disciplining the working class in an even more draconian fashion.

As the Conservatives and Liberals duke it out, they hope the debate will ignore the vast profits being extracted at the gas pumps and gigantic grocery and retail chains, the real underlying cause of inflation. •