Climate-Damage Denialism: Setting the Social Cost of Carbon

Dr. Patrick Bond’s submission to the South African National Treasury’s taxation document for the oil and gas sectors, 7 February 2022.

I am a University of Johannesburg professor, specialising in public policy, environmental sociology and environmental economics, writing in particular about the implications of the Treasury document, “What is the Most Appropriate Tax Regime for the Oil and Gas Industry?” (The views expressed below are personal, not institutional.) The implications of this document are enormous for South Africa’s climate politics. I hold a PhD in Geography and Environmental Engineering from Johns Hopkins University (1993), having earlier studied economics at Swarthmore College and the University of Pennsylvania Wharton School of Finance. I also have engaged in many South African policy processes, having drafted the Reconstruction and Development Programme White Paper (1994) and many others. I also work closely with civil society organisations in South Africa, Africa and across the world.

I am particularly interested and affected, as are all South Africans, and indeed the world’s citizens, by the climate components of the document, which need drastic, urgent improvement. The adverse economic impacts are especially notable, and must be factored in, consistent with the National Environmental Management Act’s “polluter pays” foundational principle. No apparent effort has been made by Treasury to properly cost the damage done by South Africa oil and gas even though since September 2021, it has been the subject of the International Monetary Fund’s (extremely conservative) critique, as discussed below.

Climate-Damage Denialism

In December, the Department of Mineral Resources and Energy (DMRE) issued a Gas Master Plan, which Treasury’s oil and gas taxation document will necessarily follow. Its premises have already been criticised by investigative journalist Susan Comrie at Amabhungane:

- Not only does the basecase report ignore the environmental consequences of gas, it ignores the fiscal ones too. Methane is recognised as a greenhouse gas and classified as a carbon-equivalent, meaning that it is subject to carbon tax initiatives being introduced from next year. Products produced with gas-fired power may also face higher tariffs when exported in future.

- The report does not grapple with the increasing volatility of gas prices and how this will impact on the price of electricity. Instead, the report cites a Standard Bank presentation from 2019 that suggests South Africa could take the risk of buying gas at spot price from Mozambique, Nigeria or Angola. Since that report was written, however, the price of Liquid Natural Gas (LNG) has experienced wild fluctuations. The presence of persistent shockwaves in gas prices should give government pause: as our rail network deteriorates and more goods are moved by trucks, is it wise for our supply chain to become more reliant on such a volatile fuel source?

- Another potential blind spot in the basecase report is that it implies that having gas offshore equates to having a consistent supply of cheap domestic gas. As Australia has discovered, this is not the case: although vast amounts of gas is extracted from Australia’s offshore gas fields, most of it is exported to fulfil long-term supply contracts, meaning that despite the cost of shipping, Australian gas is often cheaper in Japan than at home. To counter this, the government has introduced regulations to throttle exports if there is not enough gas for the domestic market. This has guaranteed supply, but it has not protected Australians from rising gas prices.

These are valuable critiques, and deserve to be expanded upon. This is especially true given controversies over offshore gas exploration and drilling underway in both the Indian and Atlantic Oceans. On 7 February 2022, the seismic blasting associated with gas and oil exploration was ruled illegal for the second time in a High Court in five weeks (this time Cape Town, and earlier in Makhanda). Many of the concerns related to lack of consultation, the destructive impact of such blasting on marine conservation, the welfare of shoreline communities and fisherfolk, the failure to abide by updated national environmental legislation, and the delay in Just Transition transitions for petrochemical workers, in the event seismic blasting continues. The Searcher Seismic’s Atlantic Coast exploration and the BGP Pioneer were told to halt activities because of numerous flaws in their hasty environmental filings.

And yet, when Treasury seems to want to incentivise new investments by oil and gas companies, there is a tendency to deploy climate-denialist analysis:

“While gas is a fossil fuel, its emissions are around 50 per cent less than coal and it could act as an important transition fuel as the economy transforms and shifts to lower-carbon, renewable and energy-efficient technologies. This would also help to facilitate a just transition to a lower-carbon economy and ensure energy security of supply and affordable energy that is accessible by all.”

In reality, methane gas is 80x more potent than CO2 in the critical next 20 years (and 25 times worse over 100 years), and the claim that “affordable energy for all” is an objective simply isn’t on the cards, what with Eskom proposing a 20.5% price increase for 2022.

There is a similar glaring flaw in the Treasury tax document. Its most important statement is:

“Climate change is the biggest environmental challenge and risk facing the world and should not be regarded as a major threat or alternative to, but should rather become an integral part of development efforts in the oil and gas sector through embracing the global energy transition and use of low-carbon technology” (emphasis added).

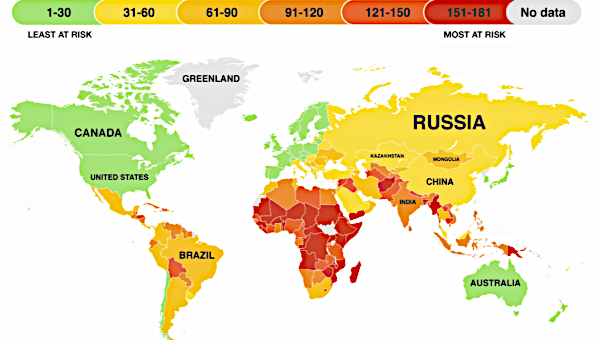

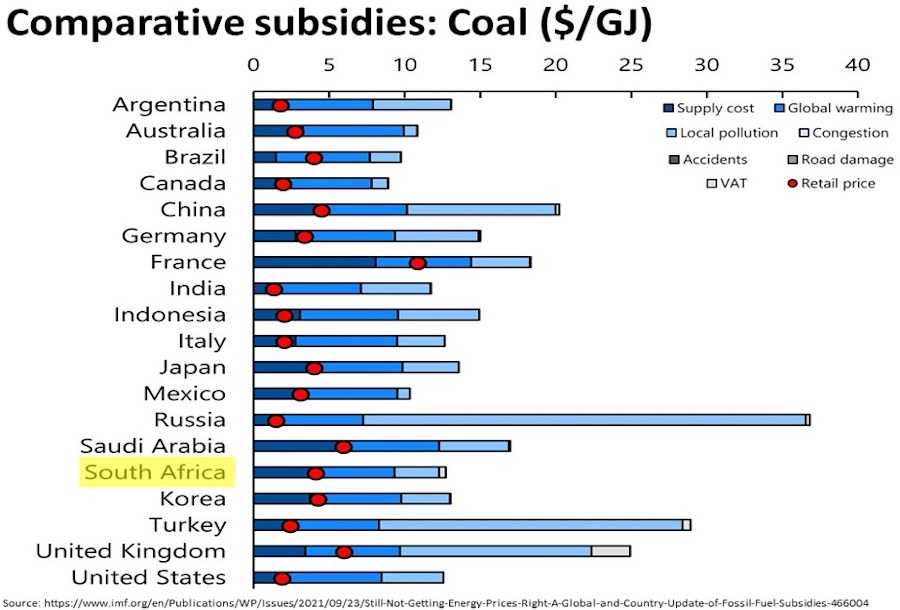

This represents climate-damage denialism. How severe are the damages caused by ‘development efforts in the oil and gas sector’? Even the International Monetary Fund estimates annual damages caused by South Africa’s greenhouse gas emissions to be R780-billion in both implicit and explicit subsidies to fossil fuel producers, especially in failing to put an economically-’efficient’ price on coal. In making this case, the IMF relies upon two extremely conservative assumptions: the Paris Climate Agreement’s 2 degree Celsius target should actually be 1.5 degrees; and the price of carbon damage is vastly underestimated. The IMF uses merely a $60/tonne price of carbon and has only a 2-degree warming ambition. The 2-degrees is extremely risky for our future generations, and the $60/tonne damage is a severe underestimate – probably by a factor of 50, since more recent research conscious of feedback loops puts the actual climate-related price at closer to $3000/ton. The impact of this damage is formidable: the damage done by Treasury’s current failure to establish proper pricing of greenhouse gas emissions is several times a multiple of GDP.

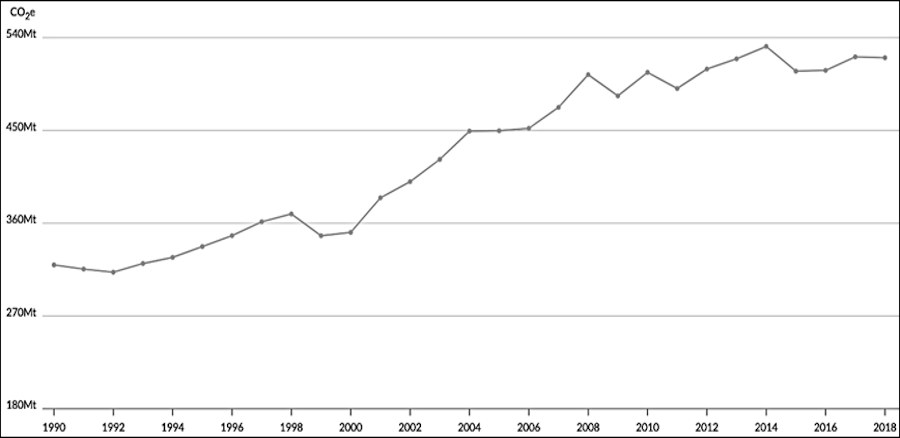

Even though South Africa’s subsidies may seem moderate in comparison to the likes of peer countries Brazil, Russia, India, China, Turkey and some rich countries, bear in mind that per person, per unit of output, SA has the world’s third-highest greenhouse emissions of any country with 10 million people or more, so our economy is exceptionally fossil addicted, with very low returns on the greenhouse gases emitted. With South Africa still emitting around 500 million tonnes/year, the climate impact of our greenhouse gases alone (at $3000/tonne) – not including many other factors such as local pollution – would be 4.7 times more damaging than South Africa’s 2021 GDP of $320-billion. Treasury is simply not factoring in low-income climate-victim countries’ demands that “loss and damage” (as won by Southern negotiators, in principle, in the UNFCCC in 2013) be more strongly factored into South Africa’s climate policy. If so, it would be abundantly clear that South Africa owes a vast climate debt to neighbouring countries.

South Africa’s total greenhouse gas emissions, Mt/year CO2-equivalent, 1990-2018

Source: ClimateWatchData 2021.

Sanctions Damage

If Treasury succeeds in incentivising an even worse national methane addiction within the energy sector through extending the current highly-favourable carbon tax regime, the likelihood of ‘climate sanctions’ against South Africa rises substantially (e.g., the EU’s Carbon Border Adjustment Mechanism starting next January). In turn, rising reliance on gas and oil means that local exporters won’t be able to claim that they are using energy with low-enough levels of greenhouse emissions, to avoid the coming sanctions. The prospect of climate sanctions is so daunting, that the main aluminium smelter (and single biggest Eskom customer), South32, is now desperately seeking to build a pumped-storage (no-emissions) alternative to Eskom high-carbon power (at the De Hoop Dam, 600km from its Richards Bay plant).

It is worth bearing in mind the point made by President Cyril Ramaphosa on October 11, 2021, explainingthe danger to the economy of further fossil fuel development, in his Presidential letter advocating a low-carbon economy and Just Transition for affected workers and communities:

“As our trading partners pursue the goal of net-zero carbon emissions, they are likely to increase restrictions on the import of goods produced using carbon-intensive energy. Because so much of our industry depends on coal-generated electricity, we are likely to find that the products we export to various countries face trade barriers and, in addition, consumers in those countries may be less willing to buy our products.”

Climate-related trade disincentives will include increased carbon taxation based on high-CO2 components of local production as well as the distance traveled by goods either through shipping or air transport. The Treasury recognised this in an August 2021 briefing to parliament, in which several sectors were identified as especially vulnerable: iron and steel, cement, fertilizers, aluminium and electricity.

In each case, South African economic development requires full cost accounting to assess whether, at a time coal-fired power plants are going to be retired early, their replacement by methane gas may exacerbate South Africa’s vulnerabilities. Bearing in mind the likelihood of climate sanctions if our economy remains reliant upon fossil fuels, the Social Cost of Carbon is the most appropriate polluter-pays metric for DMRE to judge the full costs of the proposed exploration to be followed by exploitation and combustion.

Treasury apparently does not consider the interests of export-oriented firms which will be disadvantaged (and maybe even decimated) by climate sanctions. Nor in this public document, does it specifically invite views from coastal communities (and fisherfolk), potential inland fracking sites, Just-Transition workers, marine conservationists and climate activists, women, youth and black South Africans, much less future generations, all of whom are going to be most adversely affected by climate catastrophe, and by damage to the coasts and oceans as meth-addict investors go wild.

Treasury’s Pro-Fossil Investor Bias

Instead of orienting its oil and gas tax policy toward the interest of the South African society and people, as Treasury readily admits,

The government is inviting investors’ views on its content so that we can have a regime where both government and investors gain a fair share while promoting appropriate management of our finite and non-renewable oil and gas resources, and taking into account our commitments to address climate change and other pertinent environmental challenges. The government is seeking to balance the need to invest in less carbon-intensive transition fuels with providing a fiscal and tax regime that is attractive enough for companies to explore for and produce oil and gas… (emphasis added).

Yet if the Eskom coal-to-gas conversion moves forward, immediate costing of that gas suggests the SA carbon tax – at present, $0.42/ton – is extremely unrealistic, given that it is 7000 times too low (as at present if the recent research is used). As a result of Treasury’s failure, climate sanctions are going to be devastating. Yet Treasury authors ignore higher-cost estimates of emissions, and argue instead for the exceptionally-low carbon tax on grounds that “The carbon tax will assist in reducing GHG emissions in a cost-effective manner” (while providing no modeling evidence this is the case, in the face of all the evidence of climate catastrophe).

The clear bias is to making the tokenistic tax “cost-effective” for high-pollution corporates, not for society and environment:

“The carbon tax is South Africa’s key mitigation policy measure and, combined with other climate policies, it is integral to achieving our NDC commitments in an economically efficient manner. The first phase extends from 1 June 2019 to 31 December 2022, and the second phase from 2023 to 2030. The Carbon Tax Act gives effect to the polluter-pays-principle for large emitters and helps to ensure that firms and consumers take the negative adverse costs (externalities) into account in their future production, consumption and investment decisions. For example, the carbon tax encourages internalisation of the costs associated with excessive GHG emissions by adjusting relative prices to reflect the social costs of carbon-intensive goods and services. The carbon tax will assist in reducing GHG emissions in a cost-effective manner, help to achieve our NDC target and nudge our economy onto a sustainable growth path.”

If the polluter-pays principle was really to be used, then the tax would not be $0.42 per tonne, it would be $3000/tonne. And as a result, the price elasticity of the impact of the carbon tax on CO2 consumption is so low that it never features in the Energy Intensive Users Group public statements (compared to, say, Eskom tariff increases or the prospect of climate sanctions).

Finally, although Treasury does admit it has already kept taxes comparatively low for the fossil fuel sector, it seems to want to continue or even increase such incentives:

“The current tax regime for the upstream oil and gas sector in South Africa is relatively generous when compared to other countries… [but] trying to increase the tax take by any other means would reduce the attractiveness of South Africa as an investment destination for upstream petroleum exploration.”

In sum, to reiterate, it’s quite extraordinary that in recognising a climate catastrophe, Treasury insists we should move from coal to gas so as to ‘develop’ the petroleum industry, because the climate crisis “should not be regarded as a major threat.”

Several of these points above may be worth elaborating because the DMRE Gas Master Plan Base Case Report (v.01) – which will be the main operational policy document that feeds into Treasury oil and gas taxation – was recently put to the public for comment.

DMRE’s Failure to Attempt Full Economic Costing

The DMRE Gas Master Plan makes estimates as to how much methane gas is potentially available in the relevant blocks, but has no information about the market value, and the environmental costs of likely externalities. Below are rough estimations that can guide answers to these questions.

The extremely large gas reserves anticipated to be found both offshore and onshore South Africa, should be considered as a major potential source of greenhouse gas emissions, especially if more than 13 trillion cubic feet (tcf) of gas are capable of being extracted:

- 8 tcf in the Orange Basin

- 2 tcf in the Bredasdorp Basin

- 3 tcf in the Outeniqua Basin

- discoveries that are likely in the Witwatersrand and Durban-Zululand basins

Furthermore, the Gas Master Plan also makes major claims for Mozambique’s gas fields, offshore not only Pande and Temane where Sasol is extracting and transporting gas (of which 2 tcf are left), but in the war zone in Cabo Delgado where 120 tcf are estimated to exist, in the world’s fourth largest field.

To illustrate the costs that are associated with just one particular site, the Transkei-Algoa blocks on the Indian Ocean, consider three factors: the oil-barrel equivalent of estimated gas reserves; the market value price of that gas; and the estimated Social Cost of Carbon associated with these armounts.

1) First, there may be the equivalent of a billion barrels of oil in the Transkei-Algoa blocks: Impact CEO: “We would not be investing in the way that we are looking to invest in the area if we could not see a billion-barrel potential.” Source: africa-energy.com.

2) Second, the international market value of natural gas has zigzagged dramatically, ranging in 2021 $2.4 and $6.3 per million British thermal units (MMBtu), and in early 2002 priced at around $4.85/MMBtu. Source: tradingeconomics.com.

There are 4.5 MMBtu per barrel-equivalent. If there are a billion barrels of oil (equivalent) to be extracted, the 4.5 billion MMBtus would be worth $21.825-billion, or R336 billion (i.e., above 6.8% of annual GDP of $320-billion). That would be potential gross income. But as for net income, there are major costs to extraction, still to be determined by local drilling conditions, fixed capital costs, operating expenses, liabilities for local ecological damage, taxes and royalties.

3) Local ecological damage can be considered priceless, especially in the event not only of seismic exploration blasting, but a drilling platform or pipeline rupture in the Agulhas Current, so it is difficult to estimate such costs. However, we do have some estimates of greenhouse gas damage to apply.

The main ingredient in natural gas is methane, which as a greenhouse gas is 80 times more potent in a 20-year period than CO2. Indeed the biggest externalised environmental cost of all is the impact of the combustion of methane on climate. A barrel of gas generates 236 kg of CO2-equivalents when burned, or 0.26 tons. So if there are a billion barrels of gas available in the Transkei-Algoa blocks, we can assume something close to 260 million ton-equivalents of greenhouse gas emissions.

As noted above, the Social Cost of Carbon – i.e. an assessment of damages per ton – is hotly contested. Barack Obama’s administration assessed it at $51/ton but that is expected to rise dramatically in 2022 revisions. The IMF estimates $60/ton. The European Union currently has an Emissions Trading Scheme price closer to $100/ton. But the latest research by scientists suggests $3000/ton is more accurate. Source: ucl.ac.uk.

If we set the Social Cost of Carbon at $3000/ton, and there are 260 million tons of CO2- equivalents that could be released from all the gas to be extracted in Transkei-Algoa alone, the Social Cost of Carbon would be $780-billion. Set against the gross (not net) income from a billion barrels claimed by the Impact CEO above, valued at $21.85-billion (before costs are subtracted), this extraction obviously doesn’t make sense if we take seriously full cost accounting. And if there are many multiple times as many tcfs in the entire South African gas reserves as in Transkei-Algoa, then likewise the multiples of Social Costs of Carbon also rise accordingly.

Natural capital accounting and the National Environmental Management Act’s commitment to the polluter pays principle are not referenced in the draft EIA (although sections 2.23-2.26 do mention NEMA). It is imperative for the DMRE to undertake full cost accounting on even the roughly-estimated CO2-equivalent emissions that are implied by any oil and gas exploration. No such estimates are attempted in the Gas Master Plan.

The US Precedent for Incorporating Climate-Related Costs (January 2022)

Eskom is expecting to receive climate finance on a subsidised basis, including from US government agencies. And yet in late January 2022, Judge Rudolph Contrera of the Washington, DC US District Court insisted that the full-cost accounting was not complete in the Trump administration’s permission to drill for offshore oil and gas. The Biden administration, had according to Judge Contrera, admitted that “current programs fail to adequately incorporate consideration of climate impacts into leasing decisions or reflect the social costs of greenhouse gas emissions.” Moreover, the judge found that Trump’s administration had ignored “new evidence demonstrat[ing] that existing operations in the Gulf of Mexico emit twice the amount of methane than previously thought.” Source: int.nyt.com.

Conclusion

Due to the failure of both Treasury’s taxation document for the oil and gas sectors, and the Gas Master Plan, to properly consider the full cost accounting required for such a vital natural resource (one that should also entail rudimentary natural capital accounting), and due to the adverse impact on the rest of the economy as climate sanctions are imposed, and finally due to the new precedent in which precisely such calculations led to cancellation of gas and oil offshore exploration in the United States, both Treasury and the DMRE must take responsibility for redoing its work, and should in the process reconsider making South Africa yet more greenhouse gas dependent. •

This article first published on the Oceans Not Oil website.