The Bank of Canada and the Crisis

Central banks are generally perceived as physiotherapists of sorts: squeezing the money supply and interest rates here and engaging in “quantitative easing” there in order to revive the battered body of capital. But the reality is that central banks are deeply political institutions serving the general interest of a particular economic class. Actions taken by the Bank of Canada during the financial crisis reveal a great deal in this regard. As a global “exit strategy” from emergency measures to offset the financial crisis finds itself on shaky ground, the Canadian state is walking a fine line as it begins to re-impose some of the most hawkish fiscal and monetary policies amongst the core capitalist countries. Clear socialist critiques and progressive alternatives need to be put forward in light of efforts by the Canadian state (and other core countries as well) to use the crisis to deepen neoliberalism.

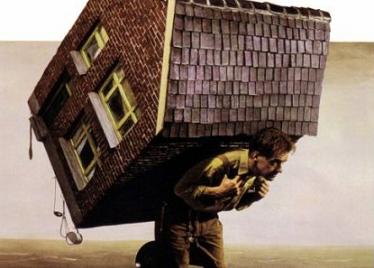

A House of Cards

Austerity measures are either being implemented already or set to be introduced across the G20. This policy response has received warm praise from Canadian Prime Minister Stephen Harper.[1] Leading up to the G20 Summit in Toronto, Harper stated that “advanced countries must send a clear message that as our stimulus plans expire, we will focus on getting our fiscal houses in order.”[2] The U.S. Obama Administration has been a dissenting voice over the timing of the exit to restraint, and both the Federal Reserve and the Administration are suggesting further stimulus measures in the face of economic weakness. Congressional elections for the fall may see a resurgent Republican party preaching fiscal restraint but radically cutting taxes to spur the recovery by further widening inequalities and stimulating overconsumption of the rich.

But the drive to “fiscal order” has clearly begun with austerity measures in Greece and much of Europe the likes of which have not been witnessed since the Second World War. Commenting on Britain’s latest Conservative-Liberal Democrat coalition budget, Financial Times columnist Philip Stephens wrote that: “Margaret Thatcher, famous, or infamous, for her eagerness to take an axe to the big state, never dared to cut so deep.”[3] Canada is projected to make similar cuts once stimulus spending comes to a halt in 2011, with program spending projected to reach levels not witnessed since the Second World War. Throughout the Baltic countries, Ireland, Britain and the Mediterranean countries of the EU, unprecedented austerity measures are already underway. The Bank of Canada cited these measures approvingly during a press conference late this July.[4] A class struggle of the highest order over the distributional burden of the crisis is well underway.

But the drive to “fiscal order” has clearly begun with austerity measures in Greece and much of Europe the likes of which have not been witnessed since the Second World War. Commenting on Britain’s latest Conservative-Liberal Democrat coalition budget, Financial Times columnist Philip Stephens wrote that: “Margaret Thatcher, famous, or infamous, for her eagerness to take an axe to the big state, never dared to cut so deep.”[3] Canada is projected to make similar cuts once stimulus spending comes to a halt in 2011, with program spending projected to reach levels not witnessed since the Second World War. Throughout the Baltic countries, Ireland, Britain and the Mediterranean countries of the EU, unprecedented austerity measures are already underway. The Bank of Canada cited these measures approvingly during a press conference late this July.[4] A class struggle of the highest order over the distributional burden of the crisis is well underway.

As Harper and other G20 leaders begin to put their respective financial houses in order according to the balanced-budget, small government dogmas of neoliberalism, they are tinkering with a delicate house of cards indeed. Liberal economists like Paul Krugman – who devotes the opening pages of his latest book to defending Keynesian policies and barricading off more radical forms of intervention – makes clear that the G20 meeting’s turn to austerity was “deeply discouraging” and that potential for a global depression remains a distinct possibility.[5] And even the conservative Federal Reserve Chairman Ben Bernanke likewise quipped about the “unusually uncertain” future of the economy; in the meetings of central bankers at Jackson Hole in August, he made clear that the Fed was actively considering the need for further monetary support to avoid a “double-dip recession.”

There are numerous potential blockage points to sustained economic growth, ranging from Europe’s sovereign debt crises to falling demand and a stagnating U.S. economy.[6] Japan appears to be slipping into another bout of deflation and falling output (and further instability in its political leadership). A delicate home market in China and critical household debt levels in much of the West serve as other potential blockage points, thus austerity measures themselves may further dampen global growth rates. The Prime Minister and G20 leaders the world over may aspire to getting “our fiscal houses in order.” But this is a delicate house of cards indeed.

The Bank of Canada and the Crisis

All central banks play a critical role within capitalist systems and states. Reduced interest rates and unparalleled injections of liquidity, to name just two key measures, serve to keep the heart of capital from sputtering to a halt. But perhaps most critically, central bank policies have never been so interdependent and fragile. Sovereign debt crises in Span, rising wages in Bangladesh and demand from China’s working class now filter into the Bank of Canada’s overnight interest rate. Moreover, central banks are critical to the process of accumulation to the degree that geographer David Harvey places them at the “apex” of monetary institutions.[7] But central banks nevertheless remain just one institution within an immensely complex state-system. So an analysis of actions taken by central banks merely offers one window into the complex dynamics of capitalism.

Inflation Rate Targeting

With regards to Canada, the Bank of Canada formally has a monopoly in the printing of money, but it does so by monitoring the creation of credit by the private banks and other credit institutes. In Marx’s terms, the Bank prints and distributes the money form, or “national uniform,” of the Canadian currency relative to the production of value and new output. But the central pillar of Bank of Canada policy today, and remains so even after the financial crisis, is its inflation-control regime. This regime aims to ensure that inflation remains within a target range between one and three per cent primarily through interest rate management that is used to signal monetary easing or tightening. The primary aim of this policy is to ensure steady and stable growth by having clear expectations about the future value of the Canadian dollar.

This regime is a fairly recent development in Canadian economic policy, as Canada was one of the first states to implement the inflation-control regime in 1991, after earlier monetarist policies of attempting to more directly control money supply growth. The consistency between the two regimes (essentially technocratic variations of neoliberal monetary policy) is that low inflation is directly linked with high levels of unemployment – a natural rate of unemployment, or what Marx called a reserve army of labour. Imposing this supposedly neutral policy is therefore a class project in the strictest sense, with Bank policy ensuring consistently high rates of unemployment.

University of Ottawa economist Mario Seccareccia, who follows Bank of Canada actions closely, has previously stressed that the inflation control regime is part of a broader neoliberal transition.[8] And in many respects, the policies adopted by the Bank of Canada in the early 1980s, and maintained till today, are consistent with those adopted elsewhere during the neoliberal turn, particularly what Britain achieved under Margaret Thatcher. Alan Budd, one of Margaret Thatcher’s chief economic advisors, made the remarkably frank confession that “the 1980s policies of attacking inflation by squeezing the economy and public spending were a cover to bash the workers. Raising unemployment was a very desirable way of reducing the strength of the working class. What was engineered – in Marxist terms – was a crisis of capitalism, which re-created a reserve army of labour, and has allowed the capitalists to make high profits ever since.”[9]

Concerning the most recent crisis, the Bank of Canada itself grew increasingly reactive as the financial crisis began to deepen in 2007. As credit markets seized up, the Bank began to lower its overnight interest rate. Beginning with a ¼ interest rate cut to 4 ¼ per cent on December 4, 2007, rates were continually lowered throughout 2008 and 2009. By April 21, 2009, rates were lowered to ¼ per cent, and this rate was maintained until Canada became the first G8 nation to raise rates on June 1, 2010. The logic was simple: reduce interest rates as much as possible to encourage borrowing, increase spending and stop the deleveraging of credit holdings by other financial institutions, corporations and households.

Interest-rate setting was by no means the only action taken by the Bank during the financial crisis. Canadian Auto Workers economist Jim Stanford has previously stressed that some $3-billion in low-cost loans were introduced in August, 2007, to insure that credit did not freeze up.[10] These injections were accompanied by a press release stating that “the Bank of Canada would like to assure financial market participants and the public that it will provide liquidity to support the stability of the Canadian financial system and the continued functioning of financial markets.”[11] The Bank also expanded the list of securities that “market participants could use as collateral.”[12] These measures continued across 2008 and 2009, shifting in some of the amounts and measures as events unfolded. Any praise of the resilient Canadian banking system should take these measures into account.

But more importantly, the recent crisis provides ample grounds for dismissing the Bank’s narrow strategy of targeting interest rates. By attributing the last major crisis of 1973 to inflation, it was argued that sustained growth can best be achieved by bringing inflation to low and stable rates. The 2007-2010 crisis reveals that inflation-rate targeting has limited effect on the crisis tendencies of capital, and certainly from preventing the eruption of financial crises. The central pillar of Bank of Canada policy faces a critical legitimacy crisis in this regard. Yet, all signs indicate the Bank intends to renew this failed policy, as Bank of Canada Chairman Mark Carney has been indicating over the summer as he tries to nudge back toward a “normalized” monetary policy. Viable alternatives must be put forward, stressing that inflation-control did nothing to curb the crisis tendencies of capital.

Systemic Risk and Exit Strategies

During this period of significant central bank intervention, the Bank attributed the global economic “turbulence” to three particular factors: excess liquidity, lack of transparency and inadequate disclosure.[13] This is shockingly narrow explanation of the financial crisis – each pointing the blame back at governmental regulatory failures, letting financial institutions off the hook, and ignoring the dynamics of the financial system as a whole. At no point was the way that forms of accumulation and social inequalities creating a mass credit explosion leading to systemic risk examined as the primary driver of this crisis. Indeed, “the unspoken ideological taboo in most public discussion of the economic crisis prohibits seeing or treating the problem as systemic, as a problem of capitalism as a system.”[14] It is now clear that central banks can merely offset, displace or further delay the systemic generation of crises within capitalism. Central banks and their policies must therefore be critically examined with viable progressive alternatives put forward.

The Bank is now tentatively shifting toward its neoliberal exit strategy with two interest rate increases in June and July to 0.75% and the potential for a further increase during its September 8 announcement. United Steelworkers economist Erin Weir argues this strategy is ultimately counterproductive stating that “the Bank of Canada is serving up anti-investment policy with a side of pro-investment rhetoric.”[15] Increased interest rates will also invariably place increased stresses on record high levels of Canadian household debt, the majority of which is tied up in mortgages, but also in consumer debt, leaving still historically high debt servicing to income ratios among the majority of Canadians.

The Keynesian Left generally views low interests rates as a positive measure, and this a view that is easily supported. But it must be stressed that lower interest payments can not stand in for an activist industrial policy and a financial system re-oriented to meeting longer-term planning priorities. Nor can they address class inequalities, the failures of social housing policy, and the fact that many Canadians were lured into a false sense of security via home ownership during the crisis as a result of low interest rates. They now face critical social and economic pressures as interest rates begin to rise. Inflation-targeting monetary policies have been, of course, established by central banks to deepen social inequalities. Low interest policies are an initial first demand at the present moment to offset deflationary conditions that continue to threaten workers’ livelihoods.

Broader issues must likewise be addressed. Viable alternatives would incorporate the inflation control regime as merely one element of a more dynamic central bank policy. Given that the Bank mandate is to insure economic wellbeing for all Canadians, revised policy must be sensitive to persistently high levels of unemployment resulting from this regressive inflation control regime. A second demand at the moment is to press for a viable policy alternative to break the inflation-targeting regime, central bank independence, deregulatory financial policies and a range of other measures that have constituted neoliberal monetary policy over the last decades. In other words, broader political and class dynamics of central banks must be brought into question. Policies during and leading out of the crisis make clear that what dominates central bank policy – and as Harvey notes, capitalist money forms as a whole – is not technocratic policies controlling inflation but a class project. It is therefore incumbent for the Left to envision an alternative to the current monetary regime.

As many writers have noted over the financial crisis, the entire nature of the monetary system is distorted when left in private hands, in a context where failures in the market are ruled out as causing ‘systemic risk.’ This suggests that financial services have, in the policy terms that have been invoked, a ‘public utility’ component, and should be nationalized.[16] This position is really to insist that an alternate public banking system, with a range of community, regional and investment banks be explored, on the one hand; and a range of institutional capacities for capital controls over the creation and flows of money be established. The Bank of Canada, like any state institution, must be regarded as a critical space of class struggle in the establishment of alternate spaces for social power. Over the short term, progressive economists need to focus their energies upon defending a more stimulative monetary policy in the face of the neoliberal demands for a turn to austerity, and then broadening to a wider programme in opposition to the 2011 renewal of the Bank of Canada policy mandate. The financial crisis is, indeed, providing grounds for questioning the fundamentals of this monetary and economic regime. •

Endnotes

1.

See Doug Henwood’s piece for a critical take on austerity measures currently underway. “Jonesing for a Slump? Austerity in the Face of Weakness,” The Bullet, No. 397, July 29, 2010.

2.

“Statement by the Prime Minister of Canada,” June 27, 2010.

3.

“Britain pays the price of penury,” Financial Times, June 25, 2010.

4.

Bank of Canada. Press conference. Online streaming audio interview, July 22, 2010.

5.

“The Third Depression,” New York Times, June 27, 2010. Krugman’s The Return of Depression Economics and the Crisis of 2008 (2009) is a helpful, but overly playful treatment, of the crisis tendencies of capital.

6.

This notion of “blockage points” to capital accumulation draws directly from geographer David Harvey’s latest book, The Enigma of Capital and the Crises of Capitalism (2010). One would be hard-pressed to find a text that employs Marxian theory in such an accessible manner.

7.

David Harvey, Limits to Capital, London: Verso, 2006, p. 250.

8.

Marc Lavoie and Mario Seccareccia, “The Bank of Canada and the Modern View of Central Banking,” International Journal of Political Economy, 35, 2006, pp. 44-61; Fletcher Baragar and Mario Seccareccia, “Financial Restructuring: Implications of Recent Canadian Macroeconomic Developments,” Studies in Political Economy, 82, 2008, pp. 61-83.

9.

David Harvey, A Companion to Marx’s Capital, London: Verso, 2010, pp. 283-4.

10.

Jim Stanford, “Bank of Canada Rides Over the Hill,” The Progressive Economics Forum, August 25, 2007.

11.

Bank of Canada, “Press Release: Bank of Canada issues statement on provision of liquidity to support the stability and efficient function of financial markets,” August 9, 2007.

12.

Bank of Canada, “Press Release: Bank of Canada Temporarily Expands List of Collateral Eligible for SPRA Transactions,” August 15, 2007.

13.

Bank of Canada, “Press Release: Addressing Financial Market Turbulence,” March 13, 2008.

14.

Rick Wolff, “Housing Crisis, System Failure,” MRZine, August 19, 2010.

15.

Erin Weir, “Carney on Business Investment: You Read it Here First,” Progressive Economics Forum, July 24, 2010.

16.

Greg Albo, Sam Gindin and Leo Panitch. 2010. In and Out of Crisis: The Global Financial Meltdown and Left Alternatives, Oakland: PM Press, pp. 109.