COVID-19: A View from the Great Depression of the 1930s

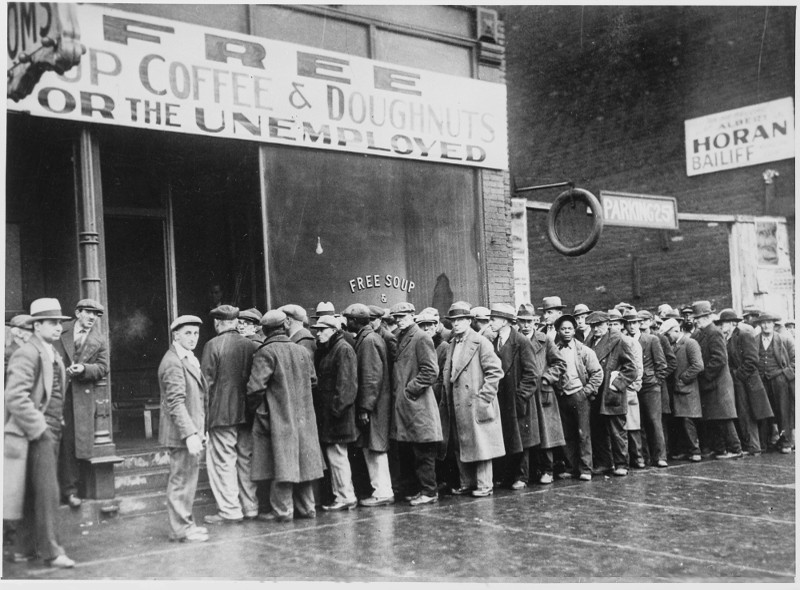

The Great Depression. It rests in our collective consciousness as a time when unemployment was rampant, when soup kitchen and bread lines were long, when misery was widespread, when dust was everywhere.

In our imaginations, the Depression had a light at the end of its dark tunnel, too. In that story, the onset of the Second World War single-handedly pulled the world out of its economically troubled times, forging along the way nothing less than a gritty demographic cohort that would come to be called the Greatest Generation.

Like most stories, this one has elements of truth to it. But nestled deep within the narrative are the more mundane public policy stories that actually pulled the world out of depression. And, looking deeper still, one can find the stories of the dramatic and necessary shifts in basic thinking about how economies, states and societies worked (and didn’t work).

In short, the Great Depression forced many to question, and then begin to abandon, long and deeply held assumptions about the nature of the very economic and political systems on which states and economies stood. In their wake, at least some of those long and deeply held assumptions were replaced with new ones more appropriate to the increasingly complex and interconnected industrial economy of the twentieth century. In the end, a nineteenth-century liberalism that had long been challenged by various socialisms from the left and by protectionism, racism, and nationalism from the right, was finally replaced by Keynesianism, a philosophy of mixed economies and class compromise.

A Major Overhaul?

As COVID-19 continues to ravage the globe in what has become a world-wide pandemic, and as a second wave threatens to crest this autumn, a major overhaul of ideas and policies is once again in order. After the Great Depression and the Second World War, a return to pre-depression liberalism just wasn’t in the cards. Today’s game, for its part, is not yet decided.

Some want to see the current crisis as our Great Depression. They want to see it as our Second World War. They want to imagine that, with the kind of determination, sacrifice, and grit displayed by generations past, existing economic and social structures will weather the current storm and come through to the other side largely undisturbed. As the crisis wears on, demands to get “back to business” are getting louder and more aggressive. They are increasingly coupled with the demand to cut government spending massively after a crisis-induced spending spree. These latter demands are reminiscent of 1930s efforts to maintain laissez-faire policies at all costs.

Early Crises Responses: Denial

At the outset of the Great Depression, most of the world’s political and economic leaders refused to believe that a crisis was looming on the horizon. For many, the now-infamous Wall Street crash in late October, 1929, was little more than a market correction, presaging another decade of strong economic growth. “The fundamental business of the country,” newly-elected American president Herbert Hoover asserted in November, 1929, “is on a sound and prosperous basis.” Chicago banker Arthur Reynolds, in the wake of Black Tuesday, when the stock market saw its largest single-day decline in its history, insisted that “this crash is not going to have much effect on business.” Stock values continued to fall the next day, for a combined total loss that has yet to be repeated. Here in Canada, Prime Minister William Lyon Mackenzie King boasted that the fundamentals of the economy were sound.

Of course, very little that was business-related was sound. Instead, most of the western industrialized world fell precipitously into a deep and prolonged economic depression.

In similar fashion, some world leaders early on doubted COVID-19 would amount to much. It was little more than a particularly nasty and virulent strain of the seasonal flu; its risks to human health were vastly overstated; it was a hoax cooked up by devious people for devious ends.

Of course, most people in the world quickly grasped that COVID-19 was none of those things. It was, instead, a serious, highly infectious disease borne of a virus we’ve not seen before. And if some world leaders failed to understand its much deeper implications, then the stock market – that oftentimes jittery barometer of looming disaster – understood those implications only too well. As COVID-19 made its way from its suspected place of origin in China to Europe and North America, and finally to the entire planet, stock market share prices fell fast. By mid-March, 2020, the Dow Jones Industrial Average had dropped more over three especially bad days than it had on its previous biggest losing day in the midst of the panic of 1987. The situation was sufficiently disturbing to trigger massive injections of central bank cash in order to prevent global finance from total collapse. Shortly, and even while the pandemic and economic crises dragged on, stock markets substantially recovered.

During the Great Depression of the 1930s, the stock market crash in October, 1929, no less than the 2020 stock market drops relating to COVID-19, was dramatic. But crashes are mostly little more than canaries in the coal mine, striking and arresting as key markers of trouble, but ultimately, less helpful in finding true causes of economic calamity or in predicting its implications.

Structural Crisis in the 1930s

The root problem that turned an otherwise common, albeit very deep, economic down turn into what we now call the Great Depression of the 1930s was western capitalism’s structural inability (or unwillingness) to direct its economic, political, and social institutions to take necessary ameliorative measures. Exacerbating the situation were early state efforts to retain the liberal trinity of free trade, the gold standard, and balanced budgets even while decades-old protectionist policies severely challenged free trade principles; even while the gold standard hadn’t been suspended; and even while government spending had ballooned to finance the First World War.

The political mainstream considered tariff walls and war as aberrations to liberal principles, which would guarantee full employment and prosperity if applied consistently. The 1929 Crash and the ensuing crisis were widely viewed as the direct consequences of these anti-liberal tendencies. In reality, however, the shift was less about a departure from liberalism and more about a deeper transformation of liberal capitalism into a monopoly capitalism that bred protectionism, imperialist rivalry, and depression.

It took another world war before policies more amenable to the then new face of capitalism were adopted and helped to usher in a period of unprecedented and, as it turned out from the 1970s onward, exceptional prosperity.

In 2020, nearly 100 years after the Great Depression, we may be in a similar situation. At present, we are collectively at grave risk because of our structural inability (or unwillingness) to direct our economic, political, and social institutions to absorb the shock brought about by COVID-19.

In that gloomy autumn of 1929, most of the western capitalist world was deeply ensconced in a blend of nationalist and liberal ideology. Economic nationalism, like its racist counterpart, ethnic nationalism, is characterized by a turning inward, by a deep-seated belief in national exceptionalism, by a desire to promote the interests of a particular ‘nation’, usually at the expense of other ‘nations.’ For its part, liberalism’s hallmarks by the early twentieth century included a deep and abiding faith in the simple laws of supply and demand, the paramountcy of the individual and individual self-interest, unfettered opportunities to accumulate individual wealth, the valorization of the self-made man, and a limited role for government.

Not surprisingly, then, these conflicting assumptions led to erratic policy changes. In the wake of the First World War, efforts to restore the gold standard, and the public spending constraints tied to it, were shortly followed by competitive devaluations and rising tariff walls in a misguided effort to protect national economies from the cancerous outside world. A spectacularly destructive example of this was the now-infamous Smoot-Hawley Tariff (1930) in the US. The basic thinking of its sponsors, Senator Reed Smoot and Congressman Willis Hawley, was that an effective tariff on imported agricultural and manufactured goods would shelter American farmers’ and manufacturers’ profits from the influx of cheap foreign goods. The results were almost immediate. And they were disastrous.

Other industrial nations, Canada included, erected their own tariff walls in retaliation. Much of the world’s trade in industrial and agricultural goods (and many more besides) shut down. Global manufacturing production stalled. Workers lost their jobs. Grain prices, already falling drastically after the First World War, took another hit. Banks failed.

It turned out that trade was crucial to the survival of the world’s economy. Economic nationalism was exactly the wrong strategy to pursue. Yet, it was also true that nineteenth century free trade had paved the way to the escalation of economic nationalism over the course of the Great Depression. Efforts to restore nineteenth century capitalism were a key factor in turning the cyclical crisis of 1929 into depression.

Another early response to the economic crisis of the 1930s was limited state contributions to emergency unemployment relief. Usually taking the form of work-for-wages schemes, relief was meant to mimic the ‘normal’ capitalist marketplace over the short-term, while pretending that the economy wasn’t falling apart. At their heart, however, such schemes were deeply rooted in liberal thinking: they generally paid less than the meanest wage available outside the relief system for fear that making relief too attractive would stifle initiative; they were deliberately linked to work in order to ensure that the unemployed wouldn’t get something for nothing; and they were small in scale, reflecting the limited power of the state to make necessary interventions into the economy.

The problems appeared almost straightaway. There was never sufficient work to keep more than a fraction of the unemployed at what was then called ‘productive work’. Most jobless men fortunate enough to secure positions on relief work projects worked less than one week out of six. Women and non-citizens were excluded entirely.

Most importantly, the state’s tight-fisted and limited approach to relief resulted in less wealth flowing through the economy, when what was critically required was more.

Making and Unmaking of the New Deal

By 1933, it had become only too clear that adherence to out-dated assumptions from the previous century were simply not working, and in fact, were very likely hindering recovery. Unemployment numbers continued to grow. Farms continued to fail, especially in the now-iconic dustbowl regions of North America. Business remained stalled. Industrial production continued to fall, sometimes dramatically.

It was time, many increasingly believed, to toss out old ideas and unchallenged assumptions and unhelpful ideologies. Embodying, perhaps, the spirit of the moment was newly-elected American president Franklin Delano Roosevelt (FDR). “The only thing we have to fear,” he thundered at his March, 1933, inauguration speech, “is fear itself.” For too long, he argued, the nation had been paralyzed by its own terrified and feckless grip on a system of wealth exchange unable to manage the complex industrial economy in its charge. What was required, he insisted, was nothing less than the total mobilization and application of the state’s collective resources to the problems plaguing the nation.

In short order – through the so-called First 100 Days of his administration – FDR dismantled the nation’s tariff walls, implemented a series of fiscal policy, banking and labour reforms, and, with the cooperation of the states, embarked on a set of “New Deal” programs providing aid to the nation’s farmers and unemployed. However, and despite a much-vaunted rhetoric, America’s first stab at the New Deal remained half-hearted. First signs of recovery triggered a return to austerity, and by 1937, the economy was back in recession. It wasn’t until the Second World War that the fixation on balanced budgets was replaced by more long-term-oriented Keynesian policies. As Joan Robinson, a collaborator of Keynes, remarked sharply, “Hitler had already found the cure to unemployment before Keynes had finished explaining why it occurred.”

Historians, of course, have debated vigorously the degree to which FDR’s New Deal reforms represented a fundamental ideological break from the past. What can’t be in dispute, in our view, is that, at the very least, the New Deal, originally nothing more than an election campaign slogan, came to signify a new and expansive role for the collective power of the state in managing national economies, including the economies of Canada and the UK.

Certainly, the onset of the Second World War and its call for ‘total war’ revealed what an organized and directed state could accomplish in short order. As historian Jack Granatstein has lately noted in a short Maclean’s magazine piece comparing Canadians’ present day COVID-19-related experience with Canadians’ experiences in World War II, “… it was a total war, a complete mobilization of Canadian society and a government-enforced equality of sharing at home. Budget deficits ceased to matter, and government spent freely to win the war.”

During the Cold War, Canada, like other Western Countries, developed an enviable welfare state marked by high quality and robust health care, and education and social service systems that would simply not have been imaginable prior to the Great Depression. In a way, welfare states mirrored the peaceful, and sometimes not so peaceful, coexistence between Western capitalism and Soviet communism on a domestic level: private enterprises retained their property and the right to manage it, but had to concede to higher levels of taxation and state intervention to fund the welfare state. Unhappily, and despite the welfare state’s obvious benefits to economic stability, its very survival rested on the acquiescence of private sector interests, leaving it at the mercy of private enterprises’ propensity to invest and pay taxes, a propensity that vanished in the face of increasing demand for welfare state expansion.

Since the 1970s, the idea of the welfare state has been in retreat, succumbing to multiple neoliberal attacks on ‘Big Government’, the ‘Nanny State’, and ‘State Socialism’. The welfare state, critics charge, robs citizens of their initiative. It encourages a mushy middle even while discouraging innovation.

One of the results of these attacks has been, broadly, the creation of a critical mass of people perennially on the cusp of economic disaster. Just last year, widely-respected studies reported that “forty percent of American households lack a basic level of savings. These ‘liquid asset poor’ households,” Prosperity Now reported in January, 2019, “don’t have enough savings to make ends meet at the poverty level for three months if their income was interrupted.”

More worrisome still, we should think, is where wealth today actually resides. In the US only seven years ago, for example, the wealthiest 1% possessed 40% of the nation’s wealth. Last year, in the third quarter of 2019, the wealthiest 10% of families in the US possessed 70% of the nation’s wealth. Canada has largely mirrored this trend. In 2012, the Broadbent Institute reported that the richest 20% of Canadians possessed 70% of the nation’s wealth. Even more striking, fully half of Canadians possessed only 6% of the nation’s wealth. The wealth gap has only widened since.

Another result of the vilification of the welfare state has been, broadly, its chronic underfunding. By the 1980s, balanced budgets were the order of the day, and welfare-state spending reductions were widely understood as the way to make that happen. Meanwhile, tax giveaways to corporations and the rich, justified by the laughable notion that making the wealthy wealthier would somehow benefit everyone, made sure the budget remained in the red, and served as pretext for the next round of welfare state austerity. The steady decline over the past half century of investments in public healthcare, in public education, in publicly-funded social services, has only widened the gap between rich and poor, and left Canadians with a public sector less robust and less well-equipped to deal effectively with the demands for services in normal times, let alone in extraordinary times of widespread crisis.

Structural Crisis Today

The current pandemic, not unlike the onset of the Depression, has in immediate and pressing ways transformed our day-to-day existence, leaving growing unemployment figures, failing businesses, falling production, and a rapidly declining economy in its wake. But the current economic crisis, although triggered in the immediate by government-ordered lockdowns meant to curb the spread the corona-virus, wasn’t caused by the lockdowns. Through most of 2019, economists were already predicting an imminent recession. When the lockdown triggered crash and recession, it also triggered a Keynesian moment of fiscal and monetary stimulus that was simultaneously welcomed with much relief by those who have borne the worst of the pandemic’s economic shocks and with deep anxiety by the rich and powerful who have benefited so much from welfare state retrenchment since the early 1980s.

Corporate calls to cut short today’s Keynesian moment come at a time when the free trade order centered on the WTO and a number of other supranational institutions is already riven by trade wars. Since the lockdown exposed the vulnerability of global supply chains even to the most ardent supporters of corporate globalization, austerity calls go hand in hand with calls for protectionist measures.

The world is in crisis at the minute. And the crisis is getting worse. Without remedial work, this is going to devolve in terrible ways. We’ve got plenty of models outlining how the COVID-19 virus is spreading. They give us a sense of what’s working, and what’s not working. Collectively, we need a similar hard conversation about why and how our current financial problems are spreading. Starting and sustaining such a conversation is hard, as the questions at its core – what kind of economy and society do we want – are increasingly obscured by fearmongering, conspiracy theories, and hate-speech.

The business community is fully aware that its calls for austerity aren’t popular when the pandemic has made abundantly clear that underpaid and marginalized workers in the health care, food services, and logistics sectors, for instance, perform essential services, while self-aggrandizing bankers and brokers are unable to explain what, if anything, they contribute to the common good but are still the first asking for state-help that they think nobody else deserves.

Perhaps not surprisingly, the unpopularity of the business community and its austerity agenda has increasingly been deflected to groups who have little to do with current conditions. They’re also often those who are among the hardest hit by both the economic crisis and COVID-19. A hotchpotch of corporate-sponsored foundations, hard-right or openly Neo-Nazi-organizations, religious fundamentalists and their respective media outlets promulgate half-truths and outright lies that continue to frustrate rational and democratic dialogue.

The corona-virus? It’s either a hoax or a Chinese invention to stifle Western economies. The spread of the virus? Caused by foreigners who have a culture of sticking close to each other instead of practicing social distancing in suburban homes. The lockdown? Globalist elites stealing ordinary peoples’ liberties. To be sure, none of these groups aims at curbing the power of global corporate elites. They direct their fire, both verbally and physically, at all the ethnic minorities and immigrants they detested long before the corona-virus had developed.

And yet, discontent with democratic retrenchment and attacks on the welfare state, increasing inequalities, and environmental destruction brought about by corporate globalization is growing. So too is disillusionment in the belief that the global marketplace is an equal opportunity game, leading to a rediscovery of moral norms dedicated to mutual help, decency, and the recognition of value in other people’s work.

A Green New Deal?

The 1930s New Deal is one point of reference for the articulation of discontent and the search for alternatives. It is sufficiently vague to bring different points of view into conversation but also carries the idea that hard times can be overcome. For some, this means a nostalgic yearning for an imagined “golden” past. Others have aimed at an updated Green New Deal that seeks a sort of class compromise between allegedly green capital and vaguely defined progressive forces aligned against the fossil counterrevolution led by people like Donald Trump and Alberta premier Jason Kenney, Brazil’s Jair Bolsonaro and Saskatchewan’s Scott Moe. Others still have pursued a more radical position, seeing the current economic crisis and pandemic as a viable entry point to overcome the capitalist imperative to accumulate no matter the social and ecological costs.

There are also some who, whether they aim for class compromise or socialist transformation, point at the need for a global deal, an ecologically and socially just alternative to corporate globalization. This would include a regionalization of production and closer ties between places of work and places of leisure to radically cut the need for internal combustion material transport, including everything from automobiles to airplanes. It would also include the dismantling of race-to-the-bottom global competition for the lowest wages and cheapest resources, even while recognizing that national economies cannot exist next to each other without having anything to do with each other. As the pandemic, climate change, and other forms of ecological destruction show all too clearly, the earth is a space shared by all its inhabitants. Preserving it as livable space, a space where we can thrive in a sustainable and fair and equitable way, is more than a useful response; it’s essential. •